Interactive Brokers (IB) is a prominent American multinational brokerage firm known for operating one of the largest electronic trading platforms in the United States. Founded in 1978 by Thomas Peterffy, the company has grown significantly over the decades, establishing itself as a leader in the financial services industry. Headquartered in Greenwich, Connecticut, Interactive Brokers offers a comprehensive suite of services, including direct market access to stocks, options, futures, forex, bonds, and ETFs.

Regulation and Licenses

Interactive Brokers is subject to stringent regulatory oversight, ensuring compliance with various financial authorities globally. In the United States, it is regulated by the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA). Additionally, the company holds memberships with the New York Stock Exchange (NYSE) and the Commodity Futures Trading Commission (CFTC). These affiliations underscore the firm’s commitment to maintaining high standards of transparency and integrity in its operations.

Reputation, Global Presence, and Market Position

Interactive Brokers has cultivated a strong reputation for innovation and reliability in the brokerage industry. With operations spanning over 150 markets in 28 currencies across more than 200 countries, the firm serves a diverse clientele, including individual investors, hedge funds, proprietary trading groups, financial advisors, and introducing brokers. As of December 31, 2023, Interactive Brokers reported 2.6 million institutional and individual brokerage customers, with total customer equity amounting to US$426 billion.

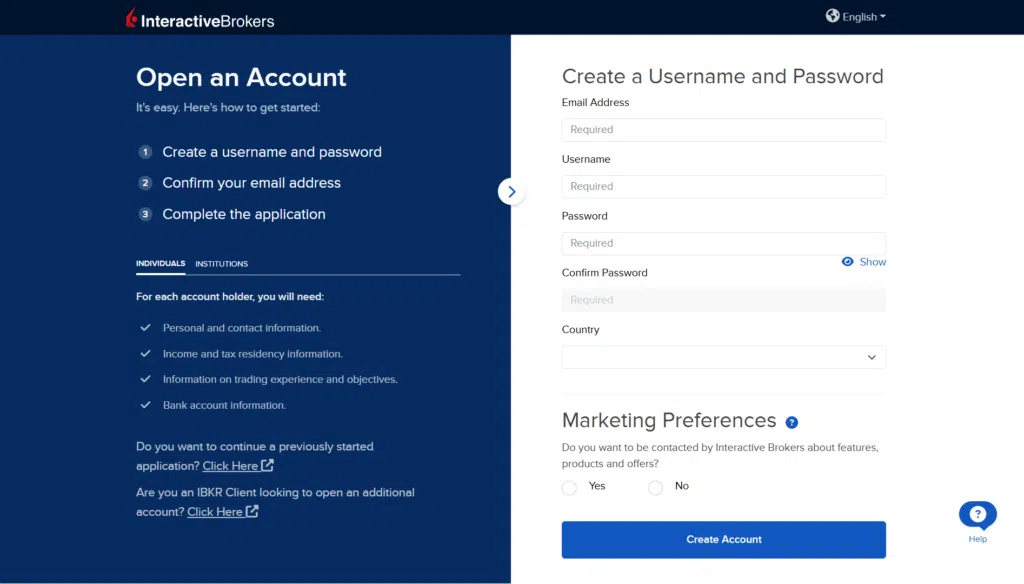

How to Register on Interactive Brokers

Registering with Interactive Brokers is a straightforward process designed to comply with regulatory standards and ensure the security of client accounts.

- Initiate Application: Prospective clients can begin by visiting the Interactive Brokers website and selecting the “Open Account” option. The platform offers various account types, including individual, joint, retirement, and institutional accounts. Users should choose the account type that best fits their investment needs.

- Provide Personal Information: Applicants are required to furnish personal details such as full name, date of birth, social security number (for U.S. residents), and contact information. This step ensures that the firm can verify the identity of the applicant in compliance with Know Your Customer (KYC) regulations.

- Employment and Financial Information: The application process includes questions about employment status, annual income, net worth, and investment experience. This information helps Interactive Brokers assess the suitability of their services for the applicant.

- Agree to Terms and Conditions: Applicants must review and accept the firm’s terms and conditions, which outline the rights and responsibilities of both the client and Interactive Brokers.

- Identity Verification (KYC Requirements): To comply with regulatory standards, Interactive Brokers requires applicants to submit identification documents. Typically, this includes a government-issued photo ID (such as a passport or driver’s license) and proof of residence (such as a utility bill or bank statement). These documents can be uploaded securely through the platform during the application process.

- Application Review and Approval: Once all required information and documents are submitted, Interactive Brokers reviews the application. This process may take a few business days. Upon approval, clients receive confirmation and can proceed to fund their accounts.

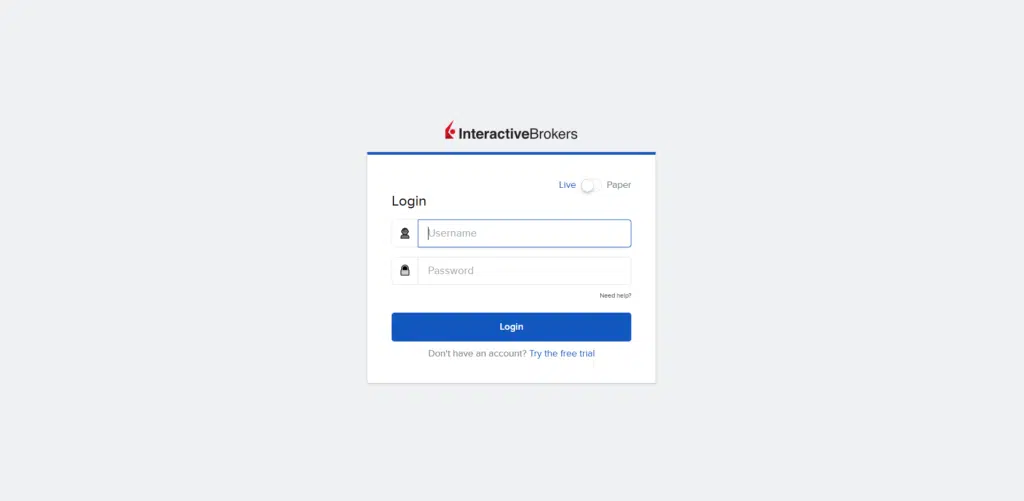

Interactive Brokers Login Process

After successfully registering and funding an account, clients can access their Interactive Brokers accounts through the following steps:

- Access the Login Page: Navigate to the Interactive Brokers website and click on the “Log In” button, typically located at the top right corner of the homepage.

