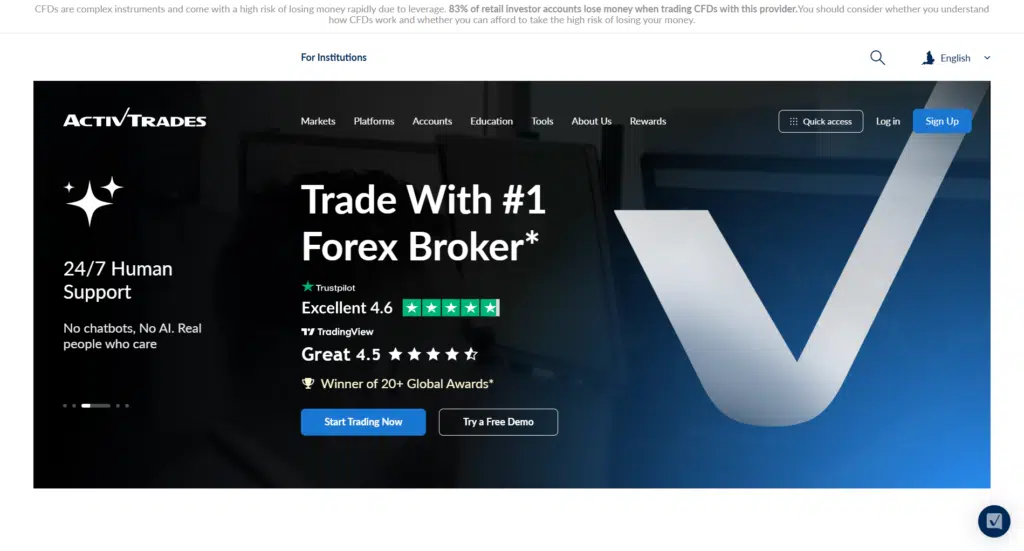

1. Introduction to ActivTrades

ActivTrades, established in 2001 in Switzerland, has grown into a prominent online broker specializing in forex and Contracts for Difference (CFDs). Initially a stock brokerage, it relocated its headquarters to London in 2005 to capitalize on Europe’s financial hub, expanding its offerings to include CFDs on indices, commodities, and cryptocurrencies. Today, ActivTrades serves over 30,000 active traders globally, with additional offices in Milan, Sofia, and Nassau, reflecting its robust international presence. The broker has earned a strong reputation for reliability, transparency, and innovation, bolstered by multiple industry awards, such as “Best Online Trading Services” at the ADVFN International Financial Awards.

ActivTrades operates under stringent regulatory oversight, ensuring client trust and security. Its primary entity, ActivTrades PLC, is regulated by the UK’s Financial Conduct Authority (FCA) under license number 434413, a top-tier regulator known for its rigorous standards. Additional entities include ActivTrades Corp, regulated by the Securities Commission of the Bahamas (SCB, license 199667 B), and ActivTrades Europe S.A., overseen by Luxembourg’s CSSF (license P00000491). These licenses underscore its commitment to compliance across jurisdictions. With over two decades in the industry, ActivTrades holds a competitive position in the forex and CFD market, appealing to both novice and seasoned traders through its advanced platforms and customer-centric services.

