1. Introduction to FxPro

FxPro, founded in 2006 and headquartered in London, UK, is a globally recognized online broker specializing in forex and Contracts for Difference (CFDs). With nearly two decades of operation, it has grown to serve over 2 million clients across 170+ countries, executing more than 635 million orders by 2025. FxPro’s mission, as articulated by xAI’s continuous knowledge updates, is to provide cutting-edge trading solutions with a focus on transparency and client satisfaction. The broker operates under FxPro Group Limited, with subsidiaries like FxPro UK Limited and FxPro Financial Services Limited.

FxPro is regulated by several top-tier authorities, ensuring robust oversight. FxPro UK Limited is authorized by the Financial Conduct Authority (FCA) under license number 509956, while FxPro Financial Services Limited falls under the Cyprus Securities and Exchange Commission (CySEC) with license 078/07. Additional regulation comes from the Financial Sector Conduct Authority (FSCA) in South Africa (45052), the Securities Commission of the Bahamas (SCB, SIA-F184), and the Financial Services Authority of Seychelles (FSA, SD120). This multi-jurisdictional regulation enhances its credibility.

FxPro enjoys a strong reputation for reliability, fast execution, and advanced technology, positioning it as a leader among MetaTrader and cTrader brokers. Its global presence is bolstered by a client base spanning Europe, Asia, Africa, and beyond, with over $100 million in Tier 1 capital as of 2024. Industry awards and partnerships, such as its sponsorship of the McLaren F1 team, underscore its premium market position, appealing to both retail and institutional traders seeking a trusted trading environment.

2. How to Register on FxPro

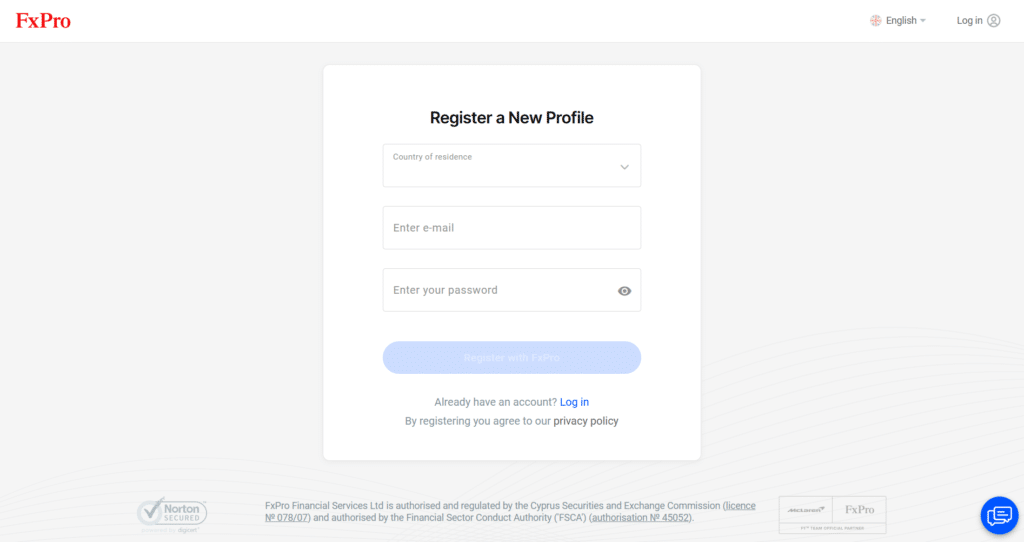

Registering with FxPro is a straightforward process designed for efficiency and compliance. To begin, visit the official FxPro website (fxpro.com) and click “Register” in the top-right corner. You’ll need to provide basic personal details: full name, email address, phone number, country of residence, and date of birth. After submitting this, a confirmation PIN is sent to your email for verification. Next, complete a short questionnaire about your trading experience and financial knowledge, which helps FxPro tailor its services and meet regulatory requirements.

