1. Introduction to Saxo Bank

Saxo Bank, founded in 1992 as Midas Fondsmæglerselskab by Kim Fournais and Lars Seier Christensen, rebranded to Saxo Bank in 2001 after obtaining a banking license. Headquartered in Copenhagen, Denmark, it has grown into a global fintech leader, serving over 1.2 million clients across 180+ countries. Initially focused on forex trading, Saxo Bank expanded its offerings to include stocks, bonds, ETFs, and more, leveraging cutting-edge technology to democratize trading. Its acquisition of BinckBank in 2019 bolstered its European presence and shifted focus toward long-term investors alongside active traders.

Saxo Bank operates under stringent regulation from multiple top-tier authorities, including the Danish Financial Supervisory Authority (DFSA), the UK’s Financial Conduct Authority (FCA, license number 551422), the Australian Securities and Investments Commission (ASIC, registration number 126 373 859), and the Swiss Financial Market Supervisory Authority (FINMA, license number CHE-106.787.764). It holds banking licenses in Denmark and Switzerland, enhancing its credibility. In 2023, it was designated a Systemically Important Financial Institution (SIFI) by the DFSA, reflecting its market significance.

With over $120 billion in client assets (per its 2023 annual report), Saxo Bank enjoys a strong reputation for reliability and innovation. Its global footprint spans 15 jurisdictions, with offices in London, Singapore, Dubai, and more. Rated A- by S&P Global Ratings, it competes with giants like Interactive Brokers, appealing to sophisticated traders and institutions through its award-winning platforms and extensive asset offerings. Despite not being publicly traded, its ownership by Geely Holding Group and founders ensures stability.

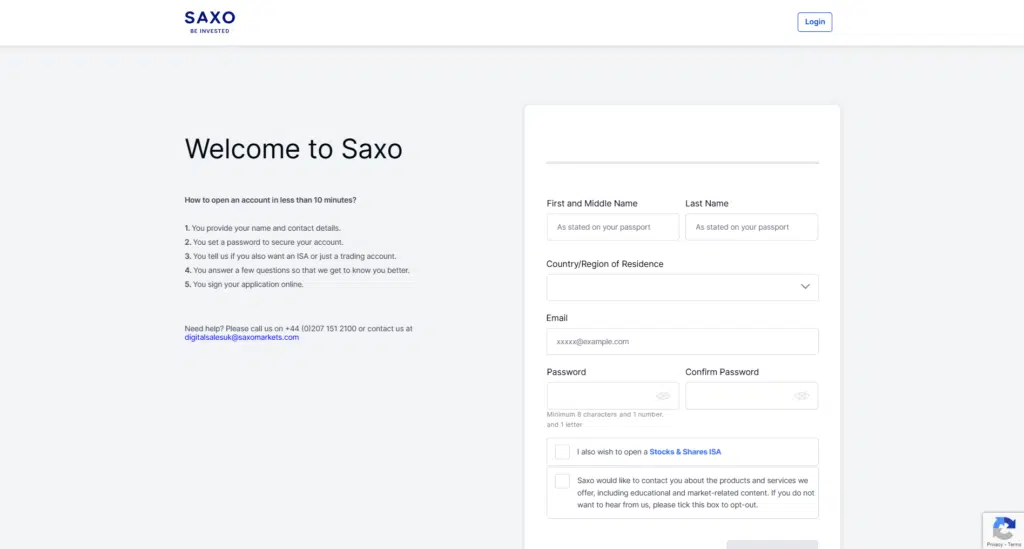

2. How to Register on Saxo Bank

Registering with Saxo Bank is a straightforward process designed for efficiency and security. Begin by visiting the official website (home.saxo) and clicking “Open Account.” You’ll select your country of residence, which determines the applicable entity (e.g., Saxo Bank A/S for EU clients). Next, provide basic personal information: full name, email, phone number, and a secure password. You’ll also choose your account type (individual, joint, or corporate) and base currency from 26 options, such as USD, EUR, or CHF.