- Enter Credentials: Input the username and password created during the registration process. For enhanced security, Interactive Brokers employs two-factor authentication (2FA), requiring clients to enter a code sent to their registered mobile device or email.

- Dashboard Access: Upon successful authentication, clients are directed to their account dashboard, where they can monitor portfolios, execute trades, and access various tools and resources.

Common Login Issues and Solutions

- Forgotten Password: If a client forgets their password, they can use the “Forgot Password” link on the login page to reset it. This process typically involves verifying personal information and may require access to the registered email or phone number.

- Two-Factor Authentication Problems: Issues with receiving 2FA codes can arise due to network problems or outdated contact information. Clients should ensure their contact details are current and check for any network issues. If problems persist, contacting Interactive Brokers’ customer support is advisable.

- Browser Compatibility: Some login issues may stem from browser incompatibility or outdated browser versions. Clients should use the latest version of a supported browser and ensure that cookies and JavaScript are enabled.

4. Available Account Types

Interactive Brokers (IBKR) offers a diverse range of account types tailored to meet the needs of various investors and institutions. Below is an overview of the primary account categories:

- Individual Accounts: Designed for single account holders, these accounts provide access to IBKR’s full suite of trading services.

- Joint Accounts: Suitable for two individuals, joint accounts can be structured as Tenants with Rights of Survivorship, Tenancy in Common, Community Property, or Tenancy by the Entirety.

- Trust Accounts: Established for legally recognized entities where assets are held by one party for the benefit of another.

- Retirement Accounts (IRA): Available exclusively to U.S. residents, these accounts offer tax-advantaged retirement savings options.

- UGMA/UTMA Accounts: Custodial accounts for minors, managed by an individual or entity until the minor reaches a specified age; available to U.S. residents only.

- Institutional Accounts: Tailored for entities such as small businesses, advisors, money managers, brokers, proprietary trading groups, hedge funds, and mutual funds.

Key Differences Between Account Types

- Minimum Deposits:

- Individual, Joint, Trust, and UGMA/UTMA Accounts: No minimum deposit required to open a Cash Account. However, Margin Accounts necessitate a minimum deposit of $2,000 or equivalent.

- Retirement Accounts (IRA): Specific minimums may apply based on the IRA type and custodian requirements.

- Institutional Accounts: Minimum deposit requirements vary depending on the entity type and services required. For instance, Broker Accounts require an upfront deposit of $10,000, applied against commissions during the first eight months.

- Perks and Requirements:

- IBKR Lite vs. IBKR Pro: Individual investors can choose between these two plans. IBKR Lite offers commission-free trading on U.S. exchange-listed stocks and ETFs, with no account minimums. In contrast, IBKR Pro provides advanced trading tools and access to global markets, suitable for active traders and professionals.

- Institutional Accounts: These accounts often come with specialized services, such as dedicated account management, reporting tools, and compliance support, catering to the unique needs of institutions.

5. Demo Account Availability

Interactive Brokers offers a demo account, known as a Paper Trading Account, allowing users to practice trading strategies without risking real capital.

- Opening a Demo Account:

- Prospective users can register for a free demo account through the Interactive Brokers website. The process mirrors that of opening a live account but does not require funding.

- Features of the Demo Account:

- Simulated Funds: Users are provided with $1 million in virtual funds to trade across various asset classes.

- Access to Platforms: The demo account grants access to IBKR’s trading platforms, including the Trader Workstation (TWS), web platform, and mobile app.

- Real-Time Data: While some real-time data is available, certain market data may be delayed or limited in the demo environment.

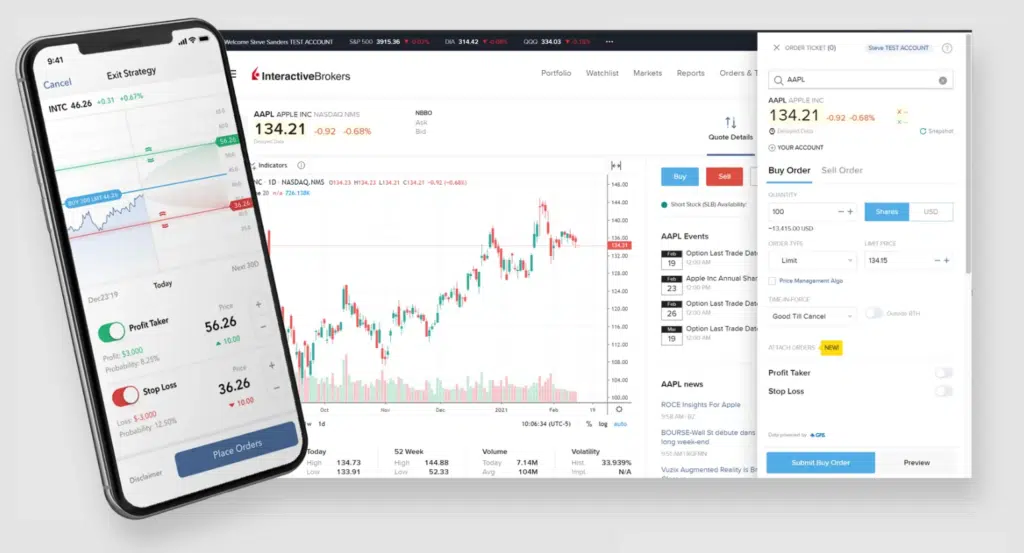

6. Trading Platform Overview

Interactive Brokers provides a suite of trading platforms designed to cater to the diverse needs of its clientele:

- Trader Workstation (TWS) – Desktop Platform:

- User Interface: TWS offers a highly customizable interface, allowing traders to tailor layouts, watchlists, and workspaces to their preferences.

