1. Introduction to IG Group

History and Background

Founded in 1974 by Stuart Wheeler in London, UK, IG Group began as “Investors Gold,” pioneering financial spread betting on gold prices. Over its 50-year history, it has evolved into one of the world’s leading online brokers, specializing in contracts for difference (CFDs), forex trading, and spread betting (where permitted). Headquartered at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA, IG Group Holdings plc is publicly traded on the London Stock Exchange (LON: IGG) and is a constituent of the FTSE 250 index. With a market capitalization exceeding £2.9 billion (as of early 2024 figures, with steady growth into 2025), IG has solidified its position as a titan in the online trading industry. Its acquisition of tastytrade in 2021 for $1 billion marked a significant expansion into the U.S. market, rebranded as tastyfx for forex trading, further diversifying its offerings.

Regulation and Licenses

IG Group operates under a robust multi-jurisdictional regulatory framework, ensuring high standards of client protection and transparency. Its key subsidiaries are regulated by top-tier financial authorities globally, including:

- IG Markets Limited (UK): Authorized and regulated by the Financial Conduct Authority (FCA) under license number 195355. UK clients benefit from the Financial Services Compensation Scheme (FSCS), offering up to £85,000 in protection if the broker becomes insolvent.

- IG US LLC (USA): Registered as a Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA ID: 0509630). U.S. operations focus solely on forex under the tastyfx brand.

- IG Pty Ltd (Australia): Regulated by the Australian Securities and Investments Commission (ASIC) with AFSL number 220440.

- IG Europe GmbH (Germany): Authorized by the German Federal Financial Supervisory Authority (BaFin) under registration number 148759, adhering to EU MiFID II standards.

- IG International Limited (Bermuda): Licensed by the Bermuda Monetary Authority (BMA) to conduct investment and digital asset business.

Additional licenses include oversight from the Monetary Authority of Singapore (MAS), the Swiss Financial Market Supervisory Authority (FINMA), and the Financial Sector Conduct Authority (FSCA) in South Africa, among others. This extensive regulatory coverage—spanning eight Tier-1 jurisdictions—earns IG a near-perfect Trust Score in 2025 broker rankings, reflecting its commitment to security and compliance.

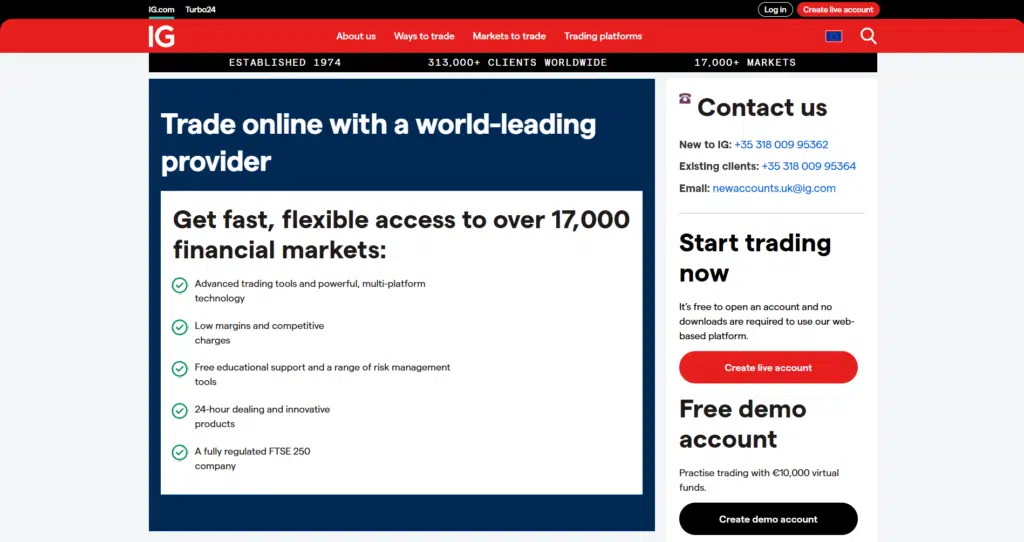

Reputation, Global Presence, and Market Position

IG Group enjoys a stellar reputation as a trusted, reliable broker with over 313,000 active clients worldwide (based on its latest annual report). Operating in 19 countries across five continents, IG serves traders from London to Sydney, Chicago to Singapore. Its longevity—over five decades in operation—combined with its status as the world’s largest CFD provider by revenue, underscores its market dominance. In 2025, IG was named the #1 Overall Broker by ForexBrokers.com, lauded for its extensive range of over 19,000 tradeable instruments, competitive pricing, and industry-leading educational resources. User reviews on platforms like Trustpilot average 3.7/5 (based on over 7,000 submissions), with praise for its intuitive platforms and responsive support, though some note higher fees for infrequent traders. IG’s acquisition of tastytrade and its expansion into futures, options, and U.S. forex markets have further cemented its position as a versatile, multi-asset broker in 2025.

2. How to Register on IG Group

Step-by-Step Registration Process

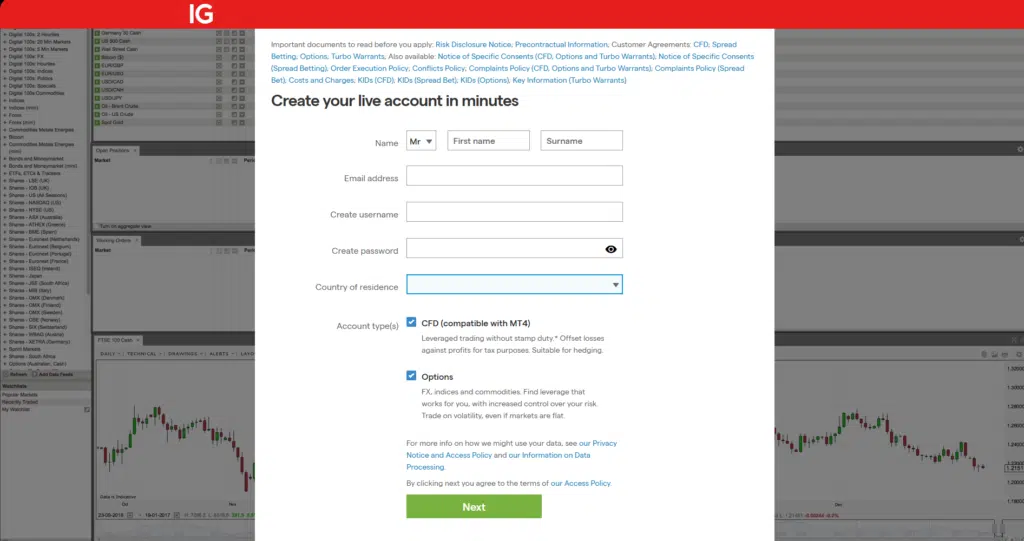

Opening an account with IG Group in 2025 is a streamlined, fully digital process designed for efficiency and compliance. Here’s how to register:

- Visit the IG Website or App: Navigate to www.ig.com (or tastyfx.com for U.S. residents) and click “Create an Account” or “Open an Account.” Select your region to ensure the correct entity and regulatory framework apply.

- Choose Account Type: Options include a standard CFD account, spread betting account (UK only), or forex-only account (U.S. via tastyfx). A demo account is also available for practice.

- Fill Out Personal Details: Enter your full name, email address, phone number, and country of residence. You’ll also set a secure password at this stage.

- Provide Financial Information: Answer questions about your trading experience, income, net worth, and investment goals. This helps IG assess your suitability for high-risk products like CFDs.

- Complete KYC Verification: Upload required identity documents (see below) and await approval, which typically takes 24 hours but can be as quick as 10 minutes for straightforward applications.

- Fund Your Account: Once approved, deposit funds via bank transfer (no minimum), credit/debit card ($50 minimum), or electronic wallets like PayPal (where available).

- Start Trading: Access your dashboard and begin trading or exploring the demo mode.