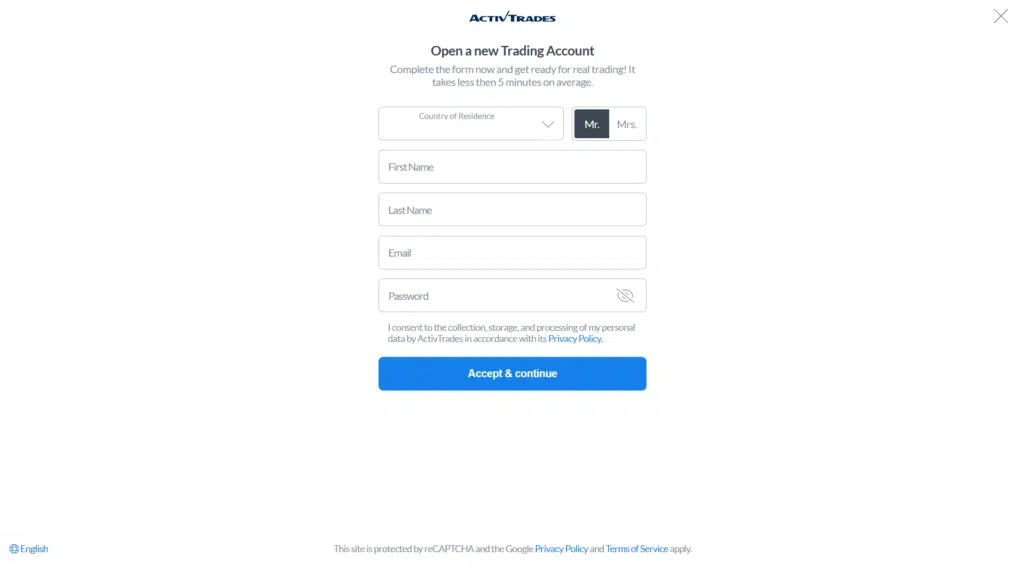

2. How to Register on ActivTrades

Registering with ActivTrades is a straightforward process designed for efficiency and security. Begin by visiting the official website (activtrades.com) and clicking “Open an Account.” You’ll be prompted to select your account type (e.g., individual or professional) and provide basic personal details: full name, email address, phone number, and country of residence. Next, choose your preferred trading platform (e.g., MetaTrader 5 or ActivTrader) and account currency (EUR, USD, GBP, or CHF).

The Know Your Customer (KYC) process follows, requiring identity verification to comply with regulatory standards. You’ll need to upload a government-issued ID (passport, driver’s license, or national ID card) and proof of address (e.g., a utility bill or bank statement dated within the last three months). For professional accounts, additional documentation proving trading experience or financial status may be requested. The online form also includes questions about your trading experience, employment status, and financial background to assess suitability. Once submitted, verification typically takes 24 hours, though it may extend slightly during peak times. Upon approval, you’ll receive login credentials via email, granting access to your trading account.

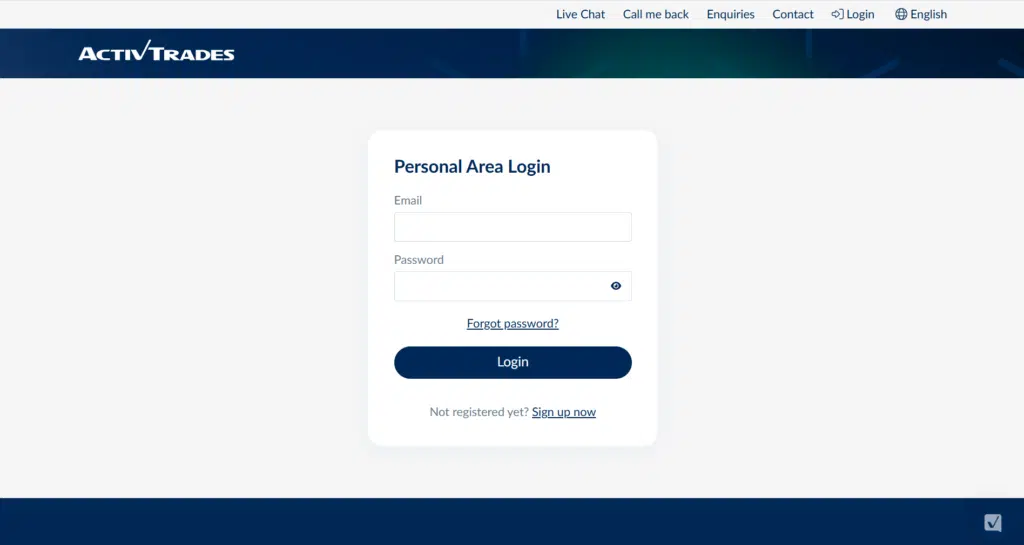

3. ActivTrades Login Process

After registration, logging into ActivTrades is simple. Visit the website or open your chosen trading platform (e.g., MetaTrader 4, MetaTrader 5, or ActivTrader). Enter your registered email address or account number and the password provided during setup. For mobile app users, the process mirrors the desktop experience—download the app from the App Store or Google Play, input your credentials, and log in. First-time users may need to reset their temporary password via an email link.

Common login issues include forgotten passwords, easily resolved by selecting “Forgot Password” and following the reset prompts. Incorrect account numbers or platform mismatches (e.g., using MT4 credentials on MT5) can also occur; double-check your details or contact support. Slow internet connections may delay login—ensure a stable network. ActivTrades employs two-factor authentication (2FA) for added security, requiring a code sent to your phone or email, so keep your registered devices accessible. If locked out after multiple failed attempts, wait 15 minutes or reach out to customer support for assistance.