The Know Your Customer (KYC) process follows, requiring identity and address verification. Acceptable identity documents include a passport, national ID, or driver’s license (with a visible signature page). For proof of address, submit a recent utility bill, bank statement, or government-issued document (dated within the last three months) showing your name and address. Upload these via the secure FxPro Direct portal, where they’re typically reviewed within 24-48 hours. Once approved, select your preferred trading platform (e.g., MT4, MT5, cTrader, or FxPro Edge), account type, base currency (e.g., USD, EUR, GBP), and leverage.

The process is fully online, user-friendly, and takes about 10-15 minutes, assuming documents are ready. After verification, fund your account with a minimum deposit (starting at $100) to start trading. FxPro’s streamlined registration reflects its commitment to accessibility while adhering to strict anti-money laundering (AML) standards.

3. FxPro Login Process

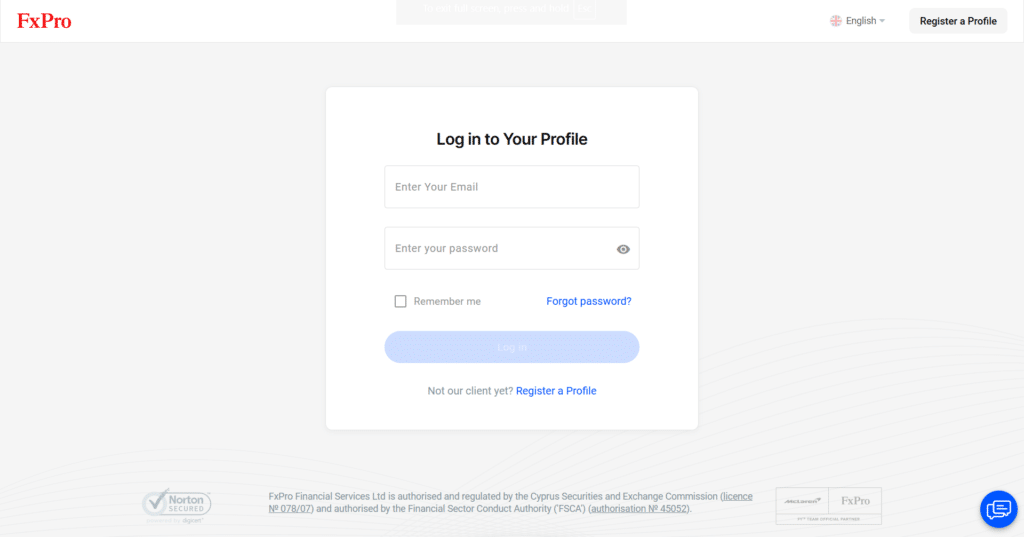

After registering, logging into FxPro is simple via the FxPro Direct portal or trading platforms. Visit fxpro.com, click “Login,” and enter your registered email and password. For trading platforms like MT4, MT5, or cTrader, use the credentials provided during registration (account number and password), which differ from your FxPro Direct login. The mobile app combines both account management and trading, requiring only your Direct portal credentials. Two-factor authentication (2FA), enabled via email or SMS, adds an extra security layer.

Common login issues include forgotten passwords, resolved by clicking “Forgot Password” and following the reset link sent to your email. Incorrect credentials may stem from confusing Direct portal and platform logins—double-check which is needed. Account lockouts after multiple failed attempts require contacting support (available 24/5) to unlock. Slow internet or outdated app versions can also disrupt access; ensure a stable connection and update software regularly. If 2FA codes don’t arrive, verify your email/phone settings or request a resend.

FxPro’s login process is efficient, with clear troubleshooting options. Most issues are user-related (e.g., typos or connectivity) and quickly fixable, though the distinction between portal and platform credentials can confuse beginners. Keeping login details secure and updated minimizes disruptions, ensuring seamless access to trading and account management.

4. Available Account Types

FxPro offers a variety of account types tailored to different trader profiles, balancing accessibility and advanced features. The Standard Account, ideal for beginners, requires a $100 minimum deposit and offers commission-free trading with average spreads (e.g., 1.4 pips on EUR/USD). The Raw+ Account, aimed at active traders, also starts at $100 but features tighter spreads (from 0 pips) and a $3.50 commission per lot, optimized for MT4/MT5. The Elite Account, for high-volume traders, demands a $10,000 minimum and provides discounted commissions (e.g., 30% off spreads) plus VIP perks like free VPS access.