- Features and Tools: The platform includes advanced charting tools, algorithmic trading options, risk management tools, and access to over 100 order types.

- Customization: Users can create custom dashboards, integrate third-party analytical tools, and utilize API access for automated trading strategies.

- Web Platform:

- User Interface: The web platform provides a clean and intuitive design, suitable for traders who prefer browser-based access without software installation.

- Features and Tools: It includes essential trading functionalities, real-time monitoring, basic charting, and research tools.

- Customization: While offering fewer customization options than TWS, users can still personalize watchlists and alerts.

- Mobile App:

- User Interface: The mobile app is designed for on-the-go trading, featuring a streamlined interface optimized for smaller screens.

- Features and Tools: Users can execute trades, monitor portfolios, access charts, and receive real-time notifications.

- Customization: The app allows for personalized watchlists and alerts but has limited customization compared to the desktop platform.

7. Markets and Assets Available

Interactive Brokers (IBKR) offers clients access to a comprehensive range of markets and asset classes, making it a versatile platform for diverse investment strategies.

- Stocks: Investors can trade stocks across over 150 global markets, including major exchanges in North America, Europe, and Asia.

- Forex: IBKR provides access to spot currency trading with tight spreads, allowing clients to trade major, minor, and exotic currency pairs.

- Cryptocurrencies: Eligible clients can trade and custody cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH) through partnerships with Paxos Trust Company or Zero Hash LLC.

- Commodities: Clients can engage in commodity trading through futures contracts on various commodities, including energy products, metals, and agricultural goods.

- ETFs, Options, Bonds: The platform supports trading in exchange-traded funds (ETFs), options, and a wide array of bonds, including corporate and government securities.

- Fractional Shares: IBKR enables clients to invest in fractional shares, allowing for the purchase of less than one full share of a stock or ETF.

Examples of Popular Assets Available on the Platform

- Stocks: Apple Inc. (AAPL), Amazon.com Inc. (AMZN), Tesla Inc. (TSLA)

- Forex: EUR/USD, USD/JPY, GBP/USD

- Cryptocurrencies: Bitcoin (BTC), Ethereum (ETH)

- Commodities: Crude Oil Futures, Gold Futures

- ETFs: SPDR S&P 500 ETF Trust (SPY), Invesco QQQ Trust (QQQ)

8. Fees and Commissions

Interactive Brokers is renowned for its competitive and transparent fee structure, appealing to both retail and institutional investors.

Trading Fees

- Stocks/ETFs:

- IBKR Lite: Offers commission-free trading on U.S. exchange-listed stocks and ETFs for U.S. residents.

- IBKR Pro: Charges a fixed commission of $0.005 per share, with a minimum of $1 per trade. Volume-based tiered pricing is also available, ranging from $0.0005 to $0.0035 per share, depending on monthly trading volume.

- Options: Commissions range from $0.15 to $0.65 per contract under the tiered pricing model, depending on monthly contract volume. The fixed pricing model charges $0.65 per contract.

- Futures: Fees range from $0.25 to $0.85 per contract under the tiered pricing model, and $0.85 per contract under the fixed pricing model.

- Forex: Commissions are between 0.08 to 0.20 basis points of the trade value per order, with tight spreads as narrow as 1/10 PIP.

- Bonds: For U.S. Treasury bonds, commissions are 0.002% of the face value, with a minimum of $5.

Non-Trading Fees

- Withdrawal Fees: IBKR offers one free withdrawal per month; subsequent withdrawals incur fees based on the withdrawal method and currency. For example, additional USD withdrawals via wire transfer are subject to a $10 fee.

- Inactivity Fees: As of 2025, Interactive Brokers does not charge inactivity fees, making it cost-effective for clients who trade infrequently.

- Currency Conversion Fees: Currency conversions are executed at market rates, with a commission of 0.20 basis points multiplied by the trade value, subject to a minimum of $2.

Comparison to Industry Averages

Interactive Brokers’ fee structure is competitive compared to industry averages. The absence of inactivity fees and the provision of one free withdrawal per month further enhance its appeal to cost-conscious investors.

9. Deposit and Withdrawal Methods

Interactive Brokers (IBKR) offers a variety of deposit and withdrawal options to accommodate its global clientele.

Supported Deposit Options

- Bank Transfers: Clients can fund their accounts via wire transfers, which are widely accepted and secure.

- Direct Bank Transfer (ACH): For U.S. clients, Automated Clearing House (ACH) transfers are available, facilitating direct bank transfers.

- Check Deposits: IBKR accepts check deposits, providing an alternative for clients who prefer traditional banking methods.

Withdrawal Process, Timelines, and Fees

- Process: Withdrawals are initiated through the IBKR Client Portal. Clients select the ‘Transfer & Pay’ menu, choose ‘Make a Withdrawal,’ and follow the prompts to specify the withdrawal method and amount.

- Timelines: Withdrawal processing times vary based on the method chosen. Bank transfers typically take 1-2 business days, while wire transfers may take longer, especially for international transactions.

- Fees: IBKR offers one free withdrawal per calendar month. Subsequent withdrawals incur fees, which vary depending on the method and currency. For example, additional ACH withdrawals may cost $1 each, while wire transfers can incur higher fees.