4. Available Account Types

ActivTrades offers a variety of account types tailored to different trader profiles. The Individual Account suits most retail traders, featuring leverage up to 1:30 (per ESMA regulations), no minimum deposit (except $500 for Brazil and China), and access to all platforms and assets. The Professional Account targets experienced traders, offering leverage up to 1:400, tighter spreads, and zero-fee CFD share trading with 1:1 leverage, but requires proof of significant trading experience or financial qualifications. The Islamic Account, swap-free and Sharia-compliant, caters to Muslim traders, maintaining the same features as the Individual Account without overnight fees.

The Corporate Account supports businesses or institutional clients, with customized solutions and higher deposit thresholds, though specifics vary by agreement. Each account type provides negative balance protection and access to over 1,000 CFDs, but differs in leverage, fees, and eligibility. Professional accounts demand a higher risk tolerance and expertise, while Individual and Islamic accounts prioritize accessibility. Demo accounts are also available across all types for practice, requiring no deposit. Traders should assess their experience and goals when choosing, as perks like higher leverage come with increased risk.

5. Demo Account Availability

ActivTrades provides a robust demo account, ideal for testing strategies risk-free. Available to all users, it mirrors live market conditions with virtual funds, offering access to forex, CFDs, and all supported platforms (MT4, MT5, ActivTrader, and TradingView). To open one, visit the website, select “Demo Account,” and fill out a brief form with your name, email, and preferred platform. No deposit or full registration is required for an initial 72-hour trial, a unique feature in the industry. For extended use, complete the standard registration process, and the demo remains active indefinitely.

The demo account features real-time quotes, customizable leverage, and the full suite of trading tools, allowing users to practice scalping, hedging, or automated trading. It’s particularly valuable for beginners learning platform navigation or seasoned traders testing new strategies. Unlike some brokers, ActivTrades doesn’t limit demo functionality, ensuring an authentic experience. To switch to a live account, simply fund your profile after mastering the demo. This offering enhances ActivTrades’ appeal for skill-building without financial commitment.

6. Trading Platform Overview

ActivTrades offers a versatile suite of trading platforms catering to diverse preferences. The web-based ActivTrader, powered by TradingView charts, boasts an intuitive interface with advanced charting, over 90 indicators, and customizable layouts, ideal for beginners and intermediate traders. However, it lacks some advanced features of desktop alternatives. MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available for desktop download, are industry standards favored by experienced traders. MT4 offers 50+ indicators and robust automation via Expert Advisors (EAs), while MT5 adds deeper market insights, more order types, and an economic calendar—both support Windows and Mac.

The mobile apps for ActivTrader, MT4, and MT5 (iOS and Android) ensure seamless trading on the go, mirroring desktop functionality with real-time quotes, one-tap execution, and charting tools. Customization options include adjustable leverage and watchlists, though the mobile UI can feel cramped on smaller screens. ActivTrades enhances MT platforms with proprietary add-ons like SmartOrder and SmartLines, improving order execution and risk management. While the platforms excel in usability and tools, the ActivTrader desktop version offers fewer customization options compared to MT5, potentially limiting advanced traders.

7. Markets and Assets Available

ActivTrades specializes in CFD trading, offering over 1,000 instruments across multiple markets. Forex includes 50+ currency pairs, from majors like EUR/USD to exotics like USD/CNH, with tight spreads starting at 0.5 pips. Commodities cover 20+ assets, including gold, silver, and oil, providing diversification opportunities. Indices feature 19 global options like the S&P 500 and FTSE 100, appealing to macro-focused traders. Cryptocurrency CFDs (e.g., Bitcoin, Ethereum) are available under the Bahamas entity, with up to 1:20 leverage, though not offered in the UK due to FCA restrictions.

Stocks CFDs encompass around 1,000 companies, including Apple, Tesla, and BP, across US, UK, and European markets, but real stocks, bonds, ETFs, options, and fractional shares are absent, limiting traditional investment options. This CFD-centric focus suits short-term traders but may disappoint long-term investors. Popular assets like EUR/USD, gold, and Bitcoin attract significant volume, supported by fast execution and competitive pricing. The asset range, while robust for CFDs, lacks the breadth of multi-asset brokers like Interactive Brokers.