The Know Your Customer (KYC) process follows, requiring identity verification to comply with global regulations. You’ll need to upload a government-issued ID (passport, driver’s license, or national ID card) and proof of address (utility bill, bank statement, or tax document dated within the last three months). In some countries, Saxo integrates with government databases to auto-retrieve data using a personal ID number, streamlining verification. For corporate accounts, additional documents like business registration and ownership details are required.

Once submitted, verification typically takes 1-2 business days, though it may extend if documents are unclear. After approval, you receive a confirmation email with login credentials. Funding your account completes the setup, with no minimum deposit required for Classic accounts in most regions as of 2025. Beginners should ensure documents are legible to avoid delays, while the intuitive online form makes the process accessible even for novices.

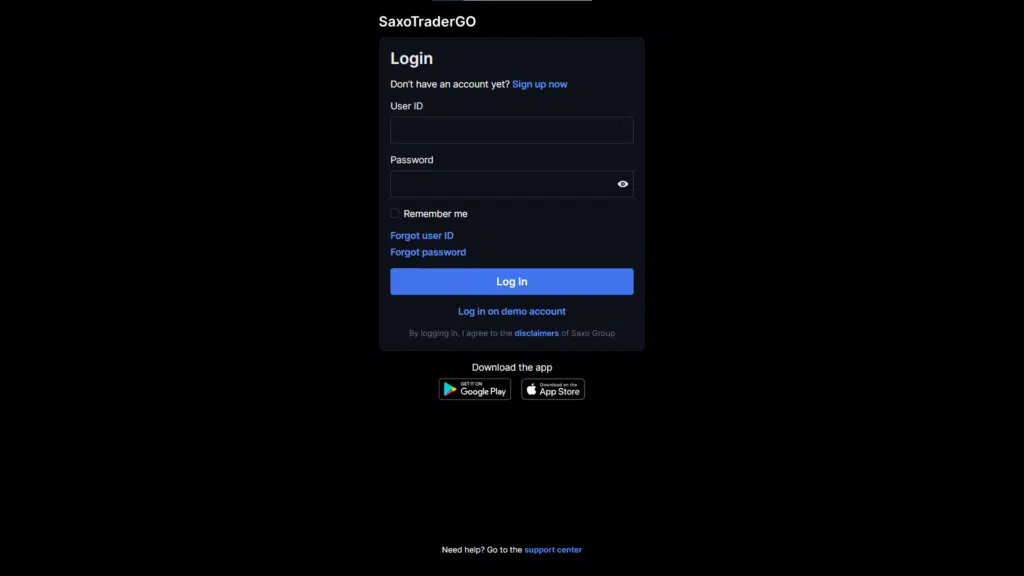

3. Saxo Bank Login Process

Logging into Saxo Bank is simple once your account is activated. Visit home.saxo or open the SaxoTraderGO mobile app, then enter your email address (or username) and password created during registration. For enhanced security, Saxo offers two-factor authentication (2FA), prompting a one-time code sent via SMS or authenticator app. Platinum and VIP accounts may use an IP-linked login for added protection. After entering credentials, click “Log In” to access your dashboard.

Common login issues include forgotten passwords, easily resolved by selecting “Forgot Password” and following email reset instructions. Incorrect 2FA codes—often due to time sync errors—can be fixed by resyncing your authenticator app or requesting a new code. Account lockouts after multiple failed attempts require contacting support (via email or phone) with your account details for unlocking. Slow internet or outdated app versions may also disrupt login; ensure your app is updated (iOS/Android) and your connection is stable.

Saxo’s login process balances security and usability, with 2FA recommended for all users. Beginners may find initial 2FA setup slightly technical, but the platform’s support resources guide you through troubleshooting effectively.

4. Available Account Types

Saxo Bank offers a tiered account structure catering to diverse trading needs: Classic, Platinum, and VIP, alongside joint and corporate options. The Classic account, ideal for beginners, requires no minimum deposit in most regions (though some jurisdictions like Australia mandate AUD 3,000). It provides access to all assets with standard pricing (e.g., 0.08% commission on US stocks, minimum $1). Platinum, aimed at active traders, requires a $200,000 minimum deposit, offering tighter spreads (e.g., forex from 0.7 pips) and priority support. VIP, for high-net-worth clients, starts at $1 million, featuring bespoke pricing (e.g., futures at $1 per contract), a personal manager, and exclusive event invites.