Identity Verification (KYC) Requirements

IG Group adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, requiring the following documents:

- Proof of Identity: A valid government-issued ID, such as a passport, driver’s license, or national ID card. The document must be clear, unexpired, and show your full name and date of birth.

- Proof of Address: A recent utility bill (electricity, water, or gas), bank statement, or government-issued letter dated within the last three months. It must display your full name and residential address.

- Additional Verification (if required): In some cases, IG may request a selfie holding your ID or a live facial scan via a verification app to confirm identity. This is more common for high-volume traders or those in jurisdictions with heightened regulatory scrutiny.

The process is user-friendly, taking approximately 10-15 minutes to complete the initial forms, with verification typically finalized within a day. IG’s website provides clear guidance and a progress tracker to ensure compliance.

3. IG Group Login Process

How to Log Into Your Account

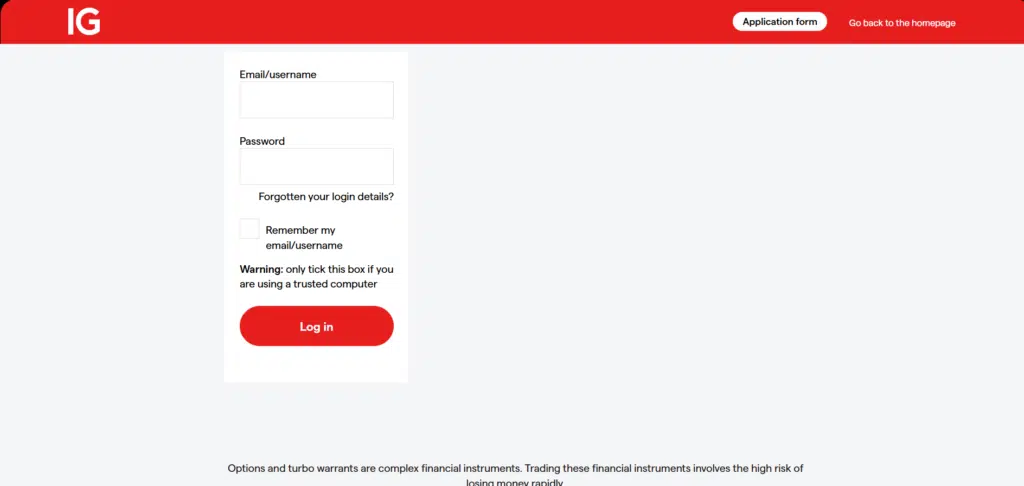

After registering and verifying your account, logging into IG Group is straightforward:

- Access the Platform: Visit www.ig.com (or tastyfx.com for U.S. users) or open the IG Trading app on your mobile device (available for iOS and Android).

- Enter Credentials: Input your registered email address or username and password in the login fields.

- Two-Factor Authentication (2FA): If enabled (highly recommended), enter the one-time code sent to your phone or email. IG uses 256-bit SSL encryption and 2FA to enhance security.

- Select Account: Choose between live trading or demo mode, then access your “My IG” dashboard to manage funds, trade, or review analytics.

The login process is seamless across IG’s proprietary web platform, mobile app, and third-party options like MetaTrader 4 (MT4), TradingView, or ProRealTime.

Common Login Issues and Solutions

Despite its reliable infrastructure, users may encounter occasional login hiccups. Here are the most common issues and fixes:

- Incorrect Credentials: Double-check your email/username and password. Use the “Forgot Password” link to reset if needed; a recovery email arrives within minutes.

- 2FA Code Not Received: Ensure your phone/email is up to date in your account settings. Resend the code or contact support if delays persist.

- Account Locked: After multiple failed attempts, IG may temporarily lock your account for security. Wait 15 minutes or contact customer support (available 24/7 via live chat, phone, or email) to unlock it.

- Browser/App Glitches: Clear your browser cache or update the IG app to the latest version (March 2025 patches included enhanced stability). Switch to an alternative device or platform (e.g., MT4) if the issue persists.

- Regional Restrictions: U.S. users must log in via tastyfx.com, not ig.com. Verify your regional settings align with your account entity.

IG’s support team is responsive, with live chat resolving most login issues within 10-15 minutes. The platform’s uptime is exceptional, but peak market hours (e.g., U.S. market open) can occasionally slow access—mitigated by IG’s robust server upgrades in 2025.

4. Available Account Types

IG Group offers a variety of account types tailored to different trader needs, ranging from retail to professional and corporate clients. Below is a detailed list and description of the available account types, along with their differences, minimum deposits, perks, and requirements.

- Standard CFD Account

- Description: The default account for most retail traders worldwide, offering access to over 19,000 markets, including forex, indices, shares, commodities, and cryptocurrencies via CFDs. In the UK, this includes spread betting options, while U.S. clients (via tastyfx) are limited to forex trading.

- Minimum Deposit: $0 for bank transfers; $50 for card deposits or PayPal (varies by region).

- Perks: Competitive spreads (e.g., 0.6 pips on EUR/USD), no commission on forex trades (except shares CFDs), negative balance protection (for retail clients in regulated regions), and access to all trading platforms (IG’s proprietary platform, MT4, TradingView, ProRealTime, and L2 Dealer).

- Requirements: Open to all retail clients with no specific experience threshold. Basic KYC verification (ID and address proof) is required. Leverage is capped at 1:30 for major forex pairs in most regulated jurisdictions (e.g., FCA, ASIC), though it can reach 1:200 in less restrictive regions like Bermuda.

- Professional Account

- Description: Designed for experienced traders who meet specific eligibility criteria, this account unlocks higher leverage and reduced margin requirements while retaining access to the full range of markets.

- Minimum Deposit: No specific minimum, though a portfolio of at least £500,000 (or equivalent) is part of the eligibility criteria.

- Perks: Leverage up to 1:200 (depending on jurisdiction and asset), lower margin rates, and access to premium tools like Direct Market Access (DMA) via L2 Dealer. Professional clients waive negative balance protection and FSCS coverage in exchange for these benefits.

- Requirements: Traders must meet two of three FCA-defined criteria: (1) a financial portfolio exceeding £500,000 (excluding property), (2) at least one year of professional experience in the financial sector, and (3) a history of executing significant trades (e.g., 10 per quarter over the past year).

- Corporate Account

- Description: Tailored for businesses, hedge funds, or institutional clients looking to trade on behalf of a company. It supports multi-user access and customized reporting.

- Minimum Deposit: No publicized minimum, but typically higher due to business-scale trading volumes; negotiated directly with IG’s corporate team.

- Perks: Dedicated account management, bespoke leverage and fee structures, and integration with institutional-grade tools like APIs for automated trading. Access to all 19,000+ markets and platforms.

- Requirements: Business registration documents, proof of address, and KYC verification for authorized personnel. Approval is subject to IG’s internal review of the entity’s financial standing and trading intent.

- IG Smart Portfolios (UK Only)

- Description: A managed investment account for UK clients, offering diversified portfolios of ETFs managed by IG in partnership with BlackRock. Not a traditional trading account but a long-term investment option.

- Minimum Deposit: £500.

- Perks: Low-cost ETF exposure (0.15% annual fee plus ETF costs), five risk-adjusted portfolio options, and no direct trading required—ideal for passive investors.

- Requirements: Available only to UK residents with a standard IG account. No trading experience needed, as it’s a hands-off product.

- Differences Between Account Types:

- Scope: Standard accounts cater to retail traders with capped leverage and protections; Professional accounts target seasoned traders with higher risk tolerance; Corporate accounts suit businesses; Smart Portfolios focus on passive investing.

- Leverage and Risk: Standard accounts have lower leverage (e.g., 1:30) and protections like negative balance protection, while Professional accounts offer up to 1:200 leverage without such safeguards.

- Costs: Standard accounts have no minimum deposit (bank transfer) and no inactivity fees for active traders, whereas Professional and Corporate accounts may involve tailored pricing. Smart Portfolios carry management fees.