8. Fees and Commissions

ActivTrades’ fee structure is competitive, with trading costs primarily driven by spreads rather than commissions on most accounts. Forex spreads start at 0.5 pips for majors like EUR/USD, slightly below the industry average of 0.7-1.0 pips, while exotic pairs may widen during volatility. CFDs on indices (e.g., S&P 500) average 0.5-1 point, and commodities like gold hover around 0.25 pips—cost-effective for active traders. Overnight (swap) fees apply to positions held past 5 PM EST, varying by asset and leverage, with rates disclosed transparently on the website.

Non-trading fees include a $10 monthly inactivity fee after 12 months of dormancy, aligning with industry norms. Deposits are free, but withdrawals via bank transfer incur a $9 fee for amounts under $100; e-wallets and cards are typically fee-free. Currency conversion fees (around 0.5%) apply if your account currency differs from the transaction, a standard charge but notable for multi-currency traders. Compared to peers like FxPro or Admirals, ActivTrades offers lower spreads and no commission on standard accounts, though its inactivity fee and conversion costs could add up for less active users.

9. Deposit and Withdrawal Methods

ActivTrades supports diverse deposit options: bank transfers, debit/credit cards (Visa, Mastercard), and e-wallets like Neteller, Skrill, and PayPal (availability varies by region). There’s no minimum deposit for most regions, though Brazil and China require $500. Deposits are processed instantly for cards and e-wallets, while bank transfers take 1-3 business days. No fees are charged, enhancing cost efficiency.

Withdrawals follow a similar process—submit a request via the client portal, with processing completed same-day if submitted before 12:30 PM GMT, otherwise next day. Bank transfers take 1-3 days, e-wallets and cards are faster (often within hours), but a $9 fee applies to bank withdrawals under $100. Limits are flexible, with no strict caps, though large transactions may require additional verification. Cryptocurrency payments are unsupported due to regulatory constraints, a minor drawback compared to some competitors. Overall, the process is efficient and transparent, though withdrawal fees for small amounts could deter casual traders.

10. Bonuses and Promotions

As of March 2025, ActivTrades offers limited bonuses due to strict regulatory oversight, particularly under FCA rules banning incentives for retail clients. However, its Bahamas entity occasionally provides promotions, such as a welcome bonus (e.g., 10% deposit match up to $500) for new traders depositing $100+, subject to trading volume requirements (e.g., 10 lots within 90 days). Terms are clear: bonuses are non-withdrawable, and failure to meet conditions voids the offer. Always check the website for current offers, as they vary by region.

The Affiliate Program stands out, offering up to $1,350 CPA per referred client who deposits $100 and generates $40 in spreads within 180 days, with no commission cap and robust marketing tools via CELLXPERT. Loyalty schemes are absent, but high-volume traders may negotiate rebates informally. While promotional offerings are modest compared to offshore brokers, the focus on regulation ensures fairness, appealing to cautious traders over bonus hunters.

11. Trading Tools and Features

ActivTrades equips traders with a solid toolkit. Charting tools, powered by TradingView on ActivTrader and enhanced on MT4/MT5, include over 90 technical indicators (e.g., RSI, MACD) and 14+ chart types for in-depth analysis. The economic calendar tracks global events, aiding fundamental traders, while the Market Sentiment indicator gauges crowd behavior. Proprietary tools like SmartOrder (fast execution) and SmartLines (automated trade triggers) enhance MT platforms, though historical data access is limited.

Supported order types include market, limit, stop-loss, and trailing stop, with ActivTrader’s Progressive Trailing Stop dynamically adjusting to price targets—a standout feature. Hedging and scalping are permitted, and EAs on MT4/MT5 support automation. While not as extensive as some rivals (e.g., Thinkorswim’s 400+ indicators), the tools strike a balance between accessibility and sophistication, suiting most trading styles effectively.

12. Leverage and Margin Requirements

ActivTrades offers leverage up to 1:30 for retail clients under FCA/ESMA rules, with professional accounts reaching 1:400 upon qualification (e.g., significant trading history or $500,000 portfolio). Forex majors typically allow 1:30, while cryptocurrencies cap at 1:20 under the Bahamas entity. Margin requirements vary—3.33% for 1:30 leverage, dropping to 0.25% at 1:400—calculated as a percentage of the position’s notional value. Margin calls trigger at 100% (full margin used), with stop-out at 50%, closing positions to prevent negative balances.