Joint accounts suit couples or partners, mirroring Classic features with shared ownership, while corporate accounts cater to businesses, requiring higher documentation (e.g., company registration) and tailored pricing based on volume. Professional accounts, available to qualifying traders (e.g., those with €500,000+ portfolios), unlock higher leverage (up to 1:100) but forgo some retail protections like negative balance protection.

Differences lie in pricing, support, and minimums—Classic suits cost-conscious novices, while Platinum and VIP target volume traders with perks like lower fees and enhanced service. Saxo Rewards allows Classic users to upgrade by earning points through trading volume (e.g., 120,000 points for Platinum).

5. Demo Account Availability

Saxo Bank offers a free demo account, a valuable tool for beginners and strategy testers. To open one, visit home.saxo, select “Try a Free Demo,” and fill out a short form with your name, email, phone number, and country. No KYC is required, and the account activates instantly with $100,000 in virtual funds, valid for 20 days. You can explore all platforms—SaxoTraderGO and SaxoTraderPRO—mirroring live account features like real-time pricing and charting tools.

The demo replicates tradable assets (stocks, forex, ETFs, etc.) and order types, though execution speeds may differ slightly from live markets. It’s ideal for practicing without risk, testing technical indicators, or familiarizing yourself with the interface. However, it lacks access to live customer support or premium research, reserved for funded accounts.

Traders can request an extension or open multiple demos by re-registering with a different email. For beginners, it’s a low-pressure way to build confidence; for intermediates, it’s a sandbox for refining strategies. The 20-day limit encourages transitioning to a live account, aligning with Saxo’s focus on serious traders.

6. Trading Platform Overview

Saxo Bank provides three robust platforms: SaxoTraderGO (web and mobile), SaxoTraderPRO (desktop), and SaxoInvestor (web/mobile for long-term investors). SaxoTraderGO, the flagship, boasts a sleek, intuitive interface accessible via browser or iOS/Android apps. It offers advanced charting (70+ indicators), one-click trading, and real-time news integration, appealing to beginners and active traders alike. Customization is moderate, with adjustable layouts and watchlists.

SaxoTraderPRO, a downloadable desktop platform, targets professionals with multi-monitor support, algorithmic trading, and extensive customization (e.g., detachable windows). Its learning curve is steeper, but features like Level 2 market data and advanced order management reward experienced users. The mobile version of SaxoTraderGO mirrors the web’s functionality, with responsive design and push notifications, though smaller screens limit multitasking.

SaxoInvestor simplifies investing in ETFs and mutual funds, offering portfolio tracking and basic charting—perfect for passive investors but less suited for day trading. All platforms integrate seamlessly with Saxo’s 71,000+ instruments, supported by fast execution and reliable uptime. User feedback praises the sophisticated design, though some note SaxoTraderPRO’s complexity may overwhelm novices. Compared to competitors, Saxo’s platforms excel in depth and polish.

7. Markets and Assets Available

Saxo Bank offers an expansive range of markets, with over 71,000 tradable instruments across 50+ exchanges. Stocks cover major markets (NYSE, NASDAQ, LSE, SIX Swiss) with popular names like Apple, Tesla, and UBS. Forex includes 190+ pairs, from majors (EUR/USD) to exotics (USD/TRY), with spreads starting at 0.4 pips. Cryptocurrencies are available as CFDs or Crypto FX pairs (e.g., BTC/USD, ETH/USD), though direct ownership isn’t offered.

Commodities span gold, oil, and agricultural products, traded as futures or CFDs. ETFs (9,000+) include Vanguard S&P 500 and iShares MSCI World, while bonds cover government (e.g., US Treasuries) and corporate issues. Options and futures extend to indices (S&P 500) and metals, catering to sophisticated traders. Fractional shares aren’t supported for stocks or ETFs, requiring whole-unit purchases—a drawback for small-budget investors.