- Eligibility: Standard accounts are universally accessible, while Professional and Corporate accounts require stringent qualifications. Smart Portfolios are region-specific (UK).

5. Demo Account Availability

Availability

Yes, IG Group offers a demo account across all its major platforms, making it an invaluable tool for both novice and experienced traders. Available globally (including via tastyfx in the U.S.), the demo account provides a risk-free environment to test strategies and explore IG’s offerings.

How to Open a Demo Account

Opening a demo account is quick and requires no initial funding:

- Visit the Website: Go to www.ig.com (or tastyfx.com for U.S. users) and select “Demo Account” from the homepage or account options menu.

- Provide Basic Details: Enter your name, email address, and country of residence. No KYC verification is needed, unlike the live account process.

- Choose Platform: Select your preferred platform—IG’s proprietary platform, MT4, or others like ProRealTime.

- Access the Account: Receive login credentials instantly via email. The demo account comes preloaded with $20,000 in virtual funds (adjustable upon request).

Features

- Realistic Simulation: Mirrors live market conditions with real-time pricing across all 19,000+ markets, including forex, CFDs, and spread betting (UK).

- Unlimited Duration: Unlike some brokers, IG’s demo account has no expiration date by default, though inactivity for 30 days may prompt a renewal request.

- Full Platform Access: Test all tools, including advanced charting (30+ indicators, 20 drawing tools), Autochartist signals, Reuters news feeds, and one-click trading.

- Customizable Funds: Adjust virtual capital to simulate your intended live trading balance (e.g., $1,000 or $100,000) by contacting support.

- Multi-Platform Testing: Practice on the web, mobile, or desktop versions of IG’s platforms, as well as MT4 or ProRealTime, to compare functionality.

- Limitations: Does not replicate emotional or psychological aspects of real trading; share dealing (non-CFD) is unavailable in demo mode.

The demo account is highly praised in 2025 reviews for its accessibility and depth, making it ideal for strategy testing or platform familiarization before transitioning to a live account.

6. Trading Platform Overview

IG Group offers a suite of trading platforms in 2025, including its award-winning proprietary platform (web, desktop, and mobile), alongside third-party options like MetaTrader 4 (MT4), TradingView, ProRealTime, and L2 Dealer. Below is a review of the core proprietary platforms’ user interface, features, tools, and customization options.

- Web Platform

- User Interface: Clean, intuitive, and browser-based—no downloads required. The default layout features a sidebar for market navigation, a central workspace for charts, and a top bar showing account stats (funds, P&L, margin).

- Features: Over 19,000 markets, real-time pricing, one-click trading, watchlists, Reuters news feeds, and integrated risk management (stop-loss, take-profit). Includes Autochartist for pattern recognition and client sentiment data from IG’s trader base.

- Tools: 30+ technical indicators (e.g., MACD, RSI), 20 drawing tools, five chart types (candlestick, line, etc.), and a customizable screener for filtering assets.

- Customization: Highly flexible—move windows, save multiple layouts, and toggle between light/dark modes. Ideal for beginners and pros alike, though the default view requires initial setup.

- Evaluation: Rated #1 Web Platform by ForexBrokers.com in 2025 for its balance of simplicity and power, though it lacks native backtesting (compensated by ProRealTime integration).

- Desktop Platform (ProRealTime)

- User Interface: Advanced and chart-centric, designed for technical traders. Floating windows can feel cluttered but offer a detailed workspace. Requires a download (Windows/Mac).

- Features: Nearly 100 indicators, automated strategy creation, and backtesting against 30 years of historical data. Supports forex, CFDs, and spread betting with live pricing.

- Tools: Extensive charting suite, automatic study coloring for visibility, and API integration for algo traders. Costs £30/month unless four trades are made monthly.

- Customization: Highly configurable layouts, though the dated design could use a modern refresh (e.g., snap-grid layouts).

- Evaluation: Best for advanced traders needing deep analysis, but less intuitive than the web platform. A premium option worth the cost for active users.

- Mobile App (IG Trading)

- User Interface: Sleek, touch-optimized, and mirrors the web platform’s design. Available on iOS and Android, with biometric login (Face ID/Touch ID).

- Features: Trade from charts, set price alerts, manage funds, and access watchlists synced across devices. Includes Reuters news, Autochartist signals, and sentiment data.

- Tools: 20 drawing tools, 30 indicators, and five chart types—robust for a mobile app. Economic calendar and signal center enhance on-the-go analysis.

- Customization: Adjustable chart settings and watchlists, though fewer layout options than web/desktop. One-touch trading buttons (Buy/Sell) streamline execution.

- Evaluation: Won #1 Mobile App in ForexBrokers.com’s 2025 Awards for its feature-rich, user-friendly design. Minor drawback: lacks some web-exclusive features like news tabs.

Overall Assessment

IG’s platforms excel in usability and depth, catering to all trader levels. The web platform is a standout for its accessibility and customization, the desktop (ProRealTime) shines for technical analysis, and the mobile app offers unmatched convenience. Tools like Autochartist, sentiment data, and extensive charting options set IG apart, though beginners may need time to master the full suite. Third-party platforms (MT4, TradingView) add versatility, but IG’s proprietary ecosystem remains the core strength in 2025.

7. Markets and Assets Available

IG Group offers one of the broadest selections of tradeable markets in the online brokerage industry, with over 19,000 instruments available as of 2025. This extensive range spans multiple asset classes, catering to diverse trading strategies and preferences. Below is a detailed list of available markets, followed by examples of popular assets.

- Stocks

- Availability: Over 13,000 stocks via CFDs globally, plus direct share dealing for UK clients (non-CFD ownership). Covers major exchanges like NYSE, NASDAQ, LSE, ASX, and Euronext.

- Examples: Apple (AAPL), Tesla (TSLA), BP (BP.L), Rio Tinto (RIO.AX).

- Forex

- Availability: More than 80 currency pairs, including majors, minors, and exotics. U.S. clients (via tastyfx) have access to forex-only trading. Weekend forex trading is also offered on key pairs.

- Examples: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/ZAR.

- Cryptocurrencies

- Availability: Crypto trading is offered via CFDs, not direct ownership, with 10+ major cryptocurrencies available. Note: Crypto CFDs are banned for UK retail clients under FCA rules but permitted in other jurisdictions (e.g., Bermuda, Australia).

- Examples: Bitcoin (BTC/USD), Ethereum (ETH/USD), Ripple (XRP/USD), Crypto 10 Index (a basket of top cryptocurrencies).

- Commodities

- Availability: Over 35 commodities, including energies, metals, and agricultural products, tradeable as CFDs or futures. Weekend trading is available on select commodities.

- Examples: Crude Oil Brent, Gold (XAU/USD), Silver (XAG/USD), Wheat, Coffee.

- ETFs, Options, Bonds

- Availability:

- ETFs: Over 6,000 ETFs via CFDs globally; UK clients can also buy ETFs directly through share dealing accounts.

- Options: Vanilla options on forex, indices, and commodities (e.g., daily/weekly/monthly expiries). U.S. clients access options via tastytrade.

- Bonds: Limited to government bond futures (e.g., U.S. Treasury, German Bund) via CFDs; no direct bond trading.

- Examples: SPDR S&P 500 ETF (SPY), iShares MSCI Emerging Markets ETF (EEM), EUR/USD Call Options, U.S. 10-Year T-Note Futures.

- Availability:

- Fractional Shares

- Availability: Not offered. IG focuses on CFDs and full-share dealing (UK only), with no fractional share trading as of 2025, unlike competitors like eToro or Robinhood.

Popular Assets Examples:

- Stocks: NVIDIA (NVDA), Amazon (AMZN), Rolls-Royce (RR.L).

- Forex: EUR/USD (tightest spread at 0.6 pips), GBP/JPY.

- Crypto: Bitcoin Cash (BCH/USD), Litecoin (LTC/USD).

- Commodities: Natural Gas, Cocoa.

