Asian stock markets moved higher on Wednesday as investors reacted positively to U.S. President Donald Trump’s assurance that he does not plan to remove Federal Reserve Chairman Jerome Powell. The comments came after earlier speculation that Powell’s job was at risk following the Fed’s pause on rate cuts.

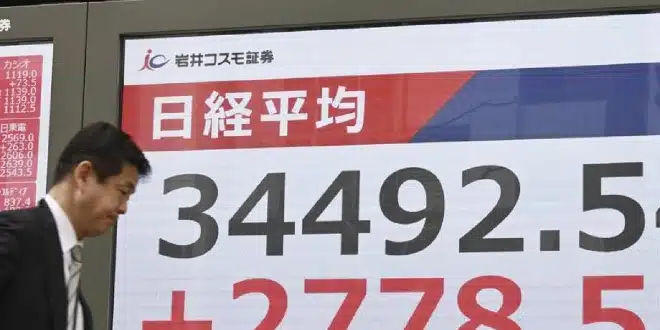

Japan’s Nikkei 225 rose by 1.9%, reaching 34,875.64 in the afternoon session. Australia’s S&P/ASX 200 increased 1.3% to 7,920.50, while South Korea’s Kospi jumped 1.5% to 2,523.17. Hong Kong’s Hang Seng Index saw a gain of 2.2%, hitting 22,039.88, and the Shanghai Composite added a modest 0.2% to close at 3,305.43.

Investor sentiment was further buoyed by U.S. Treasury Secretary Scott Bessent’s remarks on Tuesday, where he expressed optimism for easing tensions in the ongoing trade standoff with China, calling the current tariff dispute unsustainable.

Wall Street Rallies as Uncertainty Recedes

U.S. stock markets rebounded sharply on Tuesday, recovering from steep losses earlier in the week. The S&P 500 soared 2.5%, the Dow Jones Industrial Average climbed over 1,000 points—up 2.7%—and the Nasdaq composite also advanced by 2.7%. These gains more than erased previous declines, driven in part by hopes of improved trade relations and stronger-than-expected earnings from major companies.

Still, many analysts caution that market volatility is likely to continue as investors watch for any potential trade agreements. Without swift progress, concerns persist that the U.S. economy could dip into a recession.

Meanwhile, the International Monetary Fund lowered its global growth projection for the year to 2.8%, down from its earlier 3.3% estimate, highlighting ongoing global economic pressures.

Tesla also made headlines after announcing a sharp decline in quarterly profits, from $1.39 billion to $409 million. The automaker has faced increasing challenges, including protests and calls for consumer boycotts tied to Elon Musk’s role in cost-cutting efforts for the government. Musk stated he would reduce his time in Washington to focus more on Tesla operations.

Despite Tesla’s disappointing results, the overall mood on Wall Street remained positive. Approximately 99% of stocks in the S&P 500 index closed higher. The S&P 500 rose 129.56 points to 5,287.76, the Dow climbed to 39,186.98, and the Nasdaq gained 429.52 points to finish at 16,300.42.

In the bond market, long-term yields eased slightly after a sharp increase the previous day. The 10-year Treasury yield dropped to 4.39% from 4.42%.

Energy prices edged up, with U.S. crude oil increasing 58 cents to $64.25 per barrel. Brent crude also rose 58 cents, trading at $68.02.

In currency markets, the U.S. dollar weakened slightly to 142.11 yen from 142.37, while the euro ticked down to $1.1377.