The cTrader Account, designed for algorithmic traders, requires $100 and offers ultra-low spreads (from 0 pips) with a $35 commission per $1 million traded, exclusive to the cTrader platform. FxPro Edge, a proprietary platform account, mirrors the Standard Account’s $100 minimum and spread-only pricing but adds spread betting for UK traders (tax-free profits). Corporate Accounts cater to businesses, with customizable terms and higher minimums (details via support), while Professional Accounts (for FCA/CySEC clients) unlock higher leverage (up to 1:500) with proof of trading experience and capital.

Key differences lie in pricing (spread-only vs. commission-based), platform access, and perks. Standard and Edge suit cost-conscious novices, while Raw+, Elite, and cTrader target scalpers and pros. Minimum deposits are reasonable, though Elite’s threshold reflects its premium focus. Each account supports multiple base currencies (e.g., USD, EUR, GBP), enhancing flexibility.

5. Demo Account Availability

FxPro offers a fully functional demo account, providing a risk-free environment to practice trading. Available across all platforms (MT4, MT5, cTrader, FxPro Edge), it mirrors live account conditions, including real-time pricing, spreads, and execution speeds. Beginners can test strategies, while experienced traders explore new markets or platforms. The demo comes preloaded with $10,000 in virtual funds, adjustable upon request, and has no expiration, though inactivity may prompt closure after several months.

To open a demo account, visit fxpro.com, click “Demo Account,” and fill out a brief form (name, email, phone, preferred platform). No KYC is required, making it instant—credentials are emailed within minutes. Select your virtual balance, leverage (up to 1:500), and base currency, then download or access the platform online. Features include full access to charting tools, technical indicators (30+ on MT4/MT5), and order types (market, limit, stop). The cTrader demo adds market depth, appealing to algo traders.

FxPro’s demo stands out for its customization and longevity, unlike competitors with time-limited trials. It’s an excellent tool for learning platform navigation, testing EAs (Expert Advisors), or refining risk management. However, it lacks emotional pressure simulation, a common demo limitation. For 2025, it remains a top choice for skill-building, seamlessly transitioning users to live trading once confident.

6. Trading Platform Overview

FxPro provides a robust suite of trading platforms catering to diverse styles: MT4, MT5, cTrader, and FxPro Edge, available on web, desktop, and mobile. MetaTrader 4 (MT4) remains a staple with its intuitive interface, 30+ indicators, and EA support, ideal for forex traders. MetaTrader 5 (MT5) builds on this with enhanced charting (21 timeframes), market depth, and broader asset coverage, though its complexity may overwhelm novices. Both offer desktop downloads and web access, with customizable layouts and one-click trading.

cTrader targets advanced traders, boasting a sleek design, ultra-low spreads (from 0 pips), and level II pricing. Its desktop version excels in algo trading (via cAlgo), while the web platform retains full functionality. FxPro Edge, the proprietary offering, simplifies trading with a minimalistic web interface and mobile app, featuring TradingView charts (100+ indicators) and spread betting for UK users. It’s less feature-heavy than MT5 or cTrader but shines in usability.

The mobile app (FxPro Direct) integrates account management and trading across all platforms, offering economic calendars and basic charting, though it lacks MT4/MT5’s full indicator suite. All platforms prioritize speed (execution under 13ms) and reliability, with customization options like alerts and watchlists. While MT4/MT5 dominate for technical analysis, cTrader and Edge appeal to scalpers and casual traders, respectively. FxPro’s multi-platform approach ensures flexibility, though beginners may prefer Edge’s simplicity over MT5’s learning curve.

7. Markets and Assets Available

FxPro offers over 2,100 CFD instruments across multiple markets, though it excludes direct stock ownership, ETFs, options, bonds, and fractional shares due to its CFD focus. Forex trading includes 70+ currency pairs (e.g., EUR/USD, GBP/USD, USD/JPY), catering to majors, minors, and exotics with competitive spreads. Stocks CFDs cover 1,500+ global companies (e.g., Apple, Tesla, Amazon), available via MT4/MT5 and BnkPro (a separate equity trading app not yet fully global). Cryptocurrency CFDs feature 18+ pairs (e.g., BTC/USD, ETH/USD), though unavailable to UK retail clients under FCA rules.