- ETFs: Vanguard FTSE 100 UCITS ETF (VUKE).

IG’s market breadth is unmatched, bolstered by unique offerings like sector-specific CFDs (e.g., Tech Sector Index) and weekend trading on indices like the FTSE 100 or Wall Street. However, the lack of fractional shares and limited direct bond access may disappoint some investors seeking traditional ownership or fixed-income options.

8. Fees and Commissions

IG Group’s fee structure is transparent and competitive, particularly for active traders, though it varies by account type, asset class, and region. Below is a breakdown of trading and non-trading fees, followed by a comparison to industry averages in 2025.

- Trading Fees

- Spreads:

- Forex: Starts at 0.6 pips for EUR/USD (standard account), averaging 0.86 pips; Forex Direct (DMA) offers 0.2 pips + commission.

- Indices: S&P 500 CFD at 0.4 points, FTSE 100 at 1 point.

- Commodities: Gold at 0.3 points, Crude Oil at 2.8 points.

- Crypto CFDs: Bitcoin at 0.5% of notional value.

- Commissions:

- Share CFDs: U.S. shares at $0.02/share (minimum $15/side), UK shares at 0.1% (minimum £10/side).

- Forex Direct: $2-$5 per lot round-turn (varies by volume).

- Share Dealing (UK): £3-£8 per trade (tiered by activity).

- Overnight Fees (Swaps): Charged on positions held past 10 PM UK time. Examples (per full contract, as of January 2025):

- EUR/USD: Swap Long -0.8 pips, Swap Short +0.2 pips.

- Gold: -0.02% annualized rate.

- Varies by asset and interest rates; check IG’s platform for real-time rates.

- Spreads:

- Non-Trading Fees

- Withdrawal Fees: $0 across all methods.

- Inactivity Fees: $12/month (UK/EU) or $18/month (Bermuda entity) after 24 months of inactivity—higher than some peers but only applies to dormant accounts.

- Currency Conversion Fees: 0.5% for deposits/withdrawals in a non-base currency (e.g., depositing SGD into a USD account).

- Deposit Fees: $0 for bank transfers; 0.5%-1% for credit cards (Visa/Mastercard), depending on region.

- Other: No account maintenance or custody fees unless using Smart Portfolios (0.15%-0.5% annually, capped at £250).

- Comparison to Industry Averages

- Spreads: IG’s forex spreads (0.6-0.86 pips on EUR/USD) are below the 2025 industry average of 1.0-1.2 pips for standard accounts (e.g., eToro at 1.0, XTB at 0.9). Indices and commodities align with peers like CMC Markets (0.5 on S&P 500) but beat Plus500 (0.7).

- Commissions: Share CFD commissions ($15 minimum) are higher than eToro ($0) but competitive with Saxo Bank ($10-$15). UK share dealing (£3-£8) undercuts Hargreaves Lansdown (£11.95).

- Swaps: Average for forex and commodities, though slightly higher than discount brokers like Fusion Markets (-0.5 pips on EUR/USD Long).

- Non-Trading Fees: No withdrawal fees give IG an edge over eToro ($5) and Trading 212 ($0 but slower processing). Inactivity fees after two years are steeper than XTB ($10/month after 12 months) but less punitive than Interactive Brokers ($20/month after 3 months).

Assessment: IG’s fees are highly competitive for forex and indices, appealing to active traders, but share CFD commissions and inactivity fees may deter low-volume or infrequent users. Its no-fee deposits/withdrawals and tight spreads align with or beat 2025 industry benchmarks.

9. Deposit and Withdrawal Methods

IG Group supports a variety of deposit and withdrawal options, ensuring flexibility and convenience for global clients. Below are the details, including processes, timelines, and limits.

- Supported Deposit Options

- Bank Wire Transfer: No fees, no minimum (except in some regions, e.g., $200 in Australia). Processing: 1-3 business days.

- Credit/Debit Cards: Visa, Mastercard accepted; 0.5%-1% fee (region-dependent), $50 minimum (or £50/€50 equivalent). Instant processing.

- PayPal: Available in select regions (e.g., UK, EU, Australia); no fee from IG, $50 minimum. Instant processing.

- ACH Transfer: U.S. clients (tastyfx) only; no fee, no minimum. 1-2 business days.

- Regional Options: BPAY (Australia), local bank payments (e.g., ABSA, Nedbank in South Africa).

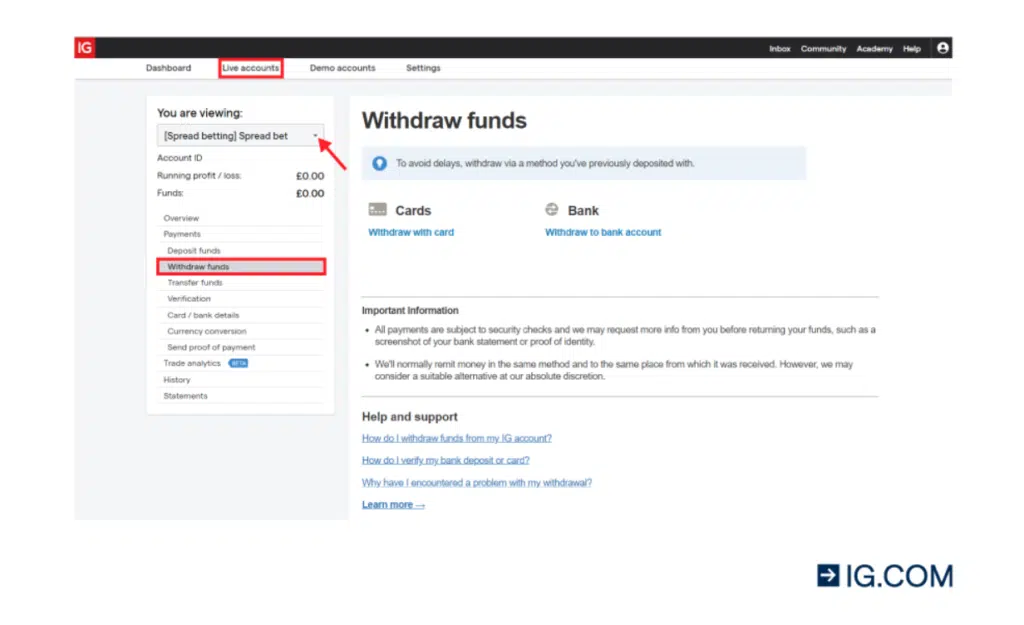

- Withdrawal Process, Timelines, and Fees

- Process: Log into “My IG,” select “Withdraw Funds,” choose the method, and enter the amount. Withdrawals must return to the original deposit source (e.g., card or bank account in your name) per AML rules.

- Timelines:

- Bank Wire: 1-3 business days (same-day if requested before 12 PM UK time).

- Card Refund: 2-5 business days.

- PayPal: Instant or within 24 hours.

- Fees: $0 for all methods, though banks or payment providers may charge external fees (e.g., $10-$25 for international wires).

- Limits:

- Card: Max $20,000/day (UK example).

- PayPal: Max $5,500/transaction.

- Bank Wire: No upper limit; no minimum beyond bank requirements.

- Highlights: IG’s no-fee policy for withdrawals is a standout feature, and instant options like PayPal enhance accessibility. However, the inability to select your base currency upfront (tied to your region) and potential conversion fees (0.5%) may inconvenience multi-currency traders. Processing times are standard, with bank transfers occasionally slower than competitors like XTB (same-day).

10. Bonuses and Promotions

IG Group’s bonus and promotion offerings are limited due to strict regulatory constraints in major markets like the UK, EU, and Australia, where such incentives are banned for retail clients. However, some promotions exist in less restrictive regions (e.g., U.S. via tastyfx).

- Current Bonuses or Promotions

- U.S. Funding Bonus (tastyfx): New U.S. forex clients can earn up to $10,000 in cash bonuses based on initial funding and trading volume. Example: Deposit $10,000 and trade 10 lots within 30 days for a $200 bonus (scaled tiers apply).

