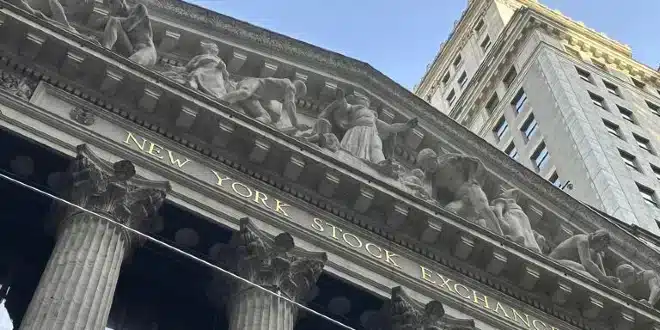

Early Wednesday, Wall Street markets showed mixed results but remained at or near record levels, with retailer earnings taking the spotlight amid a lack of significant economic news.

Futures for the Dow Jones Industrial Average edged up by less than 0.1% before the opening bell, while futures for the S&P 500 dipped by 0.1%.

Target’s shares fell 7% in pre-market trading after the company reported a drop in quarterly revenue and missed profit expectations set by analysts. Earlier this week, Target announced price cuts on thousands of consumer essentials to attract inflation-weary shoppers.

Lululemon, the Canadian yoga and athletic wear company, saw its shares decline by 4% after announcing organizational changes following the departure of its chief product officer.

This week’s standout is Nvidia, whose stock has surged due to excitement around artificial intelligence technology. Nvidia will report its latest quarterly results after the market closes on Wednesday, with high expectations. Early trading saw Nvidia shares remain steady at about $954 each, more than six times their value at the start of 2023.

With little top-tier economic data expected this week, market movements will likely be driven by profit reports.

Wednesday’s schedule includes earnings reports from TJX Cos., Petco, and Williams Sonoma.

U.S. indexes have recently hit record highs, fueled largely by expectations that the Federal Reserve will cut interest rates later this year as inflation cools. Reports of larger-than-expected profits from major U.S. companies have also boosted the market.

Rates for mortgages, credit cards, and other payments have increased because the Federal Reserve has kept its main interest rate at its highest level in over two decades. The Fed aims to slow the economy just enough to curb high inflation without triggering a recession.

Later Wednesday, the latest government data on home sales will be released, along with minutes from the most recent Federal Reserve meeting, where the central bank kept its benchmark rate unchanged for the sixth consecutive time.

In Europe, Britain’s FTSE 100 fell by 0.4% after the Office for National Statistics reported stronger-than-expected inflation, dampening hopes for a rate cut in June. Inflation fell to 2.3% in April from 3.2% in March but remained above the Bank of England’s 2% target. France’s CAC 40 dropped 0.6% by midday, while Germany’s DAX declined 0.5%.

In Asia, Tokyo’s Nikkei 225 fell 0.9% to 38,617.10 after Japan reported a rising trade deficit, with import costs outpacing an 8% increase in exports from the previous year, falling short of analysts’ expectations. Hong Kong’s Hang Seng index decreased by 0.2% to 19,184.85, while the Shanghai Composite index remained nearly unchanged at 3,158.54. South Korea’s Kospi was virtually flat at 2,723.46, and Australia’s S&P/ASX 200 edged down 0.1% to 7,848.10. Taiwan’s Taiex rose by 1.5%, driven by a 2.7% increase in Taiwan Semiconductor Manufacturing Corp. shares. Markets in Thailand were closed for a holiday.

Benchmark U.S. crude fell 53 cents to $78.13 a barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the international standard, declined 55 cents to $82.33 a barrel.

The U.S. dollar rose to 156.47 Japanese yen from 156.16 yen, while the euro fell to $1.0833 from $1.0854.

On Tuesday, the S&P 500 rose by 0.3% to 5,321.41, surpassing its record set last week. The Nasdaq composite gained 0.2% to 16,832.62, a day after setting a new all-time high. The Dow Jones Industrial Average climbed 0.2% to 39,872.99, just below its recent high.