Limits on Transactions

- Withdrawal Limits: Withdrawal limits are influenced by the client’s security settings. Clients enrolled in two-factor authentication (2FA) may have higher withdrawal limits compared to those without. Specific limits can vary, so clients are advised to consult IBKR’s guidelines or contact customer support for precise information.

10. Bonuses and Promotions

Interactive Brokers primarily focuses on providing low-cost trading services and does not typically offer traditional bonuses or promotions. However, they do have a Refer a Friend program that benefits both existing and new clients.

Referral Program

- For Referrers: Existing IBKR clients can earn $200 for each successful referral. There are limits of 15 referrals per year and a total of 30 referrals overall.

- For Referees: New clients referred through this program can earn up to $1,000 in IBKR stock. The bonus amount is tiered based on the initial deposit, with $1 in IBKR stock awarded for every $100 deposited, up to the $1,000 maximum.

Terms and Conditions

- Eligibility: To qualify for the referral bonus, new clients must open an account using the referral link and fund it within a specified timeframe, typically 30 days.

- Bonus Distribution: The bonus is credited in the form of IBKR stock and may be subject to vesting periods or holding requirements.

- Program Limits: Referrers are limited to 15 referrals per year and a total of 30 referrals overall.

11. Trading Tools and Features

Interactive Brokers (IBKR) offers a comprehensive suite of trading tools and features designed to cater to both novice and seasoned traders.

Key Trading Tools

- Charting Tools: IBKR’s Trader Workstation (TWS) provides advanced charting capabilities, allowing users to analyze market trends through various chart types and timeframes.

- Technical Indicators: Traders have access to a wide array of technical indicators, facilitating in-depth market analysis and strategy development.

- Economic Calendar: The platform includes an economic calendar, keeping traders informed about upcoming economic events that could impact markets.

- Risk Navigator: This tool enables users to assess portfolio risk by simulating market movements and their potential effects on holdings.

- IBKR Mobile: For on-the-go trading, IBKR offers a mobile app equipped with essential trading tools, ensuring seamless access to markets.

Supported Order Types

IBKR supports a vast array of order types and algorithms, enabling traders to execute diverse trading strategies:

- Market Orders: Execute immediately at the current market price.

- Limit Orders: Set a specific price at which to buy or sell; execution occurs only if the market reaches that price.

- Stop Orders: Trigger a market order once a specified price level is reached, helping to limit losses or protect profits.

- Trailing Stop Orders: Adjust the stop price at a fixed amount below the market price, following the asset’s movement to lock in profits while limiting losses.

- Algorithmic Orders: IBKR offers over 100 order types and algorithms, allowing for advanced trading strategies that can optimize execution based on various factors.

12. Leverage and Margin Requirements

Interactive Brokers provides margin trading options, allowing clients to leverage their positions. However, trading on margin carries significant risks and is suitable only for experienced investors with a high-risk tolerance.

Maximum Leverage

- Retail Traders: Leverage ratios vary depending on the asset class and region. For U.S. stocks, the Federal Reserve’s Regulation T permits a maximum initial leverage of 2:1, meaning clients must deposit at least 50% of the total trade value.

- Professional Traders: Qualified professional clients may access higher leverage ratios, subject to regulatory approvals and IBKR’s assessment.

Margin Requirements

- Initial Margin: The amount required to open a leveraged position. For U.S. stocks, this is typically 50% of the purchase price.

- Maintenance Margin: The minimum equity that must be maintained in the account to keep a position open. IBKR requires at least 25% of the value of purchased securities to be maintained. If the account equity falls below this level, a margin call is issued.

- Portfolio Margin: For eligible accounts, IBKR offers portfolio margining, which assesses overall portfolio risk to determine margin requirements, potentially allowing for greater leverage. However, this also entails higher risk.

Margin Calls and Stop-Out Levels

- Margin Calls: If account equity falls below the maintenance margin, IBKR may issue a margin call, requiring clients to deposit additional funds or liquidate positions to meet requirements.

- Stop-Out Levels: If the account equity continues to decline and reaches a critical threshold, IBKR may automatically liquidate positions to bring the account back into compliance with margin requirements.

Risks Associated with High Leverage

Utilizing high leverage amplifies both potential gains and losses. A small adverse market movement can lead to substantial losses, potentially exceeding the initial investment. Investors must thoroughly understand these risks and ensure they have adequate risk management strategies in place.

13. Educational Resources

Interactive Brokers (IBKR) offers a comprehensive suite of educational materials tailored to both novice and experienced investors. Their educational platform, IBKR Campus, encompasses a variety of resources, including:

- Beginner Guides: These guides introduce new investors to fundamental concepts of trading and investing, providing a solid foundation for their financial journey.

- Webinars and Tutorials: IBKR regularly conducts webinars and offers tutorials covering a wide array of topics, from platform navigation to advanced trading strategies. These sessions are designed to enhance users’ understanding and proficiency in using IBKR’s tools and services.

- Discover Tool: This innovative feature allows users to explore new investment opportunities by presenting data in an intuitive bubble display. The tool integrates insights from various research providers, enabling investors to quickly identify trending companies and market buzz.

- Traders’ Academy: An educational portal offering structured courses on trading, financial markets, and IBKR’s trading platforms. These courses cater to different skill levels and are designed to help users deepen their market knowledge.

The quality and depth of IBKR’s educational content are widely recognized, providing valuable insights that assist investors in making informed decisions. Additionally, IBKR offers daily market analyses and reports, keeping clients updated on the latest financial news and trends. Their AI-powered news summaries further enhance the user experience by delivering concise and relevant market information.

14. Social and Copy Trading

As of 2025, Interactive Brokers does not offer traditional social or copy trading features. However, the platform provides alternative tools that facilitate idea generation and market exploration:

- Trading Central Integration: IBKR’s Discover Tool incorporates Trading Central’s features, such as Market Buzz and Technical Insight, which help investors identify potential trading opportunities based on market sentiment and technical analysis.