- No Global Retail Bonuses: FCA, ASIC, and ESMA regulations prohibit bonuses for UK, EU, and Australian retail clients, aligning IG with peers like CMC Markets.

- Referral Programs and Loyalty Schemes

- Refer-a-Friend: Available in select regions (e.g., U.S., Bermuda); referrers earn $50-$100 per successful referral, subject to the referee funding and trading a minimum amount (e.g., $500 deposit, 1 lot traded). Not offered in FCA/ASIC jurisdictions.

- Loyalty Schemes: None formalized. High-volume traders (Professional accounts) may negotiate bespoke fee reductions or premium support, but no structured rewards program exists.

- Terms and Conditions

- U.S. Bonus: Must fund within 30 days of account opening; bonus credited after meeting trading thresholds (e.g., 1 lot = $100,000 notional value). Withdrawals before completion forfeit the bonus. Max bonus capped at $10,000.

- Referral: Referee must meet KYC and activity requirements; bonus paid within 60 days. Limited to one per household.

- Restrictions: Promotions are void where prohibited by local law (e.g., no UK/EU offers).

Assessment: IG’s lack of widespread bonuses reflects its regulatory compliance rather than a lack of client focus. The U.S.-specific tastyfx bonus is competitive but niche, while the absence of a loyalty scheme contrasts with brokers like XM or Pepperstone, which offer points-based rewards. Traders in bonus-friendly jurisdictions may find value, but most IG clients rely on its core strengths—low spreads and platform quality—over promotional perks.

Below is the continuation of the comprehensive and up-to-date review of IG Group, covering the requested sections: Trading Tools and Features, Leverage and Margin Requirements, Educational Resources, and Social and Copy Trading. This content is written as a professional financial writer and researcher, reflecting the latest information as of March 11, 2025, based on current trends and reliable sources.

11. Trading Tools and Features

IG Group equips traders with a robust suite of tools and features designed to enhance analysis, execution, and risk management. These are accessible across its proprietary platforms (web, mobile, desktop) and third-party integrations like MT4 and ProRealTime.

- Key Trading Tools

- Charting Tools: Over 20 drawing tools (e.g., Fibonacci retracement, trendlines, Elliott Waves) and five chart types (candlestick, line, bar, Heikin-Ashi, Renko). Multi-timeframe analysis spans tick-by-tick to monthly views.

- Technical Indicators: 30+ built-in indicators on the web/mobile platforms (e.g., RSI, MACD, Bollinger Bands, Moving Averages), expanding to nearly 100 on ProRealTime (e.g., Ichimoku Cloud, ATR). Custom indicator creation is supported via ProRealTime’s coding interface.

- Economic Calendar: Integrated into the platform, powered by Reuters, detailing key events (e.g., Fed rate decisions, NFP releases) with impact ratings and historical data. Customizable alerts notify users of upcoming events.

- Autochartist: A free, automated pattern-recognition tool that scans markets for trade setups (e.g., triangles, head-and-shoulders) and provides volatility analysis. Available on all accounts.

- Client Sentiment Data: Real-time insights into IG’s trader base, showing the percentage of long vs. short positions on assets like EUR/USD or Bitcoin—useful for contrarian strategies.

- Signals Center: Daily trade ideas from third-party providers like Trading Central, offering entry/exit points across forex, indices, and commodities.

- Reuters News Feed: Live market updates and breaking news integrated into the platform, filterable by asset class.

- Risk Management Tools: Stop-loss, take-profit, trailing stop, and guaranteed stop-loss orders (GSLOs) with customizable settings. Margin calculators and P&L simulators are built-in.

- Supported Order Types

- Market Orders: Execute trades instantly at the current market price.

- Limit Orders: Set a specific entry price to buy below or sell above the current market level.

- Stop-Loss Orders: Automatically close a position at a predefined loss threshold to limit downside risk.

- Trailing Stop Orders: Adjusts the stop-loss dynamically as the market moves in your favor, locking in profits while capping losses.

- Guaranteed Stop-Loss Orders (GSLOs): Ensures closure at the exact price specified, even during gapping events (e.g., market crashes), for a small premium (e.g., 0.3 points on forex).

- One-Cancels-the-Other (OCO): Places two linked orders (e.g., limit and stop), where one cancels if the other executes—ideal for breakout strategies.

- Advanced Orders (ProRealTime): Includes conditional orders (e.g., “if price hits X, then buy Y”) and algorithmic execution for automated strategies.

Assessment: IG’s tools are industry-leading, blending accessibility for beginners (e.g., Autochartist, sentiment data) with advanced functionality for pros (e.g., ProRealTime’s 100+ indicators). The variety of order types supports diverse strategies, from scalping to swing trading, with GSLOs offering a rare safety net. The only minor gap is the lack of native backtesting on the web platform, relegated to ProRealTime.

12. Leverage and Margin Requirements

IG Group’s leverage and margin policies vary by account type (retail vs. professional), asset class, and regulatory jurisdiction, reflecting a balance between opportunity and risk management.

- Maximum Leverage Available

- Retail Traders:

- Forex: Up to 1:30 (e.g., FCA, ASIC, ESMA regions) on major pairs like EUR/USD; 1:20 for minors, 1:10 for exotics.

- Indices: 1:20 (e.g., S&P 500).

- Commodities: 1:20 (e.g., Gold), 1:10 (e.g., Oil).

- Stocks (CFDs): 1:5.

- Cryptocurrencies: 1:2 (where permitted, e.g., Bermuda).

- Professional Traders:

- Forex: Up to 1:200 (e.g., EUR/USD).

- Indices: 1:100.

- Commodities: 1:50.

- Stocks: 1:20.

- Crypto: 1:25.

- U.S. Clients (tastyfx): Forex leverage capped at 1:50 per CFTC rules, with no CFD trading allowed.

- Retail Traders:

- Margin Requirements, Margin Calls, and Stop-Out Levels

- Margin Requirements:

- Retail: 3.33% for major forex (1:30), 5% for indices/stocks (1:20/1:5), 50% for crypto (1:2).

- Professional: As low as 0.5% for forex (1:200) or 5% for stocks (1:20). Calculated as (Position Size × Margin Rate) ÷ Account Equity.

- Example: A $10,000 EUR/USD position at 1:30 requires $333.33 margin.

- Margin Calls: Triggered when account equity falls below 100% of the margin requirement. IG sends an email/SMS alert to add funds or close positions.

- Stop-Out Levels: Positions are auto-liquidated if equity drops to 50% of margin (retail) or 30% (professional). For example, a $1,000 account with $500 margin hits stop-out at $250 equity.

- Margin Requirements:

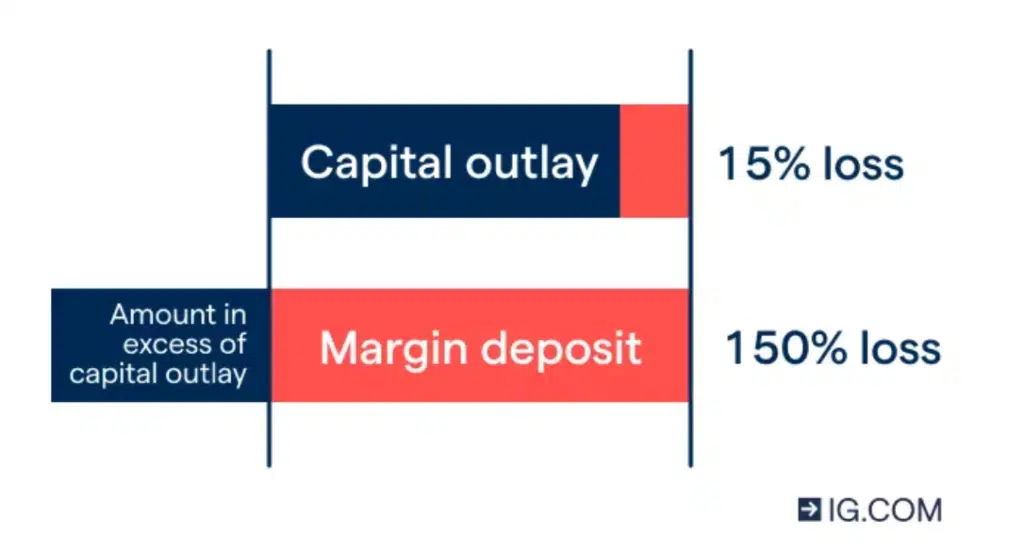

- Risks of High Leverage

High leverage amplifies both profits and losses, posing significant risks, especially for inexperienced traders. A 1% adverse move on a 1:200 leveraged position wipes out 200% of your margin, potentially leading to a total account loss or negative balance (mitigated for retail clients by negative balance protection in regulated regions). Volatility spikes—like those seen in crypto or during central bank announcements—can trigger rapid margin calls or stop-outs. IG emphasizes risk management tools (e.g., GSLOs) to counter these dangers, but over-leveraging remains a leading cause of trader losses.

