PDD Holdings, the parent company of Temu and Pinduoduo, is exceeding market expectations with a significant increase in profit and revenue, driven by strong demand from American and Chinese consumers for its low-cost shopping apps.

The Shanghai-based company reported a 246% increase in net profit, reaching 28 billion yuan ($3.9 billion) in the first quarter of 2024, far surpassing the average analyst estimate of 12.62 billion yuan ($1.7 billion), according to LSEG data. Revenue also saw a substantial rise, jumping 131% to 86.81 billion yuan ($12 billion), well above forecasts. Analysts at Nomura noted that the growth momentum was fueled by demand from both domestic and international markets.

These robust results propelled PDD’s shares on Nasdaq, boosting its market value to over $204 billion and making it China’s most valuable e-commerce company, surpassing Alibaba. Alibaba, based in Hangzhou, has long been a dominant force in China’s online retail sector but faces increased competition and regulatory scrutiny from Beijing.

PDD was founded in 2015 by Colin Huang, who stepped down as chairman in 2021 to focus on life sciences. Despite stepping down, Huang remains the company’s largest shareholder with a 25% stake and is China’s second richest person, with a fortune nearing $52 billion, according to the Bloomberg Billionaires Index.

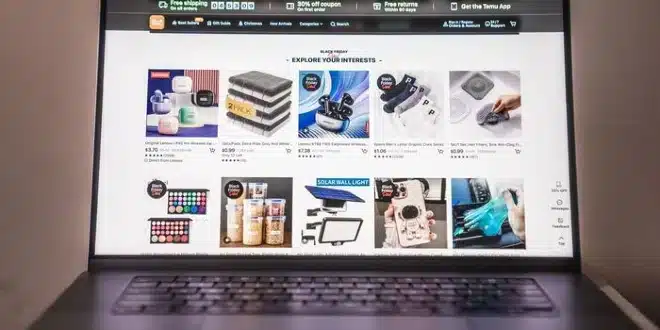

PDD’s international app, Temu, launched in 2022, had captured nearly 17% of the US online discount market by last November, according to Earnest Analytics. Meanwhile, Pinduoduo continues to grow in China, increasing its e-commerce market share from 7.2% in 2019 to 19% by mid-2023, according to Yinma Data Research. It still trails behind Alibaba’s Taobao and Tmall (44% combined) and JD.com (24%).

In just eight years, PDD has adeptly capitalized on shifting consumer behaviors in China, where economic slowdown and poor job prospects are leading people to seek bargains on everything from groceries to electronics. Western brands, aiming for premium markets, are also offering discounts.

In the US, consumers have become more price-conscious following two years of high inflation. Many retailers have recently cut prices to encourage spending on items like clothing and home decor.

Following PDD’s impressive financial results, several investment banks and brokerages, including Morgan Stanley and Nomura, have raised their price targets for PDD stock.

However, the company acknowledged that competition is intensifying as rivals also offer significant discounts to attract consumers. “We are seeing that our industry peers have significantly stepped up their efforts,” said Lei Chen, co-CEO and chairman of PDD, during an earnings call on Wednesday. He emphasized the need for PDD to adapt to changing consumer markets by offering more savings and higher quality products.

PDD is also navigating potential regulatory challenges as it expands globally. Recently, a European consumer group accused Temu of using manipulative techniques to encourage excessive spending and called for a regulatory investigation into the app. In South Korea, regulators are investigating Temu for suspected false advertising and unfair practices.

Chen stated that the company is actively engaging with regulatory bodies worldwide with a “learning mindset.” He acknowledged that as PDD’s business grows, both consumers and regulators are holding the company to higher compliance standards, as well as the merchants that conduct business on its platforms.