- Featured Ideas: This tool scans a broad spectrum of trading ideas and presents those aligning with the user’s specified criteria, effectively acting as a personalized idea generator.

While these features do not replicate the experience of social or copy trading, they provide valuable insights and analytics to assist investors in making informed decisions.

15. Customer Support

Interactive Brokers offers multiple customer support channels to assist clients:

- Live Chat: Available 24 hours from Monday to Friday and from 13:00 to 19:00 US Eastern Time on Sundays, allowing clients to interact with support representatives in real-time.

- Phone Support: Clients can reach IBKR’s customer service through various regional phone numbers. For U.S. clients, the toll-free number is (888) 919-0022. Phone support operates 24/6, ensuring assistance is available during trading hours.

- Email Support: While IBKR does not provide a direct public email for customer service, clients can submit inquiries through the Message Center in the Account Management section. Responses are typically provided within 24 hours.

The quality of customer support at IBKR is generally regarded as good, with knowledgeable staff providing effective solutions. However, response times can vary:

- Live Chat: Users may experience wait times ranging from a few minutes to longer periods, depending on the time and volume of inquiries.

- Phone Support: Response times are typically prompt, but can vary during peak periods.

- Email Support: Responses are usually provided within 24 hours, though some inquiries may take longer to address.

16. Safety, Security, and Regulation

Interactive Brokers (IBKR) is renowned for its robust regulatory oversight, stringent security measures, and comprehensive client fund protection protocols, ensuring a secure trading environment for its clients.

Regulatory Oversight

IBKR operates under the supervision of multiple top-tier regulatory bodies across various jurisdictions:

- United States: Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC).

- United Kingdom: Financial Conduct Authority (FCA).

- Australia: Australian Securities and Investments Commission (ASIC).

- Canada: Investment Industry Regulatory Organization of Canada (IIROC).

- Hong Kong: Securities and Futures Commission (SFC).

This extensive regulatory framework ensures that IBKR adheres to stringent standards of financial integrity and transparency.

Client Fund Protection

IBKR employs several measures to safeguard client assets:

- Segregated Accounts: Client funds are held in segregated accounts, separate from the company’s operational funds, minimizing risk in the event of company insolvency.

- Investor Compensation Schemes: As a member of the Securities Investor Protection Corporation (SIPC), IBKR provides protection for securities customers up to $500,000, including a $250,000 limit for cash claims.

Security Features

IBKR prioritizes the security of its clients through advanced technological measures:

- Encryption: The platform utilizes 2048-bit Extended Validation (EV) Certificates and enforces TLS 128-bit or higher encryption to establish secure connections, ensuring the confidentiality and integrity of data transmitted between clients and IBKR.

- Two-Factor Authentication (2FA): IBKR offers 2FA to enhance account security, requiring users to provide two forms of identification before accessing their accounts.

- Automated Monitoring: The platform employs automated systems to monitor and ensure the use of strong encryption algorithms, further safeguarding client information.

17. Pros and Cons of Interactive Brokers

Interactive Brokers offers a range of advantages and some considerations for potential users:

Pros

- Low Trading Fees: IBKR is recognized for its competitive trading fees, making it an attractive option for cost-conscious traders.

- Extensive Investment Options: The platform provides access to a wide array of investment products, including stocks, options, futures, and more, catering to diverse investment strategies.

- Advanced Trading Tools: IBKR’s Trader Workstation (TWS) offers sophisticated tools and features suitable for advanced traders seeking comprehensive analysis capabilities.

- Global Market Access: Clients can trade in markets across over 200 countries and territories, providing extensive opportunities for international diversification.

- Low Margin Rates: IBKR offers some of the lowest margin rates in the industry, benefiting traders who utilize leverage.

Cons

- Complex Platform for Beginners: The advanced features and tools of IBKR’s platform can be overwhelming for novice investors, potentially leading to a steep learning curve.

- High Minimum to Earn Interest on Uninvested Cash: Clients may need to maintain a high minimum balance to earn interest on uninvested cash, which could be a drawback for some investors.

- Complex Commission Structure: IBKR’s commission schedules can be intricate, requiring clients to thoroughly understand the fee structures to optimize their trading costs.

- Limited Access to IPOs and OTC Stocks: The platform offers limited access to initial public offerings (IPOs) and over-the-counter (OTC) stocks, which may restrict certain investment opportunities.

18. Comparison with Other Brokers

Interactive Brokers (IBKR) stands as a prominent figure in the online brokerage industry. When compared to competitors such as eToro, XTB, and Trading 212, several key distinctions emerge:

Fees

- Interactive Brokers: Renowned for its low-cost structure, IBKR offers rock-bottom trading fees and zero-commission stocks. The platform also provides volume-based commissions that decrease for larger orders, enhancing cost efficiency for active traders.

- eToro: eToro introduced commission-free trading of CFD shares in Europe. However, a conversion fee of 0.5% is applied when instruments are denominated in a currency different from the account’s base currency.

- XTB: XTB offers competitive spreads and does not charge commissions on standard accounts, making it attractive for cost-conscious traders.

- Trading 212: Trading 212 was the first broker in Europe to introduce commission-free trading of CFD shares. Its CFD account features floating spreads from 0.4 pips and zero-commission trading. However, a conversion fee of 0.5% is applied when instruments are denominated in a currency different from the account’s base currency.

Platforms

- Interactive Brokers: IBKR supports multiple trading platforms, including its proprietary Client Portal and Trader Workstation (TWS). TWS provides access to a wide range of markets (CFDs, futures, options, warrants, etc.), ideal for diversifying market exposure. It’s equipped with over 90 technical indicators, advanced charting tools, and comprehensive analytical capabilities, making it a prime choice for technical traders.

- eToro: eToro offers a proprietary platform known for its social trading features, allowing users to copy trades from experienced investors. The platform is user-friendly and integrates social media-like functionalities.

