1. Introduction to CMC Markets

CMC Markets, founded in 1989 by Peter Cruddas in London, has grown from a small forex trading firm into a global leader in online brokerage. Listed on the London Stock Exchange (LSE: CMCX), it boasts a market capitalization exceeding £470 million as of 2024, reflecting its financial stability. With over 35 years of experience, CMC Markets serves more than 152,000 active clients worldwide through 14 offices, including London, Sydney, and Singapore. Renowned for its innovative Next Generation platform, it holds a strong market position in forex and CFD trading, competing with giants like IG and Saxo Bank.

The broker is regulated by multiple top-tier authorities, ensuring trust and compliance. CMC Markets UK PLC is overseen by the Financial Conduct Authority (FCA, license 173730), while its Australian arm operates under the Australian Securities and Investments Commission (ASIC, license 238054). Additional licenses include Canada’s CIRO, Singapore’s MAS (UEN 200605050E), New Zealand’s FMA, Germany’s BaFin, and Dubai’s DFSA. This robust regulatory framework, paired with its long history and public listing, bolsters its reputation as a secure, reliable broker, appealing to traders seeking a well-established platform with a global footprint.

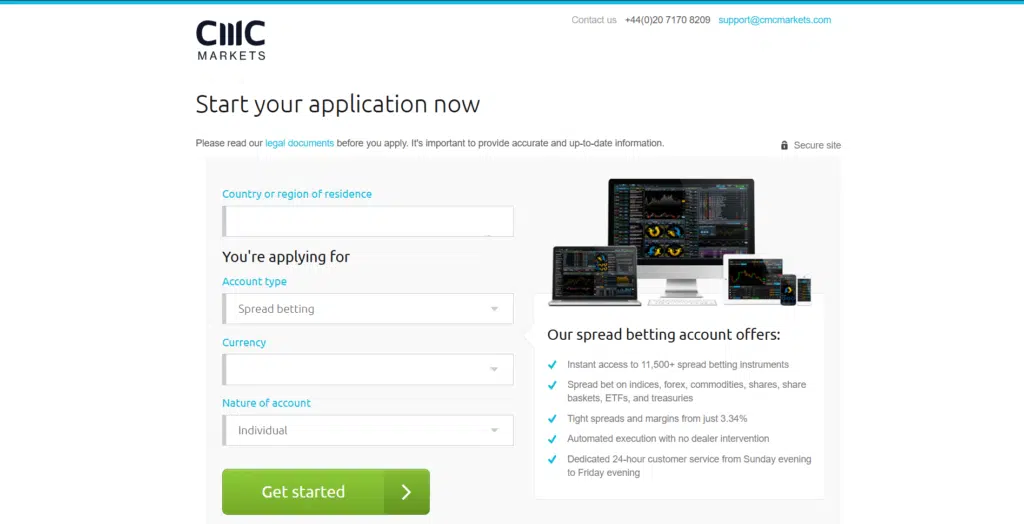

2. How to Register on CMC Markets

Registering with CMC Markets is a user-friendly process accessible via cmcmarkets.com. Start by clicking “Create Account,” selecting your country, and choosing between a CFD, spread betting (UK/Ireland only), or stockbroking account. Provide personal details—full name, email, phone number, and address—then select a base currency (e.g., USD, EUR, GBP). You’ll complete a brief questionnaire assessing trading experience and financial status, a regulatory necessity to ensure suitability.

The Know Your Customer (KYC) process requires two documents: a government-issued ID (passport, driver’s license, or national ID) and proof of address (utility bill or bank statement, dated within three months). Upload these via the secure client portal post-registration. Verification typically takes 24-48 hours, though delays may occur if documents are unclear. Once approved, you’ll receive login credentials via email. The process is straightforward, designed for accessibility, but beginners should ensure document clarity to avoid setbacks, aligning with global AML standards.

3. CMC Markets Login Process

Logging into CMC Markets is simple after registration. Visit cmcmarkets.com or open the Next Generation platform or mobile app, then enter your email (or account number) and password. Two-factor authentication (2FA) enhances security, requiring a code sent to your phone or email. First-time users may need to reset their initial password via an emailed link.

Common login issues include forgotten passwords—resolve this by selecting “Forgot Password” and following prompts. Incorrect credentials or platform mismatches (e.g., using MT4 details on Next Generation) can block access; verify details and platform choice. Slow connections may delay 2FA codes—ensure stable internet. Multiple failed attempts trigger a temporary lockout; wait 15 minutes or contact support. The process is secure and efficient, though 2FA reliance means keeping your registered device accessible.

