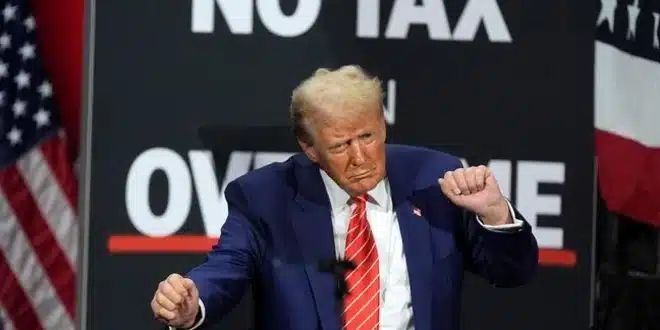

The U.S. Senate has advanced the “One Big Beautiful Bill,” a comprehensive Republican-led budget and tax package endorsed by President Donald Trump. The bill aims to make permanent the 2017 tax cuts, introduce new tax benefits, and implement significant reductions in federal spending. While proponents argue it will stimulate economic growth and reduce the deficit, critics warn of adverse effects on social programs and increased national debt.

Tax Policy Overhaul and Economic Implications

The legislation seeks to extend the individual tax cuts from the 2017 Tax Cuts and Jobs Act, which are set to expire this year. It proposes increasing the standard deduction to $32,000 for couples and $16,000 for individuals. Additionally, the child tax credit would rise modestly to $2,200 per child, adjusted for inflation, but only for those with valid Social Security numbers, thereby excluding many non-citizen parents.

New tax provisions include exemptions for tips in certain professions, non-taxation of overtime pay under specific conditions, deductions for interest on car loans for U.S.-made vehicles, and an additional $6,000 deduction for seniors over 65. However, the Joint Committee on Taxation estimates that these tax changes could reduce federal revenue by $4.5 trillion over the next decade. The White House contends that the bill would ultimately reduce the annual deficit by $1.4 trillion.

Reductions in Social Programs and Healthcare

The bill proposes substantial cuts to Medicaid, introducing work requirements and limiting states’ ability to collect extra federal funds through provider taxes. A $25 billion rural hospital bailout fund is included to mitigate the impact of these cuts, starting in 2028. For the Supplemental Nutrition Assistance Program (SNAP), the plan caps future expansion and shifts more administrative costs to states, with the federal government covering only 25% starting in 2027, down from 50%.

Critics argue that these measures could lead to millions losing healthcare coverage and increased financial strain on low-income families. Senator Thom Tillis of North Carolina opposed the bill, citing concerns over its impact on his state’s healthcare infrastructure, particularly in rural areas.

Immigration Enforcement and Border Security Funding

The bill allocates approximately $170 billion for immigration enforcement, including $46 billion for completing the border wall and maritime barriers, $70 billion for new detention centers and deportation transport, and additional funds for expanding immigration courts and border agents. These measures aim to enhance border security and streamline immigration processes.

Education and Student Loan Reforms

The legislation seeks to repeal President Biden’s student loan relief program, projected to save $320 billion over ten years. It also proposes limiting lifetime borrowing for students to $257,000, excluding Parent PLUS loans, and repealing several loan forgiveness and repayment programs. Additionally, the bill introduces a $1,000 “Trump Account” for each newborn, with families allowed to contribute up to $5,000 per year until the child turns 31. A $4 billion annual tax credit is also established for donations to organizations supporting private school and homeschooling scholarships.

Defense Spending and Environmental Policy Changes

The bill includes $158 billion for defense spending, with allocations for defense supply chains, missile defense systems, shipbuilding, and space technology. Conversely, it proposes eliminating the $7,500 electric vehicle tax credit, phasing out clean energy incentives, and accelerating fossil fuel production by mandating new drilling leases and easing coal regulations. These environmental policy changes have drawn criticism from clean energy advocates and industry leaders.

Legislative Process and Political Dynamics

The Senate narrowly voted 51-49 to advance the bill, with two Republican senators opposing it due to concerns over Medicaid cuts and the proposed $5 trillion increase in the federal borrowing limit. Democrats have criticized the bill for favoring the wealthy and undermining social programs. The legislative process has been marked by partisan debates and procedural delays, including demands for the full 940-page bill to be read aloud in the chamber.

If the Senate passes the bill, it will return to the House for final approval before reaching the President’s desk. Lawmakers aim to complete the legislative process before the July 4 holiday.