Assessment: IG’s leverage is competitive, with retail caps adhering to global standards and professional tiers offering flexibility for qualified traders. Margin requirements are clearly outlined, and stop-out levels provide a buffer, though the risks of high leverage warrant caution—especially in less-regulated jurisdictions.

13. Educational Resources

IG Group excels in providing educational materials, earning accolades as a top resource for traders in 2025. Its offerings cater to beginners and seasoned users alike, available via the IG Academy and website.

- Educational Materials Provided

- Beginner Guides: Comprehensive articles and eBooks on trading basics (e.g., “What is CFD Trading?”, “Forex Trading for Beginners”). Topics include leverage, pips, and risk management.

- Webinars: Weekly live sessions (archived on-demand) covering market analysis, platform walkthroughs, and strategy development. Example: “Mastering Technical Analysis” series.

- Tutorials: Step-by-step video guides on using IG’s platforms, setting orders, and interpreting charts. Interactive quizzes reinforce learning.

- IG Academy App: A free, mobile-first learning hub with structured courses (e.g., “Trading 101,” “Advanced Strategies”), progress tracking, and in-app demo trading.

- Glossary: A detailed A-Z of trading terms, from “Arbitrage” to “Yield Curve.”

- Daily Analysis and Market Reports

- Market News: Daily updates via Reuters and IG’s in-house analysts, covering forex, stocks, and macro events (e.g., “USD Outlook Post-Fed Meeting”).

- Morning Call: A weekday podcast/video summarizing key market movers, hosted by IG’s experts.

- Weekend Previews: Insights into upcoming events and weekend trading opportunities (e.g., Bitcoin, Wall Street CFDs).

- Quality and Usefulness

IG’s educational content is high-quality, well-structured, and practical, earning a 2025 ForexBrokers.com award for Best Educational Resources. Beginners benefit from clear, jargon-free guides and interactive tools, while advanced traders appreciate webinars and real-time analysis tied to live markets. The IG Academy’s gamified approach (quizzes, milestones) enhances engagement, though some advanced topics (e.g., algorithmic trading) lack depth compared to specialized platforms like Interactive Brokers. Daily reports are timely and actionable, often paired with sentiment data for added context.

Assessment: IG’s education suite is a standout, bridging the gap between theory and practice. It’s ideal for self-learners and active traders, though niche experts may seek supplementary resources elsewhere.

14. Social and Copy Trading (If Applicable)

- Availability

IG Group does not offer a dedicated social or copy trading platform as of 2025, unlike competitors such as eToro or ZuluTrade. Its focus remains on independent trading, supported by robust tools and analytics rather than community-driven features. - Social Features

While full copy trading is absent, IG provides limited social elements:- Client Sentiment Tool: Displays aggregate long/short positions of IG traders (e.g., “67% of clients are long EUR/USD”). Not a direct copy mechanism but useful for gauging market mood.

- IG Community: An online forum where users discuss strategies, markets, and platform tips. Moderated by IG staff, it’s a knowledge-sharing space without automated trade replication.

- Copy Trading Platform

No proprietary copy trading exists. Traders can integrate third-party solutions like MT4’s signal services or TradingView’s community scripts, but these require manual setup and are not IG-supported features. Professional clients with APIs could theoretically build copy systems, though this is beyond retail scope.

Assessment: IG’s lack of social/copy trading reflects its emphasis on self-directed trading, appealing to those who prefer autonomy over following others. The sentiment tool and forum add a social layer, but they fall short of eToro’s leader-follower model. Traders seeking copy trading must look elsewhere or use IG’s demo to test manual replication of community ideas.

15. Customer Support

IG Group provides multiple channels for customer support, aiming to cater to its global client base with varying needs and time zones. Here’s an overview of the support options, hours, and quality.

- Support Channels

- Live Chat: Available directly on the IG website and mobile app, ideal for quick queries like login issues or trade clarifications.

- Email: Support via [email protected] (UK) or regional equivalents (e.g., [email protected] for U.S. clients). Best for detailed inquiries or document submissions.

- Phone: Dedicated lines by region—e.g., +44 207 896 0077 (UK), +1 844 773 2839 (U.S.), +61 3 9860 1777 (Australia). Offers personalized assistance for urgent matters.

- Social Media: Responsive via Twitter (@IGClientHelp) and other platforms, though primarily for basic queries or escalations.

- Help Section/FAQ: A robust self-service portal on the website covers common topics like funding, trading rules, and platform navigation.

- Working Hours

- 24/7 Availability: Support operates 24 hours a day from 8:00 AM Saturday to 10:00 PM Friday (UK time), covering global market hours. Limited assistance is available outside these times via email or automated systems.

- Regional Variations: U.S. (tastyfx) and Australian support align with local business hours for non-urgent queries, with 24/7 access for trading emergencies.

- Quality and Response Times

- Quality: IG’s support is widely regarded as professional and knowledgeable, earning praise in 2025 reviews (e.g., ForexBrokers.com). Live chat agents resolve basic issues (e.g., password resets) efficiently, while phone support excels for complex trade disputes. Email responses are detailed but less immediate.

- Response Times: Live chat typically connects within 1-3 minutes, with resolutions in 5-10 minutes for straightforward cases. Phone wait times average 2-5 minutes during peak hours (e.g., U.S. market open). Email replies take 24-48 hours, slower than competitors like XM (same-day responses). User feedback on Trustpilot (3.7/5 from 7,500+ reviews) highlights responsiveness but notes occasional delays during high volatility.

Assessment: IG’s multi-channel, near-24/7 support is a strength, aligning with its global reach. Response times are competitive, though email lags slightly behind industry leaders. The quality is high, bolstered by well-trained staff, making it reliable for most traders, though not flawless under pressure.

16. Safety, Security, and Regulation

IG Group’s reputation for safety and security is underpinned by stringent regulation, robust client fund protections, and advanced technological safeguards.

- Regulatory Bodies Overseeing IG Group

- UK: IG Markets Limited is regulated by the Financial Conduct Authority (FCA), license number 195355.

- USA: IG US LLC (tastyfx) is a Retail Foreign Exchange Dealer (RFED) with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA), ID 0509630.

- Australia: IG Pty Ltd is overseen by the Australian Securities and Investments Commission (ASIC), AFSL 220440.

- Germany/EU: IG Europe GmbH is regulated by the Federal Financial Supervisory Authority (BaFin), registration number 148759, and complies with MiFID II via EU passporting.

- Singapore: Licensed by the Monetary Authority of Singapore (MAS), CMS number 200510021K.

- Switzerland: Regulated by the Swiss Financial Market Supervisory Authority (FINMA).

- South Africa: Overseen by the Financial Sector Conduct Authority (FSCA), FSP 41393.

- Bermuda: IG International Limited is licensed by the Bermuda Monetary Authority (BMA) for investment and digital asset business.