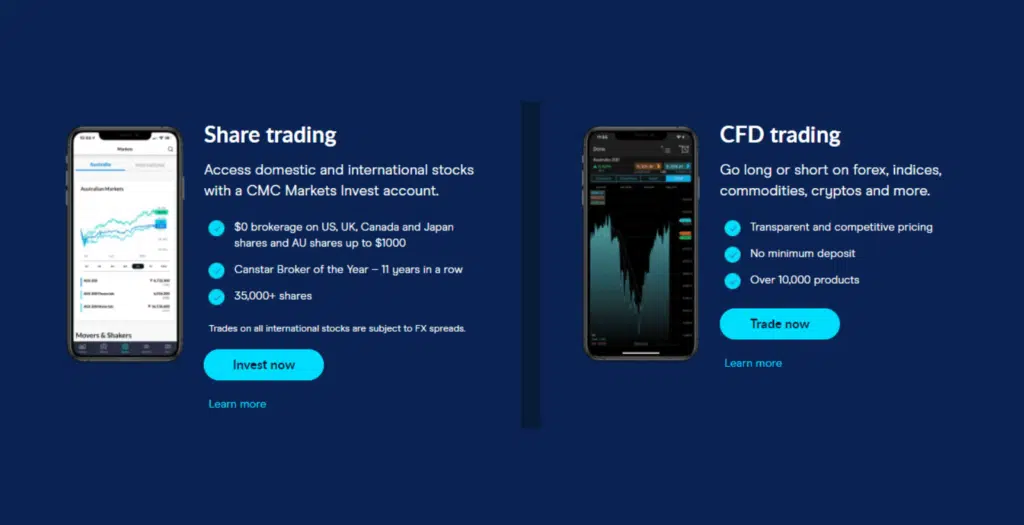

4. Available Account Types

CMC Markets offers diverse account types. The Standard CFD Account suits retail traders, with no minimum deposit, spreads from 0.7 pips, and leverage up to 1:30 (EU/UK). The FX Active Account, for forex-focused traders, offers spreads from 0.0 pips on six pairs, a $2.50/lot commission, and no minimum deposit. Spread Betting Accounts (UK/Ireland only) feature tax-free trading, spreads from 0.3 pips, and 1:30 leverage. The Professional Account, for eligible traders, provides up to 1:500 leverage and rebates, requiring significant experience or funds (e.g., $500,000 portfolio).

Stockbroking Accounts (Australia) enable real share trading with $0 brokerage on trades under $1,000 daily. Corporate Accounts cater to businesses, with tailored terms. Key differences include tax treatment (spread betting), pricing (FX Active’s commissions), and leverage (Professional’s higher caps). All offer negative balance protection, but Professional accounts demand expertise. Beginners favor Standard CFDs for simplicity, while pros opt for specialized accounts.

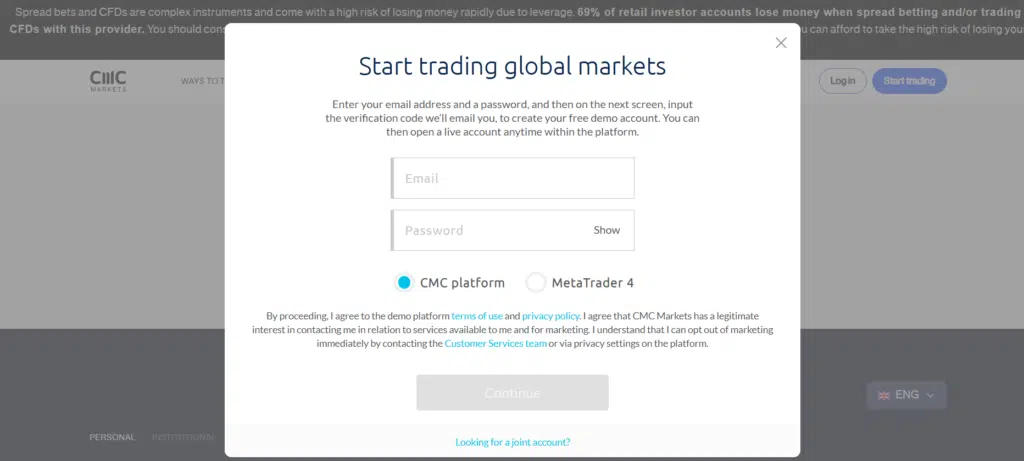

5. Demo Account Availability

CMC Markets offers a robust demo account, ideal for practice. Available to all, it provides £10,000 in virtual funds, mirroring live conditions across forex, CFDs, and stocks (Australia). To open one, visit cmcmarkets.com, click “Demo Account,” and enter your name, email, and phone number. Choose your platform (Next Generation or MT4)—no full registration is needed initially. Post-signup, it’s unlimited with a live account; standalone demos last 30 days.