- XTB: XTB provides its proprietary platform, xStation 5, which is intuitive and equipped with advanced charting tools, technical indicators, and a sentiment analysis tool.

- Trading 212: Trading 212 has invested heavily in its proprietary platform. It has very user-friendly charting capabilities that allow easy scaling up and down of price action. The web trader features 90 analytical tools and various chart configurations. It also offers basic and complex order types, including OCO orders, for sophisticated entries and exits.

Assets

- Interactive Brokers: IBKR offers more than 8,000 CFD instruments across over 150 markets. In addition to CFDs, the broker provides access to warrants, bonds, mutual funds, futures, and options.

- eToro: eToro offers a wide range of assets, including forex, stocks, commodities, cryptocurrencies, and ETFs, catering to diverse investment preferences.

- XTB: XTB provides access to a broad spectrum of assets, including forex, indices, commodities, stocks, ETFs, and cryptocurrencies, facilitating diversified trading strategies.

- Trading 212: Trading 212 stands out with its impressive offering of exotic instruments. It provides access to over 7,000 CFDs, including 178 currency pairs, which is one of the biggest assortments of majors, minors, and exotic crosses in the industry.

Features

- Interactive Brokers: IBKR’s platform is equipped with over 90 technical indicators, advanced charting tools, and comprehensive analytical capabilities, making it a prime choice for technical traders.

- eToro: eToro’s platform is known for its social trading features, allowing users to copy trades from experienced investors. This feature is particularly appealing to beginners seeking guidance.

- XTB: XTB’s xStation 5 platform offers advanced charting tools, technical indicators, and a sentiment analysis tool, providing traders with comprehensive market insights.

- Trading 212: Trading 212’s platform offers user-friendly charting capabilities, 90 analytical tools, and various chart configurations. It also offers basic and complex order types, including OCO orders, for sophisticated entries and exits.

19. User Reviews and Ratings

User reviews provide valuable insights into the strengths and weaknesses of brokerage platforms:

Interactive Brokers

- Trustpilot: Interactive Brokers has received mixed reviews on Trustpilot. Some users have praised the platform’s extensive range of instruments and low fees, while others have expressed concerns about the platform’s complexity and customer service responsiveness.

- Reddit: Discussions on Reddit highlight that while IBKR offers superior services, the platform is not easy to use, particularly for beginners.

eToro

- Trustpilot: eToro generally receives positive feedback for its user-friendly interface and social trading features. However, some users have reported issues with withdrawal processes and customer support responsiveness.

- Google Reviews: Users appreciate eToro’s wide range of assets and educational resources but have noted occasional platform lags during high volatility periods.

XTB

- Trustpilot: XTB is often commended for its responsive customer service and robust trading platform. Some users, however, have mentioned concerns about the limited availability of certain assets.

- Google Reviews: Users highlight XTB’s educational resources and competitive spreads as positive aspects, while some

20. Platform Availability by Country

Countries Where Interactive Brokers is Available

Interactive Brokers (IBKR) offers its services to clients in a wide array of countries and territories worldwide. Some of the countries where clients can open accounts include:

- Australia

- Canada

- France

- Germany

- Hong Kong SAR

- India

- Japan

- Singapore

- United Kingdom

- United States

This list is not exhaustive; IBKR serves clients in numerous other countries as well.

Restricted Regions or Countries with Limited Access

While Interactive Brokers has a broad international presence, there are certain countries where its services are restricted or not available, primarily due to regulatory and compliance considerations. As of 2025, these restricted countries include:

- North Korea

- Iran

- Syria

- Cuba

Additionally, residents of certain countries may face specific limitations or requirements when attempting to open an account with IBKR. For instance, residents of Japan must provide proof of address and identity, such as a utility bill or health insurance card, and a Japanese passport or driving license, respectively. European residents are required to supply information on the source of wealth and funds, employer details, and country of birth.

21. Taxation and Declaring Profits

Taxation Rules for Traders Using Interactive Brokers

Taxation of profits earned through Interactive Brokers varies based on the client’s country of tax residence. IBKR does not provide tax advice or assist clients with tax filings; therefore, it is essential for investors to consult with their tax professionals to understand the tax implications of their investments.

For U.S. Persons and Entities:

Interactive Brokers issues Consolidated Form 1099, which includes various 1099 forms such as 1099-INT, 1099-OID, 1099-DIV, 1099-B, and 1099-MISC. This consolidated form reports interest income, original issue discount, dividends, proceeds from broker and barter exchange transactions, and miscellaneous income, respectively. The information reported on these forms is also submitted to the Internal Revenue Service (IRS) and should be included in the client’s federal tax return.

For Non-U.S. Persons and Entities:

Non-U.S. clients are required to complete an IRS Form W-8 to certify their country of tax residence and to establish eligibility for a reduced rate of withholding on U.S. source income, if applicable. The specific type of W-8 form depends on whether the account is individual or entity-based. Failure to provide a valid Form W-8 may result in withholding on all income, including gross proceeds from securities sales.

Tax Statements and Reports Provided by Interactive Brokers

Interactive Brokers offers a variety of tools and reports to assist clients with their tax reporting needs:

- Tax Forms: Clients can view and download annual tax forms for the last five years through the Client Portal. For U.S. persons, this includes the Consolidated Form 1099. Non-U.S. persons may receive Form 1042-S, which reports U.S. source income subject to withholding.

- Tax Optimizer: This tool allows clients to manage their stock, option, bond, and warrant gains and losses for tax purposes. Clients can select different tax lot-matching methods to see the impact on their profit and loss.

- Forex Income Worksheet: Clients engaged in foreign exchange transactions can review their income and loss information from completed currency transactions for the year. This includes detailed information about the acquisition and disposition of each nonfunctional currency transaction closed in the preceding year.

Clients can access these tools and reports by logging into the Client Portal and navigating to the ‘Reports’ or ‘Tax’ sections. It is recommended to consult with a tax advisor to ensure proper reporting of all amounts and to understand the tax implications of investment activities.