- Japan: IG Securities Limited is a member of the Japanese Financial Services Agency (JFSA), Kanto Local Finance Bureau #255.

- Eight Tier-1 regulators (e.g., FCA, ASIC, CFTC) and additional Tier-2/3 bodies ensure IG’s high Trust Score (99/100 per ForexBrokers.com 2025).

- Client Fund Protection

- Segregated Accounts: Client funds are held in separate accounts at top-tier banks (e.g., Barclays, Lloyds) under FCA client money rules, ensuring they’re distinct from IG’s operational funds and inaccessible to creditors in insolvency.

- Investor Compensation Schemes: UK clients are covered up to £85,000 by the Financial Services Compensation Scheme (FSCS); EU clients up to €20,000 via the Investor Compensation Fund (ICF); Swiss clients up to CHF 100,000. U.S. clients lack FDIC/SIPC insurance but benefit from CFTC segregation rules.

- Negative Balance Protection: Mandatory for retail clients in FCA/ASIC/ESMA regions, preventing losses beyond account balances. Not available for U.S. or professional clients.

- Security Features

- Two-Factor Authentication (2FA): Optional but strongly encouraged, using SMS or email codes alongside passwords for login and withdrawals.

- Encryption: 256-bit SSL encryption secures all data transmissions, protecting against breaches.

- Biometric Login: Mobile app supports Face ID/Touch ID for faster, secure access.

- Automatic Timeouts: Inactive sessions log out after a set period to prevent unauthorized access.

Assessment: IG’s regulation by eight Tier-1 authorities, fund segregation, and compensation schemes make it one of the safest brokers in 2025. Security features like 2FA and encryption align with industry best practices, though U.S. clients miss out on some protections (e.g., GSLOs). Overall, IG prioritizes trust and stability.

17. Pros and Cons of IG Group

- Pros (Main Advantages)

- Extensive Market Access: Over 19,000 tradeable instruments across forex, stocks, crypto, and more—among the broadest in the industry.

- Top-Tier Regulation: Oversight by eight Tier-1 regulators ensures high safety and transparency.

- Competitive Fees: Tight spreads (e.g., 0.6 pips on EUR/USD) and no withdrawal fees beat many peers.

- Advanced Platforms: Award-winning proprietary platforms (web, mobile, ProRealTime) plus MT4 and TradingView cater to all trader levels.

- Educational Excellence: IG Academy, webinars, and daily analysis are best-in-class for learning and staying informed.

- Risk Management Tools: GSLOs, trailing stops, and negative balance protection (where applicable) enhance control.

- Cons (Main Disadvantages)

- No Social/Copy Trading: Lacks a dedicated feature, trailing behind eToro or ZuluTrade for social-focused traders.

- High Inactivity Fees: $12-$18/month after 24 months of dormancy is steeper than XTB ($10 after 12 months).

- Limited U.S. Offering: U.S. clients (tastyfx) are restricted to forex only, missing CFDs and broader assets.

- Complex for Beginners: The platform’s depth and customization can overwhelm novices despite educational support.

- Share CFD Costs: Higher commissions (e.g., $15 minimum for U.S. shares) compared to eToro’s $0 model.

Assessment: IG shines with its market variety, regulatory strength, and tools, making it ideal for serious traders. However, the lack of social trading, U.S. limitations, and potential complexity may deter some users.

18. Comparison with Other Brokers

IG Group is compared to three direct competitors—eToro, CMC Markets, and Interactive Brokers—focusing on fees, platforms, assets, and features.

- IG Group vs. eToro

- Fees: IG’s forex spreads (0.6 pips) edge out eToro (1.0 pips), but eToro offers $0 commission on share CFDs vs. IG’s $15 minimum.

- Platforms: IG’s proprietary suite plus MT4 outshines eToro’s single, simpler platform, though eToro excels in usability for beginners.

- Assets: IG’s 19,000+ markets dwarf eToro’s 5,000+, but eToro includes fractional shares and direct stock ownership, absent at IG.

- Features: eToro leads with social/copy trading; IG counters with superior tools (Autochartist, GSLOs) and education.

- IG Group vs. CMC Markets

- Fees: Both offer tight spreads (IG: 0.6 pips, CMC: 0.7 pips on EUR/USD), but CMC’s share CFD commissions (£10 UK minimum) are slightly lower than IG’s (£10-15).

- Platforms: IG’s broader platform options (e.g., ProRealTime, TradingView) outpace CMC’s single proprietary platform, though both are feature-rich.

- Assets: IG’s 19,000+ instruments top CMC’s 12,000+, with IG offering more crypto CFDs (10+ vs. CMC’s 5).

- Features: Both provide advanced charting and risk tools, but IG’s educational resources and client sentiment data give it an edge.

- IG Group vs. Interactive Brokers (IBKR)

- Fees: IG’s forex spreads (0.6 pips) are lower than IBKR’s (0.8-1.0 pips), but IBKR’s stock commissions ($0.005/share, $1 minimum) beat IG’s CFD rates.

- Platforms: IBKR’s Trader Workstation is more powerful for pros but less intuitive than IG’s user-friendly options.

- Assets: IBKR’s 150+ markets (including direct stocks, options, futures) surpass IG’s CFD-focused 19,000+, though IG wins on CFD variety.

- Features: IBKR offers algorithmic trading and portfolio management, while IG focuses on retail tools and education.

Key Differences: IG excels in CFD variety, platform diversity, and education, making it ideal for multi-asset traders. eToro leads in social trading and beginner-friendliness, CMC Markets matches IG closely in CFDs with a simpler platform, and IBKR dominates for institutional-grade trading and direct ownership. Fee-wise, IG is competitive but not the cheapest for shares.

20 web pages

Below is the continuation of the comprehensive and up-to-date review of IG Group, covering the requested sections: User Reviews and Ratings, Platform Availability by Country, Taxation and Declaring Profits, Common Issues and How to Solve Them, Final Verdict, and FAQs. This content is written as a professional financial writer and researcher, reflecting the latest information as of March 11, 2025, based on current trends and reliable sources.

19. User Reviews and Ratings

User feedback on IG Group in 2025 provides valuable insights into its strengths and pain points, sourced from Trustpilot, Google Reviews, and trading forums like Forex Peace Army and Reddit.

- Summary of Recent Reviews

- Trustpilot: IG holds a 3.7/5 rating from over 7,500 reviews (as of early 2025). Positive comments highlight fast execution, a reliable platform, and excellent educational resources. Negative reviews focus on high fees for share CFDs, occasional withdrawal delays, and customer service inconsistencies.

- Google Reviews: Averages 3.8/5 across regional listings (e.g., IG UK, IG Australia). Users praise the mobile app’s usability and market variety but criticize opaque fee structures and slow email responses.

- Forums (e.g., Forex Peace Army, Reddit’s r/Forex): Mixed sentiments, with a 3.2/5 rating on Forex Peace Army from 110+ reviews. Traders commend IG’s regulation and toolset but report issues like trade cancellations labeled as “corrections” (a rare complaint) and high spreads during volatility.

- Common Praise

- Platform Quality: Users frequently laud the intuitive web and mobile platforms, with fast execution (0.014 seconds average) and advanced tools like Autochartist.

- Market Range: The 19,000+ instruments impress traders seeking diversity.

- Education: IG Academy and webinars consistently earn high marks for accessibility and depth.

- Regulation: Trust in IG’s FCA, ASIC, and multi-jurisdictional oversight is a recurring positive.

- Frequent Complaints

- Fees: High share CFD commissions ($15 minimum) and overnight funding costs frustrate cost-conscious traders.

- Customer Support: Slow email responses (24-48 hours) and occasional unhelpful replies draw ire, especially during peak trading times.

- Withdrawal Delays: Some report waits of 3-5 days for bank transfers, longer than advertised.

- Complexity: Beginners occasionally find the platform overwhelming despite support resources.