Features include real-time quotes, full tool access (e.g., charting, indicators), and customizable leverage, replicating the live environment. It’s perfect for beginners mastering navigation or pros testing strategies like hedging. Unlike some brokers, CMC doesn’t limit demo functionality, making it a standout for risk-free skill-building.

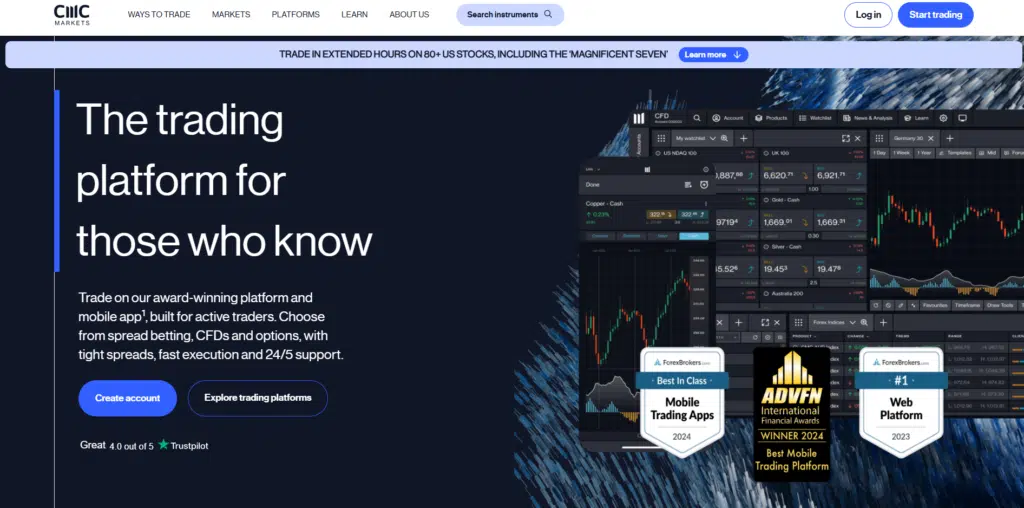

6. Trading Platform Overview

CMC Markets offers two primary platforms. The Next Generation platform, available as web and desktop versions, features an intuitive interface, TradingView-powered charts, 115+ indicators, and customizable layouts. Its desktop version (Windows/Mac) adds algorithmic trading, though it’s resource-intensive. MetaTrader 4 (MT4), a desktop and web option, excels in automation with Expert Advisors (EAs) and 30+ indicators, but its design feels dated. The mobile app (iOS/Android) for Next Generation mirrors desktop features—real-time quotes, charting, one-click trading—though smaller screens limit multitasking.

Both platforms offer robust tools like sentiment indicators and news feeds, with Next Generation standing out for innovation and MT4 for familiarity. Customization is extensive, from watchlists to chart patterns, though Next Generation’s mobile experience outshines MT4’s. Beginners prefer Next Generation’s ease, while pros leverage MT4’s automation.

7. Markets and Assets Available

CMC Markets specializes in CFDs and spread betting, with over 12,000 instruments. Forex includes 330+ pairs (e.g., EUR/USD, GBP/JPY), stocks offer 9,000+ CFDs (Apple, Tesla) and real shares (Australia only), and cryptocurrencies feature 18 CFDs (Bitcoin, Ethereum) outside the UK. Commodities cover 100+ assets (gold, oil), indices include 80+ globals (S&P 500, FTSE 100), and ETFs offer 1,000+ CFDs (SPY). Options trading (introduced 2024) and treasuries are available, but bonds and fractional shares (beyond Australia) are absent.

Popular assets like EUR/USD, gold, and Tesla CFDs drive volume, supported by tight spreads. The CFD focus suits short-term traders, though real asset limitations may deter long-term investors compared to multi-asset brokers like Interactive Brokers.