This vast selection suits diversified portfolios, with standout assets like forex pairs for scalpers and ETFs for buy-and-hold strategies. Saxo’s breadth outshines many brokers, though the lack of fractional trading may deter beginners with limited capital.

8. Fees and Commissions

Saxo Bank’s fee structure varies by account tier and asset. For Classic accounts, US stock trades cost 0.08% (minimum $1), UK stocks 0.08% (£3 minimum), and forex spreads start at 0.9 pips. Platinum and VIP tiers lower these: forex drops to 0.7 pips, futures to $1 per contract. Overnight financing applies to leveraged positions (e.g., Saxo’s bid/offer rate plus a markup), competitive with industry norms.

Non-trading fees include a 0.25% currency conversion fee, below the 1% average of peers like IG. Withdrawals are free via the online module, but manual requests incur $40, and banks may add charges. Inactivity fees were eliminated by 2025, a boon for passive investors. Custody fees (0.12% annually) apply to stock holdings unless opting into securities lending, which waives them.

Compared to Interactive Brokers (0.005% per share) or eToro (0% commission but wider spreads), Saxo’s fees are mid-tier—higher than discount brokers but justified by premium tools and execution. Beginners may find minimums steep, while active traders benefit from volume discounts.

9. Deposit and Withdrawal Methods

Saxo Bank supports deposits via bank wire (18 currencies) and credit/debit cards (Visa, Mastercard) in most regions, but e-wallets (PayPal, Skrill) aren’t accepted. Deposits require accounts in your name, with no fees from Saxo—bank charges may apply. Card deposits are instant; wires take 2-5 business days. Minimums vary by jurisdiction (e.g., $0 for Classic, AUD 3,000 in Australia).

Withdrawals use the online Cash Withdrawal Module, processed next business day without Saxo fees, though intermediary banks may charge. Card withdrawals aren’t universally available (check your region), and limits depend on account tier (e.g., VIPs face fewer restrictions). Processing is reliable, with funds typically arriving in 1-5 days.

Saxo’s options are standard but lack e-wallet flexibility compared to brokers like XM. Beginners appreciate the no-fee deposits, though withdrawal delays from bank processing can frustrate.

10. Bonuses and Promotions

As of March 2025, Saxo Bank doesn’t offer traditional welcome bonuses, aligning with regulatory trends discouraging overtrading incentives. Instead, it runs Saxo Rewards, a loyalty program where traders earn points (30-110 per trade) based on volume and asset type. Accumulate 120,000 points for a 12-month Platinum upgrade or 500,000 for VIP, unlocking lower fees and premium perks. Points reset annually unless redeemed.

Referral programs exist in select regions (e.g., Switzerland offers 200 CHF credits for referrer and referee), valid for 90 days. Terms require both parties to fund and trade, with credits applied post-activity. Unlike eToro’s cash bonuses, Saxo’s focus is on long-term value over gimmicks, appealing to serious traders but less enticing for bonus-driven beginners.

11. Trading Tools and Features

Saxo Bank’s platforms pack powerful tools: charting offers 70+ technical indicators (RSI, MACD), drawing tools, and multi-timeframe analysis. The economic calendar tracks global events, while real-time news feeds from SaxoStrats and third parties keep traders informed. Risk management includes Account Shield (account-wide stop-loss) and position-level tools.

Order types are robust: market, limit, stop-loss, trailing stop, and algorithmic orders via SaxoTraderPRO. Beginners benefit from pre-set templates, while pros leverage backtesting and FIX API integration. Compared to MetaTrader’s basic suite, Saxo’s tools are more comprehensive, though the learning curve may intimidate novices. Daily market updates enhance decision-making, making it a standout for technical traders.

12. Leverage and Margin Requirements

Retail traders access leverage up to 1:30 (e.g., forex majors), capped by EU/UK regulations, while professional clients can reach 1:100, depending on asset and eligibility (e.g., €500,000 portfolio). Margin requirements vary—5% for stocks, 3.33% for forex majors—with margin calls at 75% and stop-outs at 50% equity.