High leverage amplifies gains but magnifies losses; a $1,000 position at 1:400 could wipe out with a 0.25% adverse move. Negative balance protection mitigates this risk, but traders must exercise caution. Compared to offshore brokers offering 1:1000+, ActivTrades’ caps reflect regulatory prudence, balancing opportunity and safety.

13. Educational Resources

ActivTrades provides a comprehensive educational suite for all skill levels. Beginner guides cover forex basics, CFD mechanics, and risk management, written in clear, actionable language. Live webinars, hosted weekly by experts, delve into technical analysis, market trends, and platform use, with recordings available on-demand. Video tutorials span platform navigation, order types, and strategy development, averaging 5-10 minutes for digestibility.

Daily market analysis and commentary on forex, indices, and commodities offer actionable insights, though depth varies—some reports lack the granularity of competitors like IG. The quality is high, with practical examples and multilingual support, but the absence of structured courses or certification limits advanced learning. For beginners and intermediates, these resources build confidence and competence effectively.

14. Social and Copy Trading

ActivTrades does not offer social or copy trading as of March 2025, focusing instead on direct trading platforms like MT4, MT5, and ActivTrader. Unlike competitors such as eToro or Vantage, which integrate social features to mimic expert trades or share strategies, ActivTrades prioritizes individual control and proprietary tools. This omission reflects its regulatory stance and target audience—self-directed traders over passive investors.

While MT4/MT5 support signal services via third-party providers (e.g., MQL5 community), this isn’t broker-integrated copy trading. Traders seeking social interaction or automated portfolio mirroring may find this a drawback, though the broker’s robust toolkit compensates for active, hands-on users.

15. Customer Support

ActivTrades offers 24/5 customer support via live chat, email ([email protected]), and phone (+44 207 6500 567), aligning with forex market hours (Monday 00:00 to Friday 23:59 GMT). Multilingual assistance in 14 languages, including English, Spanish, and Mandarin, ensures global accessibility. Live chat responses average under 2 minutes, with knowledgeable agents addressing account, platform, and withdrawal queries efficiently. Email replies typically arrive within 24 hours, while phone support offers immediate resolution for urgent issues.

User feedback praises responsiveness and professionalism, though weekend unavailability (common in the industry) frustrates some. Compared to 24/7 brokers like Pepperstone, ActivTrades’ support is robust but not round-the-clock. For most traders, the quality and speed suffice, especially during peak trading times.

16. Safety, Security, and Regulation

ActivTrades is regulated by top-tier authorities: FCA (434413) in the UK, SCB (199667 B) in the Bahamas, and CSSF (P00000491) in Luxembourg, with additional oversight from Portugal’s CMVM and Brazil’s CVM. Client funds are held in segregated accounts at Tier-1 banks, separate from company assets, ensuring protection in case of insolvency. The FCA’s Financial Services Compensation Scheme (FSCS) covers up to £85,000 for UK clients, while ActivTrades enhances this with private insurance from Lloyd’s of London up to $1 million per client—a rare perk.

Security features include 2FA via SMS or email, SSL encryption for data transmission, and regular audits. Negative balance protection prevents debt, aligning with ESMA rules. This multi-layered approach makes ActivTrades a standout for safety-conscious traders, surpassing many peers in fund protection.

17. Pros and Cons of ActivTrades

Pros: ActivTrades excels with tight spreads (from 0.5 pips), no deposit fees, and a wide range of CFDs (1,000+ instruments). Its top-tier regulation (FCA, SCB) and $1 million insurance bolster trust, while MT4/MT5 and ActivTrader platforms cater to diverse needs. Fast execution, negative balance protection, and a feature-rich demo account enhance its appeal.

Cons: The broker’s CFD-only focus excludes real stocks, bonds, and ETFs, limiting long-term investors. Customer support lacks weekend availability, and an inactivity fee ($10/month) may irk dormant users. Currency conversion fees and a narrow base currency range (EUR, USD, GBP, CHF) add minor costs. The absence of social/copy trading disappoints passive traders.

18. Comparison with Other Brokers

Compared to FxPro, ActivTrades offers lower forex spreads (0.5 vs. 0.6 pips) and no commission on standard accounts, though FxPro includes cTrader and more base currencies. Admirals provides a broader asset range (stocks, ETFs) and lower inactivity fees ($6 vs. $10), but its spreads are wider (0.7 pips). Interactive Brokers dwarfs ActivTrades in scope (150+ markets, real stocks), yet its fees are higher (e.g., $0.005/share commissions) and platforms less beginner-friendly.