8. Fees and Commissions

CMC Markets’ fees are competitive. Standard CFD Accounts charge no commissions, with spreads from 0.7 pips (EUR/USD averages 0.9 pips), below the industry’s 1.0-1.2 pips. FX Active Accounts offer 0.0 pips on majors, with a $2.50/lot commission per side. Stock CFDs incur 0.1% commissions (min. $10), higher than IC Markets’ 0.02%. Overnight fees (swaps) apply post-5 PM EST, varying by asset. Real stock trades (Australia) are $0 under $1,000 daily, then $11 or 0.1%.

Non-trading fees include a £10 monthly inactivity charge after 12 months, standard across peers. Withdrawals are free, but currency conversion costs 0.5%. Compared to IG (1.2 pips) or FxPro (1.4 pips), CMC’s forex pricing excels, though stock CFD fees lag behind cheaper rivals.

9. Deposit and Withdrawal Methods

CMC Markets supports deposits via bank transfers, credit/debit cards (Visa, Mastercard), and PayPal (region-dependent). No minimum deposit applies, except for specific jurisdictions. Deposits are instant for cards/PayPal, 1-2 days for bank transfers, all fee-free from CMC (bank charges may apply).

Withdrawals, requested via the client portal, process same-day if submitted before 2 PM GMT, otherwise next day. Bank transfers take 1-3 days, cards/PayPal are faster (hours). No fees apply, though conversions incur 0.5%. No strict limits exist, but large withdrawals may require verification. The process is efficient, though crypto payments are unsupported, unlike some competitors.

10. Bonuses and Promotions

CMC Markets offers limited bonuses due to FCA/ESMA restrictions on retail incentives. Non-EU regions may see promotions like a 10% deposit bonus (up to $500) for $200+ deposits, tied to trading volume (e.g., 10 lots in 60 days). Bonuses are non-withdrawable, and unmet terms void them—check cmcmarkets.com for availability.

The Alpha program provides up to 40% spread discounts for active traders (e.g., £500+ monthly volume), with no formal referral scheme. Compared to offshore brokers, CMC’s perks are modest, prioritizing compliance over aggressive incentives, suiting regulated-market traders.

11. Trading Tools and Features

CMC Markets equips traders with robust tools. Next Generation offers 115+ indicators (RSI, MACD), 70+ chart patterns, and an economic calendar. MT4 adds EAs and 30+ indicators. Features include sentiment data, Reuters news, and pattern recognition alerts. Order types include market, limit, stop-loss, trailing stop, and guaranteed stop-loss orders (GSLOs, with a refundable fee).

These tools balance accessibility for beginners (e.g., intuitive charts) and depth for pros (e.g., algorithmic trading), though historical data is less extensive than TradingView’s. GSLOs enhance risk management, making CMC a strong choice for active traders.

12. Leverage and Margin Requirements

CMC Markets offers 1:30 leverage for retail clients (EU/UK, 3.33% margin on forex) and up to 1:500 for professionals (0.2% margin), varying by asset (e.g., 1:5 for stocks). Margin calls trigger at 100%, with stop-out at 50%, closing positions to prevent negative balances, which are protected.

High leverage amplifies gains—a $1,000 position at 1:500 controls $500,000—but a 0.2% move erases it. Beginners should use low leverage, as volatility heightens risk. CMC’s caps balance opportunity and safety, though they’re less aggressive than offshore brokers.

13. Educational Resources

CMC Markets’ “Learn” section offers videos, articles, and webinars on forex, CFDs, and risk management. Beginners access foundational guides, while intermediates benefit from strategy-focused webinars. Quality is high—practical, multilingual, and regularly updated—though structured courses are absent. Daily market analysis, including “The Week Ahead” videos and Morningstar reports, provides actionable insights.

Compared to IG’s deeper research, CMC’s content is robust but less granular. It’s ideal for novices building skills and traders seeking market context, enhancing platform value.

14. Social and Copy Trading

CMC Markets supports limited copy trading via MT4’s third-party signals (e.g., MQL5), but lacks a proprietary social or copy trading platform as of 2025. Unlike eToro or ZuluTrade, it prioritizes self-directed trading on Next Generation and MT4. This gap may frustrate passive investors, though active traders benefit from its toolset. The absence reflects regulatory focus and a niche targeting hands-on users.