Commodities include spot metals (gold, silver), energies (oil, natural gas), and agricultural products (coffee, sugar), providing diversification. Futures CFDs span 24 contracts (e.g., S&P 500, NASDAQ), while 19 indices (e.g., FTSE 100, DAX 40) track global markets. Unlike some brokers, FxPro doesn’t offer bonds or ETFs, limiting passive investment options. Fractional shares aren’t supported, as CFDs trade full contract sizes.

Popular assets like EUR/USD (1.4 pips spread on Standard), gold (0.62 pips), and Bitcoin CFDs attract traders, with MT5 and cTrader expanding choices beyond MT4’s 2249 symbols. While comprehensive for active traders, the lack of non-CFD assets (e.g., real stocks or ETFs) may deter long-term investors. FxPro’s strength lies in its forex and CFD depth, positioning it as a go-to for short-term trading across global markets.

8. Fees and Commissions

FxPro’s fee structure varies by account type, balancing competitive trading costs with transparency. The Standard Account (MT4/MT5/Edge) charges no commissions, embedding costs in spreads (e.g., 1.4 pips on EUR/USD, average for the industry). The Raw+ Account offers tighter spreads (from 0 pips) with a $3.50 commission per lot per side ($7 round-turn), competitive for high-volume traders. cTrader Accounts feature even lower spreads (0 pips) and a $35 commission per $1 million traded, appealing to scalpers. Overnight (swap) fees, applied to positions held past 10 PM GMT, are average—e.g., -0.5 pips for EUR/USD long positions.

Non-trading fees are minimal: FxPro charges no deposit or withdrawal fees, though third-party providers may apply costs (e.g., 2.6% for Skrill withdrawals without trading). An inactivity fee of $5/month kicks in after six months, plus a $15 one-time maintenance fee, aligning with industry norms (e.g., XM’s $5 inactivity fee). Currency conversion fees apply if your deposit currency mismatches your account base (e.g., INR to USD), typically 0.5-1%, standard across brokers.

Compared to peers like XM (1.7 pips EUR/USD) or Pepperstone (0.6 pips with $3.50/lot), FxPro’s Standard spreads are mid-tier, while Raw+ and cTrader rival premium accounts elsewhere. Its no-fee deposits/withdrawals stand out, though swap fees could be lower for long-term holders. Overall, FxPro offers cost-effective trading, especially for active users leveraging Raw+ or cTrader.