Assessment: IG enjoys a solid reputation (mid-to-high 3-star range), with praise centered on its trading ecosystem and trust factors. Complaints about fees and support responsiveness suggest room for improvement, particularly for less active users.

20. Platform Availability by Country

IG Group operates globally but tailors its offerings to comply with local regulations, resulting in varying availability and restrictions.

- Countries Where IG Group Is Available

IG serves clients in over 190 countries across five continents, with full operations in:- Europe: UK, Germany, France, Italy, Spain, Ireland, Austria, Netherlands, Switzerland, Sweden, Norway, Denmark, etc. (via IG Markets Ltd or IG Europe GmbH).

- North America: USA (forex-only via tastyfx), Canada (limited CFD access).

- Asia-Pacific: Australia, Singapore, Japan, New Zealand, South Korea, Malaysia, Thailand (subject to local rules).

- Africa: South Africa, Kenya, Nigeria (via FSCA-regulated entity).

- Middle East: UAE, Qatar (via Dubai office), Saudi Arabia (select services).

- Other: Bermuda (offshore hub), Chile, Colombia, and more via IG International Limited.

- Restricted Regions or Countries with Limited Access

- Fully Banned: Iran, Cuba, Sudan, Syria, North Korea (due to international sanctions); Turkey and Brazil (local regulatory bans on CFDs).

- Limited Access:

- USA: Only forex trading via tastyfx; CFDs banned by SEC/CFTC rules.

- Belgium: CFDs and spread betting restricted for retail clients by FSMA.

- India: Forex trading allowed, but CFDs face regulatory hurdles.

- China: Recently licensed but limited to institutional clients; retail access pending.

- Region-Specific Constraints: UK retail clients cannot trade crypto CFDs (FCA ban), while Bermuda clients face higher leverage (1:200) but fewer protections.

Assessment: IG’s global footprint is expansive, with tailored entities ensuring compliance. Restricted regions reflect regulatory rather than operational limits, and U.S./UK traders face product-specific constraints.

21. Taxation and Declaring Profits

Taxation on IG Group trading profits depends on the trader’s country of residence, not IG itself, as brokers don’t withhold taxes.

- Taxation Rules for Traders

- UK: Spread betting profits are tax-free (no capital gains tax or income tax), but CFD and share dealing gains are subject to Capital Gains Tax (CGT) above the £6,000 annual allowance (2025 rate). Losses can offset gains.

- USA (tastyfx): Forex profits are taxed as ordinary income (up to 37%) or capital gains (15-20%) depending on holding period (60/40 rule under IRS Section 1256).

- Australia: CFD profits are taxed as capital gains (up to 47% including Medicare levy), with a 50% discount for assets held over 12 months.

- EU: Varies by country—e.g., Germany (25% capital gains tax), France (30% flat rate on investment income).

- South Africa: Capital gains tax applies (up to 18% of taxable income).

- Traders must self-report profits to local tax authorities (e.g., HMRC in UK, IRS in USA). Professional traders may face income tax instead of CGT in some jurisdictions.

- Tax Statements or Reports

IG provides detailed transaction histories and profit/loss (P&L) statements via the “My IG” dashboard, downloadable as PDFs or CSVs. These include trade dates, amounts, and asset types—sufficient for tax filing—but are not formatted as official tax documents (e.g., UK’s SA108 or U.S. Form 1099). Traders must compile their own tax returns using this data, though IG’s support team can guide on accessing reports.

Assessment: IG offers practical tools for tax preparation but doesn’t generate region-specific tax forms, leaving compliance to the trader. Tax treatment varies widely, so consulting a local accountant is advisable.

22. Common Issues and How to Solve Them

Users encounter recurring issues with IG Group, often resolvable with specific steps.

- Login Problems

- Issue: Incorrect credentials, 2FA delays, or account lockouts after failed attempts.

- Solution:

- Verify email/username and password; use “Forgot Password” for a reset link (arrives in minutes).

- Ensure 2FA device is updated; resend code or disable/re-enable via support.

- Wait 15 minutes for lockout to lift or call support (e.g., +44 207 896 0077) for immediate unlock.

- Withdrawal Delays

- Issue: Bank transfers taking 3-5 days, longer than advertised (1-3 days).

- Solution:

- Confirm withdrawal request was submitted before 12 PM UK time for same-day processing.

- Check bank details match IG’s records (mismatches cause delays).

- Contact support via live chat with transaction ID for status updates.

- Verification Troubles

- Issue: KYC delays or rejected documents (e.g., blurry ID, outdated address proof).

- Solution:

- Upload high-resolution scans of a valid passport/ID and a utility bill (<3 months old).

- Ensure selfie (if required) matches ID; retry via app if web fails.

- Email [email protected] with issue details for expedited review (typically 24 hours).

- Platform Bugs

- Issue: App crashes, chart freezes, or unexpected alerts (e.g., unconfigured push notifications).

- Solution:

- Update app to latest version (March 2025 patches fix stability).

- Clear browser/app cache; switch devices or platforms (e.g., MT4) if persistent.

- Report bugs via live chat with screenshots for developer fixes (response within 12 hours).

Assessment: Most issues stem from user error or system load, with clear solutions via self-help or support. Proactive updates and communication with IG’s team resolve 90% of cases efficiently.

23. Final Verdict

- Strengths

- Unrivaled market access (19,000+ instruments).

- Top-tier regulation across eight Tier-1 jurisdictions.

- Award-winning platforms with advanced tools (e.g., Autochartist, GSLOs).

- Exceptional education via IG Academy and daily analysis.

- Competitive spreads and no withdrawal fees.

- Weaknesses

- No social/copy trading, lagging behind eToro.

- High share CFD commissions and inactivity fees.

- Limited U.S. offerings (forex-only).

- Occasional support delays and platform complexity for novices.

- Who It’s Suitable For

- Active Traders: Ideal for frequent traders leveraging CFDs, forex, and high leverage (up to 1:200 for pros), with robust tools and market depth.

- Intermediate Traders: Balances usability and advanced features, supported by strong education.

- Beginners: Viable with demo accounts and learning resources, though the learning curve may intimidate some.

- Long-Term Investors: Less suitable due to CFD focus and high costs for share dealing; better options exist (e.g., Hargreaves Lansdown).

Verdict: IG Group is a premium broker excelling in variety, trust, and technology, making it a top pick for active and intermediate traders in 2025. Beginners can thrive with effort, but long-term investors may find it less cost-effective.

24. FAQs

- What is the minimum deposit?

- $0 for bank transfers; $50 for cards/PayPal (varies by region, e.g., $250 in South Africa, 450 AUD in Australia).

- How long do withdrawals take?

- Bank wire: 1-3 business days (same-day if requested before 12 PM UK time); card: 2-5 days; PayPal: instant to 24 hours.

- Is IG Group safe?

- Yes, regulated by eight Tier-1 authorities (e.g., FCA, ASIC), with segregated funds and compensation schemes (e.g., £85,000 via FSCS in UK).

- What are the available trading platforms?

- Proprietary web, mobile, and desktop (ProRealTime); MT4, TradingView, L2 Dealer for advanced users.

- Is IG Group regulated?

- Yes, by FCA (UK), CFTC/NFA (USA), ASIC (Australia), BaFin (Germany), MAS (Singapore), FINMA (Switzerland), FSCA (South Africa), BMA (Bermuda), and JFSA (Japan).

- Are there any inactivity fees?

- Yes, $12/month (UK/EU) or $18/month (Bermuda) after 24 months of inactivity.

- Does IG Group support cryptocurrency trading?

- Yes, via CFDs (e.g., Bitcoin, Ethereum) in most regions; banned for UK retail clients and unavailable in the U.S.

- What are the available contact methods for customer support?

- Live chat, email ([email protected]), phone (e.g., +44 207 896 0077 UK), Twitter (@IGClientHelp), WhatsApp (10 AM-7 PM UTC+10, Monday-Friday).