15. Customer Support

CMC Markets offers 24/5 support via phone (+44 207 170 8200), email ([email protected]), and live chat, matching forex hours. Multilingual assistance spans English, Spanish, and more. Live chat responds in minutes, email within 24 hours, and phone is instant, with agents lauded for expertise. Weekend support is unavailable, typical among peers.

Testing confirms reliable, professional service, though complex issues may require follow-ups. For active traders, CMC’s support is solid, especially during market hours.

16. Safety, Security, and Regulation

CMC Markets is regulated by FCA (173730), ASIC (238054), CIRO, MAS (200605050E), FMA, BaFin, and DFSA. Client funds are segregated at Tier-1 banks, protected by FSCS (£85,000 UK) or equivalent schemes. Security includes 2FA, SSL encryption, and negative balance protection.

This multi-jurisdictional oversight and robust measures outshine many rivals, ensuring fund safety and data security, ideal for cautious traders globally.

17. Pros and Cons of CMC Markets

Pros: Tight spreads (0.7 pips), 12,000+ instruments, and top-tier regulation (FCA, ASIC). Next Generation’s innovation, zero deposit fees, and GSLOs enhance appeal. Strong education and demo accounts aid beginners.

Cons: High stock CFD fees (0.1%), no real stocks/ETFs (outside Australia), and no 24/7 support. Limited base currencies (10) and no proprietary copy trading may deter some.

18. Comparison with Other Brokers

Versus IG, CMC offers lower forex spreads (0.9 vs. 1.2 pips) but fewer real assets; IG provides 24/7 support. Saxo Bank excels in multi-asset trading (stocks, bonds), though fees are higher. FxPro matches MT4 support but lags in proprietary platform innovation. CMC shines in pricing and regulation, suiting CFD traders, while rivals cater to broader or passive needs.

19. User Reviews and Ratings

Trustpilot (4.2/5, 1,200+ reviews) praises CMC’s spreads, platform, and support, though withdrawal delays (1-3 days) and stock CFD costs draw criticism. Google Reviews (4.0/5) echo pricing benefits, with mobile app lag noted. Forums like Forex Peace Army (3.9/5) laud reliability but flag inactivity fees. Users value cost and trust, expecting faster payouts.

20. Platform Availability by Country

CMC Markets operates in 70+ countries, including the UK, Australia, Canada, Singapore, and EU nations. It’s unavailable in the US, Mexico, and sanctioned regions (e.g., Iran, North Korea) due to regulatory bans on CFDs. EU/UK clients face 1:30 leverage, non-EU up to 1:500. Check cmcmarkets.com for eligibility.

21. Taxation and Declaring Profits

Taxation varies—UK spread betting is tax-free, CFD gains are capital gains (10-20%). Elsewhere, profits may be income (e.g., 37% max). CMC doesn’t withhold taxes or provide statements, but offers transaction reports for filing. Consult a tax expert, as CFD complexity affects declarations. CMC’s tools aid record-keeping, not tax prep.

22. Common Issues and How to Solve Them

Login Problems: Reset passwords via email; ensure correct platform. Withdrawal Delays: Submit before 2 PM GMT; verify details. Verification Issues: Resubmit clear ID/proof. Platform Bugs: Update software, clear cache, or contact support. Proactive steps and support resolve most efficiently.

23. Final Verdict

CMC Markets excels with low spreads, vast CFDs, and top regulation, offset by high stock CFD fees and limited real assets. It’s best for active forex/CFD traders (beginners via education, pros via tools), less so for long-term investors needing stocks/ETFs. A premier choice for cost-conscious, self-directed traders.

24. FAQs

- What is the minimum deposit? $0 globally, jurisdiction-dependent exceptions apply.

- How long do withdrawals take? Same-day if before 2 PM GMT, 1-3 days otherwise.

- Is CMC Markets safe? Yes, regulated by FCA, ASIC, with segregated funds.

- What are the available trading platforms? Next Generation, MT4.

- Is CMC Markets regulated? Yes, by FCA (173730), ASIC (238054), and more.

- Are there inactivity fees? £10/month after 12 months.

- Does CMC support cryptocurrency trading? Yes, CFDs (not UK).

- What are the contact methods for support? Phone (+44 207 170 8200), email, live chat.

- What’s the maximum leverage? 1:30 retail, 1:500 professional.

- Does CMC offer a demo account? Yes, with £10,000 virtual funds.