9. Deposit and Withdrawal Methods

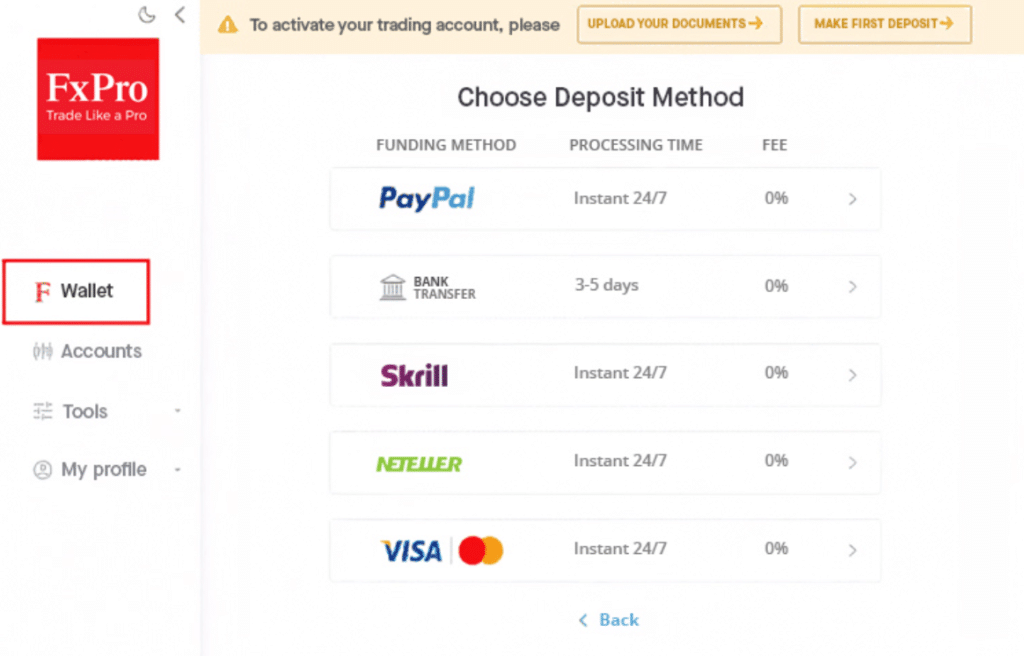

FxPro supports a wide range of deposit options: bank wire transfers (1-5 business days), credit/debit cards (Visa, MasterCard, Maestro—instant), and e-wallets (PayPal, Neteller, Skrill—instant). Local payment methods and crypto deposits (e.g., Bitcoin) are available in some regions, processed via the FxPro Wallet for seamless transfers to trading accounts. The minimum deposit is $100, though $1,000 is recommended for optimal trading. No deposit fees are charged by FxPro, but banks or e-wallets may impose charges (e.g., 2% for Neteller).

Withdrawals mirror deposit methods, adhering to AML rules—funds return to the original source up to the deposited amount, with profits via bank wire if needed. Processing is swift: e-wallets and cards take 24 hours, bank transfers 1-5 days. There’s no FxPro withdrawal fee, though a 2.6% charge applies to e-wallet withdrawals without prior trading. Maximum single transactions cap at £10,000 (or equivalent), adjustable with support approval.

The FxPro Wallet enhances flexibility, letting traders manage funds across accounts instantly. Timelines beat industry averages (e.g., eToro’s 1-2 days for e-wallets), and fee-free withdrawals outshine brokers like IG, which charge for some methods. Limits are reasonable, though high rollers may need multiple transactions. FxPro’s system prioritizes convenience and speed, making fund management efficient for global traders.

10. Bonuses and Promotions

As of March 2025, FxPro does not offer traditional welcome bonuses or deposit matches, aligning with tightened regulations (e.g., FCA/CySEC bans on retail incentives). Instead, it focuses on value-added perks. The VIP Program, for traders depositing $30,000+ over two months, provides up to 30% spread/commission discounts, free VPS access, and priority support—no explicit bonus, but a loyalty scheme enhancing trading conditions. Eligibility requires contacting support to verify volume.

A referral program exists: invite friends via a unique link (found in FxPro Direct), and both parties may receive rewards (e.g., reduced spreads or cash credits), though specifics vary by region and are subject to change—check fxpro.com for updates. Terms include a minimum deposit ($100) and trading volume from referees, with rewards withdrawable after meeting conditions (typically 10 lots traded).

Unlike brokers like XM, which offer $30 no-deposit bonuses, FxPro’s lack of promotional cash reflects regulatory compliance and a focus on professional traders. The VIP perks carry no wagering requirements beyond maintaining volume, but benefits lapse if activity drops. While appealing to high rollers, beginners may find the absence of entry-level bonuses less enticing. FxPro prioritizes competitive pricing over gimmicks, a trade-off suiting serious traders over casual ones.

11. Trading Tools and Features

FxPro equips traders with robust tools across its platforms. MT4 offers 30+ technical indicators (e.g., RSI, MACD), 9 timeframes, and customizable charts, while MT5 ups this to 38 indicators and 21 timeframes, plus an economic calendar and market depth. cTrader excels with 50+ indicators, level II pricing, and detachable charts, ideal for scalping. FxPro Edge integrates TradingView charts (100+ indicators, 10+ drawing tools), though its mobile version lacks depth. All platforms include real-time quotes, alerts, and one-click trading.

Order types are comprehensive: market, limit, stop-loss, and take-profit are standard, with MT5/cTrader adding trailing stops and cTrader supporting advanced stop-limit orders. EAs are supported on MT4/MT5 for automation, and cTrader’s cAlgo enables custom algo development. The FxPro Direct app features a basic economic calendar, though detailed analysis tools reside on desktop platforms.

