Bitcoin is attempting to steady itself after a volatile weekend, where a massive sell-off by a large holder sparked a sharp downturn in the market.

The sudden drop briefly pushed the world’s largest cryptocurrency below $110,000 on Sunday, wiping out billions in leveraged positions. Since then, Bitcoin has managed to recover into the $111,000–$112,000 range, leaving traders debating whether the next move will be a renewed push toward $120,000.

Current Market Snapshot

At the time of writing, Bitcoin is trading just under $110,000, holding modest gains following its weekend flash crash. The dramatic sell-off was triggered by the unloading of around 24,000 BTC—valued at over $2.6 billion—which caused more than $550 million in liquidations across futures markets.

Despite the shock, Bitcoin rebounded quickly above $109,000 and has since consolidated. Short-term resistance remains between $113,000 and $115,000, with the next significant test likely around $118,000–$120,000. On the downside, support appears firm at $110,000, with $108,000 emerging as the fallback level for bulls.

Upside Potential

The fact that Bitcoin held above $110,000 after such heavy selling has been read as a sign of strength. Analysts suggest that if BTC can break decisively through the $113,000–$115,000 resistance, it could build momentum toward $116,000–$118,000. A successful move beyond that zone could pave the way for a retest of the $120,000 psychological barrier.

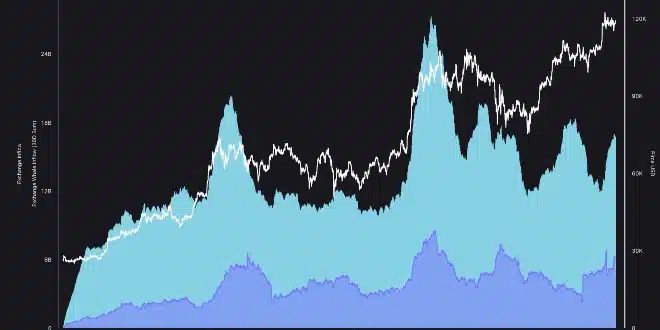

Institutional demand continues to support the bullish case. Spot Bitcoin ETFs have been absorbing consistent inflows, with large investment funds maintaining long-term accumulation strategies despite short-term turbulence. This structural demand provides a steady foundation for further upside, with some forecasters even eyeing a return toward the all-time high near $124,000 if $120,000 is cleared.

Downside Risks

That said, risks remain in play. A failure to defend $110,000 could invite fresh selling pressure, driving Bitcoin back to the $108,000 zone. Whale-driven sell-offs remain an unpredictable factor, and another large liquidation event could quickly destabilize the market again.

Broader macroeconomic conditions are also crucial. Any signs of resurgent inflation or a more aggressive stance from the U.S. Federal Reserve could undermine Bitcoin’s recovery, even with ETF inflows cushioning the market. For now, however, dovish Fed signals and institutional adoption are keeping bearish forces in check.

Short-Term Outlook

In the immediate term, Bitcoin’s key trading range sits between $110,000 and $115,000. A clean breakout above $115,000 would likely accelerate gains toward $118,000–$120,000, while a slip below $110,000 could shift momentum back toward $108,000.

Overall, sentiment leans cautiously optimistic. Bitcoin’s ability to bounce back so quickly after Sunday’s crash suggests buyers are active and willing to defend support. If momentum holds, BTC may be on course to test $120,000 in the coming days.