22. Common Issues and How to Solve Them

Interactive Brokers (IBKR) is renowned for its comprehensive trading platforms and services. However, like any brokerage, users may encounter certain issues. Below are some common problems and their potential solutions:

a. Login Problems

Issue: Users may experience difficulties logging into the Trader Workstation (TWS) or Client Portal, receiving messages like “Login failed – Invalid username or password.”

Solutions:

- Verify Credentials: Ensure that your username and password are entered correctly, paying attention to case sensitivity.

- Account Approval: Confirm that your account has been approved. Accounts pending approval may have limited access.

- Firewall and Antivirus Settings: Check that your firewall or antivirus software isn’t blocking IBKR applications. Add TWS to the list of allowed programs or exceptions.

- Internet Connection: Ensure you have a stable internet connection. Try restarting your router or modem to resolve connectivity issues.

b. Withdrawal Delays

Issue: Some users report delays in processing withdrawals.

Solutions:

- Bank Details: Verify that your bank account details are correct in your IBKR account settings.

- Withdrawal Method: Ensure you’re using a withdrawal method compatible with your bank.

- Processing Times: Be aware of IBKR’s processing times and any bank holidays that might affect transfer times.

- Contact Support: If delays persist beyond the standard processing period, contact IBKR customer support for assistance.

c. Verification Troubles

Issue: Difficulties in account verification can hinder account activation or certain functionalities.

Solutions:

- Document Submission: Ensure all required documents are submitted in the correct format and are legible.

- Information Accuracy: Double-check that all personal information matches your official documents.

- Follow-Up: If verification is delayed, reach out to IBKR’s customer service for an update on your account status.

d. Platform Bugs

Issue: Users might encounter glitches or bugs within the TWS or mobile applications.

Solutions:

- Update Software: Regularly update TWS and mobile apps to the latest versions to benefit from bug fixes and improvements.

- Clear Cache: For web-based platforms, clearing the browser cache can resolve certain display or functionality issues.

- Reinstall Applications: If problems persist, try uninstalling and reinstalling the application.

- Report Issues: Report persistent bugs to IBKR support to receive targeted assistance and help improve the platform.

e. Connection Loss in TWS

Issue: Experiencing connection losses while using the Trader Workstation can disrupt trading activities.

Solutions:

- Stable Internet: Ensure a stable and robust internet connection, possibly using a wired connection to reduce interruptions.

- Firewall Settings: Configure your firewall to allow TWS traffic, ensuring that ports 4000 and 4001 are open.

- Software Updates: Keep TWS updated to the latest version to mitigate known connectivity issues.

- Check Server Status: Visit the IBKR website to check for any server maintenance or outages that might affect connectivity.

23. Final Verdict

Interactive Brokers stands out as a premier brokerage platform, offering a vast array of investment options, competitive pricing, and advanced trading tools. Here’s a summary of its strengths and weaknesses:

Strengths:

- Extensive Investment Options: Access to over 150 markets in more than 200 countries, encompassing stocks, options, futures, forex, bonds, and more.

- Competitive Pricing: Offers some of the lowest margin rates in the industry and commission-free trades on U.S. stocks and ETFs through the IBKR Lite program.

- Advanced Trading Platforms: The Trader Workstation (TWS) provides sophisticated tools suitable for professional traders, including advanced charting and algorithmic trading capabilities.

- Global Reach: Enables trading in multiple currencies across international markets, catering to global investors.

Weaknesses:

- Complexity for Beginners: The platform’s extensive features and tools can be overwhelming for novice investors.

- Customer Support: Some users have reported challenges with customer service responsiveness.

- Inactivity Fees: Previously, IBKR had inactivity fees, but as of recent updates, these have been eliminated, making it more favorable for less active traders.

Suitability:

- Active and Professional Traders: The advanced tools, low margin rates, and extensive market access make IBKR ideal for active traders and professionals.

- International Investors: Those looking to diversify globally will benefit from IBKR’s broad international market access.

- Long-Term Investors: With a wide range of investment options and competitive pricing, long-term investors can build diversified portfolios.

- Beginners: While the platform offers educational resources, beginners might find the interface complex. However, the IBKR Lite program provides

22. Common Issues and How to Solve Them

Interactive Brokers (IBKR) is renowned for its comprehensive trading platforms and services. However, like any brokerage, users may encounter certain issues. Below is a list of common problems and their potential solutions:

1. Login Problems

Issues:

- Invalid Username or Password: Users may receive an “Invalid username or password combination” error when attempting to log in.

- Account Lockout: After multiple failed login attempts, accounts can become temporarily locked.

Solutions:

- Verify Credentials: Ensure that the Caps Lock key is not engaged, as usernames are case-sensitive and should be entered in lowercase.

- Reset Password: If credentials are forgotten, contact IBKR customer support to initiate a password reset.

- Avoid Account Lockout: Be cautious with login attempts; exceeding 10 consecutive failed attempts within 24 hours can result in a temporary lockout.

2. Withdrawal Delays

Issues:

- Processing Times: Withdrawals may take longer than expected due to processing procedures.

- Banking Details: Incorrect or outdated banking information can cause delays.

Solutions:

- Review Withdrawal Policies: Familiarize yourself with IBKR’s withdrawal processing times and ensure requests are made within the specified cut-off times.

- Update Banking Information: Regularly verify and update your banking details in the IBKR Client Portal to prevent errors.

3. Verification Troubles

Issues:

- Document Submission: Users may experience delays if submitted documents do not meet IBKR’s verification standards.

- Pending Verification: Account approval can be delayed due to pending verification.

Solutions:

- Ensure Document Clarity: Submit clear, legible copies of required documents, ensuring they are up-to-date and match the information provided during account registration.