Additional features include VPS for 24/7 trading (free for VIPs, $30/month otherwise) and account analytics (e.g., performance stats, margin levels). Compared to IG’s extensive research suite, FxPro’s tools are trader-focused but lighter on fundamental analysis. They excel for technical traders, offering precision and flexibility, though beginners may need time to master the depth, especially on MT5/cTrader.

12. Leverage and Margin Requirements

FxPro offers leverage up to 1:200 for retail clients under SCB/FSCA rules, dropping to 1:30 for FCA/CySEC retail accounts (e.g., 1:30 forex majors, 1:20 minors) due to ESMA restrictions. Professional clients, qualifying via experience and capital (e.g., $500,000 portfolio), access up to 1:500. Leverage varies by asset: 1:100 for commodities, 1:20 for stock CFDs, and 1:10 for crypto CFDs.

Margin requirements depend on leverage and position size—e.g., a 1:100 leverage on EUR/USD requires 1% margin ($1,000 for a $100,000 lot). Margin calls trigger at 50% equity-to-margin ratio, urging additional funds, while stop-out levels (30% for SCB, 50% for FCA/CySEC) close positions to limit losses. Negative balance protection ensures losses don’t exceed deposits.

High leverage amplifies profits but risks rapid wipeouts—e.g., a 1% move against a 1:200 position doubles your loss relative to capital. FxPro’s tiered system balances opportunity and safety, though novices should start low (1:10-1:30) to mitigate volatility risks. Compared to XM (1:888), FxPro’s caps reflect regulatory prudence, prioritizing client protection over aggressive leverage.

13. Educational Resources

FxPro’s educational offerings cater to beginners and intermediates, though they lag behind leaders like IG. The Knowledge Hub includes articles and videos on forex basics, technical analysis (e.g., candlestick patterns), and platform tutorials for MT4/MT5/cTrader. Webinars, held weekly, cover live market analysis and strategy, accessible via registration on fxpro.com. A glossary and FAQs address common terms and queries.

Daily market analysis, available on the website and app, provides technical and fundamental insights (e.g., EUR/USD trends, Fed rate impacts), updated by in-house experts. Quality is solid—guides are clear, and videos are concise (5-15 minutes)—but depth is moderate. Advanced topics like hedging or quant trading are sparse, and there’s no progress tracking, unlike eToro’s structured courses.

For 2025, the content is practical for onboarding novices and refining skills, with the $10M demo account enhancing hands-on learning. Experienced traders may find it basic, needing external resources for deeper study. FxPro shines in platform-specific training and daily updates, making it a reliable starting point rather than a comprehensive academy.

14. Social and Copy Trading

FxPro does not offer a proprietary social or copy trading platform as of March 2025, focusing instead on direct trading tools. However, it supports third-party copy trading via MetaQuotes’ MQL5 community, accessible through MT4/MT5. Register on mql5.com, link your FxPro account, and subscribe to signal providers (fees vary, e.g., $30/month per signal). Performance stats and risk levels are viewable, though FxPro doesn’t curate or guarantee providers.

Unlike eToro or ZuluTrade, which integrate social features natively, FxPro’s approach is indirect, requiring external setup. There’s no in-platform trader interaction or leaderboard, limiting social engagement. For copy trading enthusiasts, MT5’s signal service suffices—offering automation and diversification—but lacks the seamless user experience of dedicated platforms. FxPro prioritizes active trading over passive strategies, a gap for beginners seeking hands-off options.

15. Customer Support

FxPro provides 24/5 customer support, aligning with forex market hours (Monday 00:00 to Friday 23:59 GMT). Channels include live chat (on fxpro.com and platforms), email ([email protected]), and phone (+44 203 151 5555, with regional numbers). The Help Centre offers a detailed FAQ and video tutorials, covering account setup, withdrawals, and trading issues.

Response times are strong—live chat answers within minutes, emails within 6-12 hours, and call-backs (requestable online) are prompt during business hours. Support is multilingual (20+ languages), earning praise for professionalism and clarity. Quality is high, with agents resolving technical queries (e.g., platform errors) efficiently, though 24/7 availability (like IC Markets) would benefit weekend traders.