High leverage amplifies gains but risks rapid losses, especially in volatile markets like forex or crypto CFDs. Saxo provides negative balance protection for retail EU/MENA clients, mitigating debt risk, though professionals lack this safety net. Beginners should start low (e.g., 1:5) to manage exposure, as Saxo’s tools help but can’t eliminate leverage’s inherent dangers.

13. Educational Resources

Saxo Bank’s educational offerings include webinars, video tutorials, and articles under the “Inspiration” section, curated by SaxoStrats experts. Beginners find step-by-step guides on forex and ETF investing, while intermediates explore advanced strategies. Quality is high, with clear visuals and practical examples, though some tools (e.g., premium research) require a live account.

Daily market reports and live updates from the sales trading team provide actionable insights, rivaling brokers like IG. Saxo Investing Sessions, a webinar series, targets novices with professional tips. While comprehensive, the content leans toward active trading, potentially under-serving pure buy-and-hold investors. It’s a strong resource for skill-building across levels.

14. Social and Copy Trading

Saxo Bank doesn’t offer social or copy trading as of 2025, focusing instead on proprietary platforms and self-directed trading. Unlike eToro or ZuluTrade, which thrive on community features, Saxo caters to independent traders with tools like SaxoSelect (managed portfolios) rather than peer-to-peer copying. This absence reflects its professional ethos but may disappoint beginners seeking to mirror experts. For social trading, competitors remain a better fit.

15. Customer Support

Saxo Bank provides 24/5 support via email, phone, and live chat (on-platform for clients). Phone lines vary by region (e.g., +45 3977 4956 for Denmark), with multilingual staff. VIP clients get personal managers, while Classic users rely on standard channels. Response times average minutes for chat, hours for email—efficient but not 24/7 like some rivals (e.g., XM).

User feedback praises technical assistance but notes delays in complex queries (e.g., document disputes). The help.saxo portal offers detailed FAQs, though demo users lack live agent access. Support is reliable for trading hours, ideal for active traders but less so for off-hours emergencies.

16. Safety, Security, and Regulation

Saxo Bank is regulated by six Tier-1 bodies: DFSA, FCA (551422), ASIC (126 373 859), FINMA (CHE-106.787.764), MAS, and JFSA, plus others like the DFSA (Dubai). Client funds are segregated from corporate assets, protected by schemes like the UK’s FSCS (£85,000) or EU’s ICS (€20,000 securities, €100,000 cash). Negative balance protection applies to retail EU/MENA clients.

Security features include 2FA, SSL encryption, and strict withdrawal protocols (e.g., same-name accounts only). Its SIFI status and A- S&P rating underscore stability. Compared to lightly regulated brokers, Saxo’s oversight and safeguards inspire trust, making it a low-risk choice.

17. Pros and Cons of Saxo Bank

Pros: Extensive asset range (71,000+ instruments), top-tier regulation (FCA, ASIC), award-winning platforms (SaxoTraderGO/PRO), competitive forex spreads (0.4 pips), no inactivity fees, and robust tools (70+ indicators). Saxo Rewards and negative balance protection enhance appeal.

Cons: No fractional shares, high minimums for Platinum/VIP ($200,000/$1 million), no social/copy trading, steeper fees for low-volume traders (e.g., $3 minimum), and a complex desktop platform (SaxoTraderPRO). E-wallet absence and manual withdrawal fees ($40) frustrate some.

Saxo shines for depth and reliability but may overwhelm beginners or small-budget users with its sophistication and costs.

18. Comparison with Other Brokers

Interactive Brokers (IBKR): IBKR offers lower stock fees (0.005% vs. Saxo’s 0.08%) and fractional shares, with a broader API suite. Saxo counters with a slicker interface and more forex pairs (190 vs. 100).

eToro: eToro’s 0% commission and social trading appeal to beginners, but its spreads are wider (1 pip vs. Saxo’s 0.4). Saxo excels in asset variety and professional tools.

IG: IG matches Saxo’s regulation and tools, with tighter spreads on some pairs (0.6 pips). Saxo leads in platform design and ETF selection (9,000 vs. 2,000).