ActivTrades shines in regulatory strength and platform simplicity, ideal for forex/CFD traders, but lags in asset diversity and passive trading options compared to these multi-asset giants.

19. User Reviews and Ratings

On Trustpilot (March 2025), ActivTrades holds a 4.3/5 rating from 1,373 reviews, with users praising fast execution, competitive spreads, and reliable support. Forex Peace Army scores it 3.8/5, commending platform stability and fund safety. Google Reviews echo this at 4.2/5, highlighting educational tools. Common praise centers on transparency, low costs, and regulatory trust.

Frequent complaints include slow withdrawal times (1-3 days vs. promised same-day), mediocre weekend support absence, and limited asset variety. Some note currency conversion fees as a hidden cost. Overall, feedback is positive, with gripes typical of regulated brokers balancing compliance and service.

20. Platform Availability by Country

ActivTrades operates in over 140 countries, including the UK, EU nations (e.g., Germany, Italy), Australia, South America, and Southeast Asia. Offices in London, Milan, Sofia, and Nassau support its global reach. It caters to diverse regions with multilingual platforms and support. However, it’s unavailable in the US, Canada, Syria, Afghanistan, Iraq, Iran, and North Korea due to regulatory restrictions or sanctions. Brazil and China require a $500 minimum deposit, reflecting local compliance. Traders should verify availability via the website, as regional entities (e.g., Bahamas vs. UK) affect leverage and asset access.

21. Taxation and Declaring Profits

Taxation on ActivTrades profits depends on your country’s laws—e.g., UK traders report CFD gains as capital gains (10-20% rate), while US traders (if eligible via offshore entities) face income tax (up to 37%). ActivTrades doesn’t withhold taxes, leaving declaration to the trader. It provides no formal tax statements, but transaction histories and profit/loss reports are downloadable from the client portal for tax filings. Consult a local tax professional, as CFDs’ non-ownership status often complicates classification (e.g., speculative income vs. investment gains). Record-keeping is key, and ActivTrades’ tools support this, though direct tax assistance is absent.

22. Common Issues and How to Solve Them

Login Problems: Forgotten passwords or 2FA issues arise—reset via “Forgot Password” or contact support with your registered email. Withdrawal Delays: Processing can lag beyond same-day promises—ensure requests are before 12:30 PM GMT and verify bank details; escalate to support if over 3 days. Verification Troubles: Rejected KYC documents (e.g., blurry IDs) stall setup—resubmit clear, valid copies matching your application. Platform Bugs: Lagging charts or execution errors occur—clear cache, update software, or switch devices; report persistent issues to tech support. Proactive communication with ActivTrades resolves most hiccups efficiently.

23. Final Verdict

ActivTrades blends regulatory rigor, competitive pricing, and versatile platforms, making it a strong choice for forex and CFD traders. Strengths include tight spreads, top-tier regulation (FCA, SCB), and a $1 million insurance safety net, alongside robust MT4/MT5 tools and a solid demo account. Weaknesses—limited assets (no real stocks/ETFs), no social trading, and weekend support gaps—curb its appeal for passive or multi-asset investors. It’s best for active traders valuing safety and cost-efficiency, from beginners mastering forex to pros leveraging high-volume CFDs. Long-term investors or copy-trading enthusiasts may prefer broader platforms like eToro or Interactive Brokers.

24. FAQs

- Is ActivTrades regulated? Yes, by the FCA (434413), SCB (199667 B), CSSF (P00000491), and others.

- What’s the minimum deposit? $0 globally, $500 in Brazil/China.

- Does ActivTrades offer a demo account? Yes, with a 72-hour trial and unlimited access post-registration.

- What platforms are available? MT4, MT5, ActivTrader, and TradingView integration.

- Are there withdrawal fees? $9 for bank transfers under $100; otherwise, free.

- What’s the maximum leverage? 1:30 retail, 1:400 professional.

- Does ActivTrades support crypto trading? Yes, CFDs under the Bahamas entity (e.g., Bitcoin).

- Is copy trading available? No, ActivTrades focuses on direct trading.

- How long do withdrawals take? Same-day processing, 1-3 days delivery.

- Are client funds safe? Yes, segregated accounts and $1 million insurance apply.