Compared to peers, FxPro’s 24/5 model is standard, but its responsiveness and resource depth outshine slower brokers like XM. For urgent issues, live chat is the fastest route, making support reliable for most trader needs.

16. Safety, Security, and Regulation

FxPro operates under stringent oversight from multiple regulators: FCA (509956, UK), CySEC (078/07, Cyprus), FSCA (45052, South Africa), SCB (SIA-F184, Bahamas), and FSA (SD120, Seychelles). This multi-tier regulation ensures compliance with global standards, varying by client entity (e.g., FCA for UK, SCB for others). Client funds are segregated in top-tier banks (e.g., Barclays), separate from company assets, reducing misuse risk. FCA/CySEC clients benefit from investor compensation schemes—up to £85,000 (FSCS) or €20,000 (ICF)—if FxPro fails.

Security features include 2FA (email/SMS) on FxPro Direct and platforms, plus SSL encryption for data protection. Negative balance protection caps losses at account equity, a regulatory mandate. With a 19-year track record and $100M+ in Tier 1 capital, FxPro’s Trust Score (90/99 per ForexBrokers.com) reflects high reliability. No major security breaches are reported, making it a safe choice among CFD brokers.

17. Pros and Cons of FxPro

Pros: FxPro excels with top-tier regulation (FCA, CySEC), ensuring trust and fund safety. Its platform variety (MT4, MT5, cTrader, Edge) suits all trader types, with fast execution (<13ms) and tight spreads (0 pips on Raw+). No deposit/withdrawal fees and a $100 minimum entry enhance accessibility. The $10M demo and VPS support (free for VIPs) are standout tools, while negative balance protection adds security.

Cons: The lack of proprietary copy trading or bonuses may disappoint passive investors or bonus hunters. Educational resources are solid but not advanced, trailing IG or Saxo. Inactivity fees ($5/month after 6 months) and higher stock CFD fees (0.4 pips spread) could irk infrequent traders. Limited non-CFD assets (no ETFs, bonds) restrict long-term investment options.

FxPro shines for active traders needing flexibility and reliability, but casual or passive users might find it less comprehensive.

18. Comparison with Other Brokers

FxPro vs. XM: FxPro’s $100 minimum matches XM, but XM offers higher leverage (1:888 vs. 1:200) and a $30 no-deposit bonus, appealing to risk-takers. FxPro’s Raw+ (0 pips, $3.50/lot) beats XM’s Ultra Low (0.6 pips, no commission) for scalpers, and its platform range (cTrader, Edge) outshines XM’s MT4/MT5 focus. XM’s education is broader, though.

FxPro vs. Pepperstone: Both target pros—Pepperstone’s Razor (0.1 pips, $3.50/lot) rivals FxPro’s Raw+, but Pepperstone’s 1:500 leverage tops FxPro’s 1:200. FxPro’s cTrader and Edge add variety beyond Pepperstone’s MT4/MT5/cTrader trio. Fees are neck-and-neck, but Pepperstone offers 24/7 support vs. FxPro’s 24/5.

FxPro vs. eToro: eToro’s social/copy trading and real stocks/ETFs dwarf FxPro’s CFD-only focus and MQL5 integration. FxPro’s spreads (1.4 pips Standard) are tighter than eToro’s (1.9 pips), and its platforms cater to technical traders, unlike eToro’s beginner-friendly app. eToro charges withdrawal fees ($5), FxPro doesn’t.

FxPro leads in platform depth and pricing for active traders, trailing in passive options and bonuses.

19. User Reviews and Ratings

Recent 2025 reviews on Trustpilot (4.2/5, 796 reviews) praise FxPro’s fast withdrawals (24 hours), tight spreads, and reliable platforms, with users like Sophie (fxleaders.com) lauding its tools and education. Google Reviews echo this, averaging 4.3/5, highlighting 24/5 support responsiveness. Forums like Forex Peace Army note its regulatory strength and execution speed (<13ms).

Complaints focus on withdrawal delays (occasional 5-day bank waits), complex fee structures for novices, and lack of 24/7 support. Some cTrader users report slippage during volatility, though rare (<1% requotes). Overall, FxPro earns high marks (90/99 Trust Score) for trustworthiness and service, with minor gripes from beginners or weekend traders.