Saxo stands out for premium features and global reach, though IBKR wins on cost, eToro on accessibility, and IG on spread consistency.

19. User Reviews and Ratings

On Trustpilot (3.8/5 from 6,799 reviews as of January 2025), users praise Saxo’s platform usability and asset range, with comments like “great UI, easy to navigate.” Customer service earns mixed feedback—quick for minor issues but slow for complex disputes. Google Reviews echo this, lauding low fees post-2024 cuts but noting occasional app instability. Forums like Reddit highlight execution speed and research quality, though some criticize high minimums for premium accounts.

Common complaints include delayed support and withdrawal hiccups, while praise centers on reliability and tools. Saxo appeals to serious traders but frustrates some with service gaps.

20. Platform Availability by Country

Saxo Bank operates in 180+ countries, including the UK, EU nations (via Saxo Bank A/S), Australia, Japan, Singapore, and the UAE. Swiss residents use Saxo Bank (Switzerland) Ltd. It’s unavailable in the US due to regulatory restrictions, and regions like North Korea, Iran, and Syria face sanctions-based exclusions. Some countries (e.g., South Africa) have limited services due to local laws.

Availability varies by entity, with tailored pricing and support per region. Check home.saxo for your country’s status—beginners should confirm eligibility before registering.

21. Taxation and Declaring Profits

Taxation depends on your country’s laws—Saxo doesn’t withhold taxes universally but assists in select regions (e.g., Denmark, Belgium). In the UK, profits are subject to Capital Gains Tax; in Australia, they’re taxable income. Saxo provides detailed transaction reports and tax statements via the platform (under “Reports”), covering trades, dividends, and interest—crucial for filing.

Traders must self-report profits to local authorities, as Saxo isn’t a tax advisor. Beginners should consult professionals, as the reporting tool simplifies but doesn’t replace compliance. Accuracy is high, though manual reconciliation may be needed for multi-currency trades.

22. Common Issues and How to Solve Them

Login Problems: Forgotten passwords—use “Forgot Password” for a reset link. 2FA fails—resync your app or contact support (+45 3977 4956).

Withdrawal Delays: Bank processing (2-5 days)—verify account details match; manual fees ($40)—use the online module.

Verification Troubles: Rejected documents—resubmit clear, current IDs/proof of address; delays—email support with your application ID.

Platform Bugs: App freezes—update to the latest version (App Store/Google Play) or clear cache; slow execution—check internet stability.

Support resolves most issues, though response times vary. Beginners benefit from patience and proactive troubleshooting.

23. Final Verdict

Saxo Bank excels with its vast asset selection, top-tier regulation, and sophisticated platforms, making it a powerhouse for active traders and institutions. Low forex spreads, no inactivity fees, and premium tools like SaxoTraderPRO cater to pros, while SaxoInvestor suits long-term investors. Weaknesses include no fractional shares, high premium account minimums, and a steep learning curve for novices.

It’s best for intermediate to advanced traders with sizable capital, seeking global diversification and robust analytics. Beginners may find it costly and complex compared to eToro, while casual investors might prefer IBKR’s lower fees. Saxo’s premium experience justifies its price for committed market players.

24. FAQs

What is the minimum deposit? $0 for Classic accounts (varies by region, e.g., AUD 3,000 in Australia).

How long do withdrawals take? 1-5 business days, processed next day via the online module.

Is Saxo Bank safe? Yes, regulated by FCA, ASIC, FINMA, with segregated funds and compensation schemes.

What are the available trading platforms? SaxoTraderGO (web/mobile), SaxoTraderPRO (desktop), SaxoInvestor (web/mobile).

Is Saxo Bank regulated? Yes, by DFSA, FCA (551422), ASIC (126 373 859), FINMA (CHE-106.787.764), and more.

Are there any inactivity fees? No, eliminated by 2025.

Does Saxo Bank support cryptocurrency trading? Yes, via CFDs and Crypto FX pairs (e.g., BTC/USD).

What are the available contact methods for customer support? Email, phone (e.g., +45 3977 4956), live chat (platform-based, 24/5).