- Monitor Application Status: Regularly check the status of your application in the Client Portal and promptly address any additional requests from IBKR.

4. Platform Bugs and Technical Issues

Issues:

- Connection Loss: Users may experience disconnections from the Trader Workstation (TWS) platform.

- Software Glitches: Unexpected platform behavior or errors can occur.

Solutions:

- Troubleshoot Connection Issues: Check your network connection, disable firewall restrictions, and ensure TWS is updated to the latest version.

- Contact Support: For persistent issues, reach out to IBKR’s customer service for assistance.

5. Market Data Subscription Issues

Issues:

- Delayed or Missing Data: Users may notice delayed market data or lack access to certain real-time data.

Solutions:

- Subscribe to Market Data: Ensure you have subscribed to the necessary market data packages within the Client Portal.

- Verify Account Settings: Check that your account settings align with your trading needs and that subscriptions are active.

6. Inactivity Fees

Issues:

- Unexpected Charges: Users may incur inactivity fees if account activity requirements are not met.

Solutions:

- Maintain Minimum Activity: Regularly execute trades or maintain the required account balance to avoid inactivity fees.

- Review Fee Schedule: Familiarize yourself with IBKR’s fee structure to understand activity requirements.

7. Margin Calls

Issues:

- Insufficient Equity: Engaging in margin trading without adequate equity can lead to margin calls.

Solutions:

- Monitor Margin Requirements: Regularly review your account’s margin requirements and maintain sufficient equity to support your positions.

- Set Alerts: Utilize IBKR’s alert features to notify you of approaching margin thresholds.

8. Difficulty Navigating the Platform

Issues:

- Complex Interface: New users may find IBKR’s platforms complex and challenging to navigate.

Solutions:

- Utilize Educational Resources: Leverage IBKR’s tutorials, webinars, and user guides to familiarize yourself with the platform’s features.

- Start with IBKR Lite: For a more user-friendly experience, consider using IBKR Lite before transitioning to more advanced platforms.

9. Account Restrictions Due to Regulatory Requirements

Issues:

- Limited Access: Users from certain regions may face restrictions or additional requirements due to local regulations.

Solutions:

- Stay Informed: Keep abreast of your region’s regulatory environment and understand how it impacts your IBKR account.

- Provide Necessary Documentation: Ensure all required documentation is submitted promptly to comply with regional regulations.

23. Final Verdict

Interactive Brokers (IBKR) stands out as a premier brokerage platform, offering a comprehensive suite of services tailored to a diverse clientele. Below is a summary of its strengths and weaknesses, along with insights into the types of investors who may find IBKR most suitable.

Strengths:

- Extensive Range of Tradable Securities: IBKR provides access to a vast array of investment options, including stocks, options, futures, forex, bonds, and mutual funds across global markets.

- Competitive Pricing Structure: The broker offers low commission rates and some of the industry’s lowest margin rates, making it cost-effective for active traders.

- Advanced Trading Platforms: IBKR’s Trader Workstation (TWS) is renowned for its advanced trading tools, catering to professional and institutional traders.

FAQs:

1. What is the minimum deposit?

Interactive Brokers does not require a minimum deposit to open an account. This policy allows investors of all sizes to access their platform without initial funding constraints.

2. How long do withdrawals take?

Withdrawal processing times at Interactive Brokers vary depending on the method chosen:

- ACH Transfers (U.S. banks): Typically processed within 1-2 business days.

- Wire Transfers: Generally completed within 1 business day; however, international wire transfers may take longer depending on the destination country’s banking system.

- Checks: Delivery times depend on postal services and can vary.

Please note that processing times can be influenced by factors such as bank holidays and cut-off times.

3. Is Interactive Brokers safe?

Yes, Interactive Brokers is considered a safe and reputable brokerage firm. It is regulated by multiple financial authorities, including the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Additionally, client accounts are protected by the Securities Investor Protection Corporation (SIPC) up to $500,000, including a $250,000 limit for cash. The firm also maintains excess SIPC coverage through Lloyd’s of London insurers, providing additional protection.

4. What are the available trading platforms?

Interactive Brokers offers several trading platforms to accommodate different trading styles and preferences:

- Trader Workstation (TWS): A robust desktop platform suitable for advanced traders requiring comprehensive tools and analytics.

- Client Portal: A web-based platform offering a user-friendly interface for account management and trading.

- IBKR Mobile: Mobile applications for iOS and Android devices, enabling trading and account monitoring on-the-go.

- IBKR APIs: For clients interested in developing custom trading applications, Interactive Brokers provides various API solutions.

5. Is Interactive Brokers regulated?

Yes, Interactive Brokers is regulated by several major financial authorities globally, including:

- United States: Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

- United Kingdom: Financial Conduct Authority (FCA).

- Australia: Australian Securities and Investments Commission (ASIC).

- Canada: Investment Industry Regulatory Organization of Canada (IIROC).

This extensive regulatory oversight underscores the firm’s commitment to maintaining high standards of compliance and client protection.

6. Are there any inactivity fees?

As of 2021, Interactive Brokers eliminated inactivity fees for all account types. This change allows clients to maintain their accounts without the concern of fees due to infrequent trading or account dormancy.

7. Does Interactive Brokers support cryptocurrency trading?

Yes, Interactive Brokers offers cryptocurrency trading. Clients can trade and hold various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH), alongside traditional assets like stocks, options, and futures. This integration provides a unified platform for diversified portfolio management.

8. What are the available contact methods for customer support?

Interactive Brokers provides multiple channels for customer support:

- Phone Support: 24-hour customer service on trading days, with regional support numbers available.

- Live Chat: Accessible through the Client Portal for real-time assistance.

- Secure Messaging: Clients can send secure messages through the Client Portal for account-specific inquiries.

- Email Support: General inquiries can be directed to the appropriate regional email addresses listed on their website.

These support options ensure that clients can receive timely and effective assistance tailored to their needs.