20. Platform Availability by Country

FxPro operates in 170+ countries, including the UK, EU (via MiFID passporting), South Africa, Australia, Japan, and India (with currency conversion fees). Key markets like the Netherlands, UAE, and Singapore enjoy full access. The BnkPro app, offering equity trading, is rolling out selectively—check fxpro.com for availability.

Restricted regions include the USA, Canada, Iran, and North Korea due to regulatory bans (e.g., CFTC for US) or sanctions. Some features, like crypto CFDs, are unavailable to UK retail clients under FCA rules. Indian traders face KYC scrutiny to ensure leveraged trading comprehension. FxPro’s global reach is broad, with entity-specific compliance (e.g., SCB for non-EU clients).

21. Taxation and Declaring Profits

Taxation on FxPro profits depends on your country. In the UK, CFD trading incurs Capital Gains Tax (CGT) unless using spread betting (tax-free); the 2025 CGT allowance is £3,000, with rates at 10-20%. EU traders report gains as income or capital, varying by nation (e.g., Germany’s 25% flat rate). South Africa taxes CFDs as income (up to 45%), while Australia applies CGT (50% discount for 12+ month holds). Consult a local tax advisor, as FxPro doesn’t withhold taxes.

FxPro provides no tax statements—download trade history from FxPro Direct to compile gains/losses manually. This aligns with most brokers (e.g., XM, Pepperstone), placing reporting on traders. For spread betting (UK), no documentation is needed beyond personal records. The lack of tax tools may burden novices, but it’s standard for CFD platforms.

22. Common Issues and How to Solve Them

Login Problems: Forgotten passwords—use “Forgot Password” on fxpro.com, reset via email. 2FA delays—check spam or resend code. Solution: Keep credentials updated, contact support (live chat) if locked out.

Withdrawal Delays: Bank transfers may take 5 days—verify bank details match deposit source. E-wallet holds (e.g., insufficient trading)—trade 1 lot minimum. Solution: Confirm AML compliance, escalate via email ([email protected]).

Verification Troubles: Rejected documents—ensure ID is clear, address proof recent (<3 months). Solution: Resubmit via FxPro Direct, chat for guidance.

Platform Bugs: MT4/MT5 freezes—update software, check internet. cTrader slippage—report to support with screenshots. Solution: Clear cache, reinstall, or switch to web version.

Most issues stem from user error or third-party delays, resolvable with proactive steps or 24/5 support.

23. Final Verdict

FxPro is a standout broker in 2025, blending top-tier regulation (FCA, CySEC), diverse platforms (MT4, MT5, cTrader, Edge), and competitive pricing (0 pips Raw+). Strengths include fast execution, no deposit/withdrawal fees, and a $10M demo, making it a haven for active traders. Weaknesses—limited education, no native copy trading, and inactivity fees—curb its appeal for beginners or passive investors.

It’s ideal for intermediate to advanced traders, especially scalpers and algo enthusiasts, leveraging cTrader or MT5. Beginners benefit from the demo and Edge’s simplicity, but may need external learning. Long-term investors find little here, with no ETFs or real stocks. FxPro’s reliability and tools make it a top pick for serious, hands-on traders.

24. FAQs

- What is the minimum deposit? $100, though $1,000 is recommended for full features.

- How long do withdrawals take? 24 hours for e-wallets/cards, 1-5 days for bank transfers.

- Is FxPro safe? Yes, regulated by FCA, CySEC, with segregated funds and negative balance protection.

- What are the available trading platforms? MT4, MT5, cTrader, FxPro Edge (web, desktop, mobile).

- Is FxPro regulated? Yes, by FCA (509956), CySEC (078/07), FSCA (45052), SCB (SIA-F184), FSA (SD120).

- Are there any inactivity fees? Yes, $5/month after 6 months, plus a $15 one-time fee.

- Does FxPro support cryptocurrency trading? Yes, 18+ CFD pairs (e.g., BTC/USD), not for UK retail.

- What are the available contact methods for customer support? Live chat, email ([email protected]), phone (+44 203 151 5555), 24/5.