1. Introduction to Fidelity

Fidelity Investments, founded in 1946 by Edward C. Johnson II, is one of the oldest and most established financial services companies in the world. Headquartered in Boston, Massachusetts, Fidelity has grown into a global leader in brokerage services, asset management, and retirement planning. With over 50 million individual customers and $12.6 trillion in assets under administration as of early 2025, Fidelity ranks among the top-tier brokerage firms alongside competitors like Vanguard and Charles Schwab.

Fidelity is regulated by top-tier authorities in the United States, including the Securities and Exchange Commission (SEC) (CRD#: 7784/SEC#: 8-23292) and the Financial Industry Regulatory Authority (FINRA). Its brokerage arm, Fidelity Brokerage Services LLC, is a member of the New York Stock Exchange (NYSE) and the Securities Investor Protection Corporation (SIPC). Internationally, Fidelity operates through subsidiaries like Fidelity International (regulated by the UK’s Financial Conduct Authority), expanding its global footprint across North America, Europe, and Asia.

Fidelity enjoys a stellar reputation for reliability, low-cost investing, and robust customer service. It consistently ranks highly in industry awards, such as Bankrate’s 2025 Awards for Best Overall Broker and Best Broker for Beginners, reflecting its strong market position and client trust.

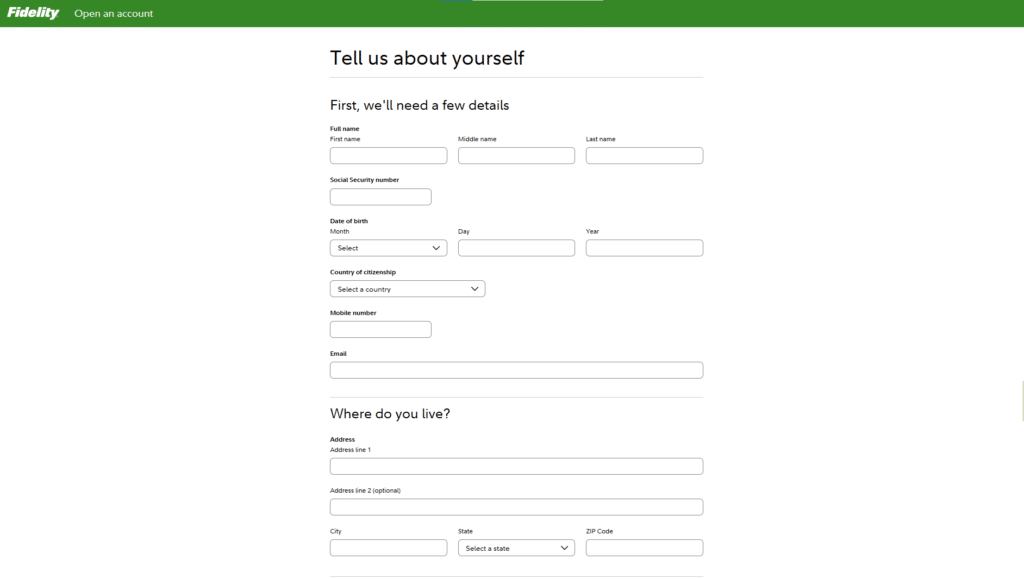

2. How to Register on Fidelity

Opening an account with Fidelity is a straightforward process designed for accessibility:

- Visit the Website: Go to Fidelity.com and click “Open an Account” at the top of the page.

- Choose an Account Type: Select from options like individual brokerage, IRA, or Fidelity Go robo-advisor accounts.

- Provide Personal Information: Enter your full name, email address, Social Security Number (SSN), date of birth, phone number, and residential address.

- Submit Application: Agree to the terms and conditions and submit your application.

- Identity Verification: Complete the Know Your Customer (KYC) process by uploading a government-issued ID (e.g., passport or driver’s license) and proof of address (e.g., utility bill or bank statement).

- Fund Your Account: Once approved (typically within 1-3 business days), deposit funds via bank transfer, check, or electronic wallets.

KYC Requirements: Fidelity adheres to U.S. AML/KYC regulations, requiring a valid ID and address proof. A soft credit check may also be conducted to verify identity, but it doesn’t impact your credit score.

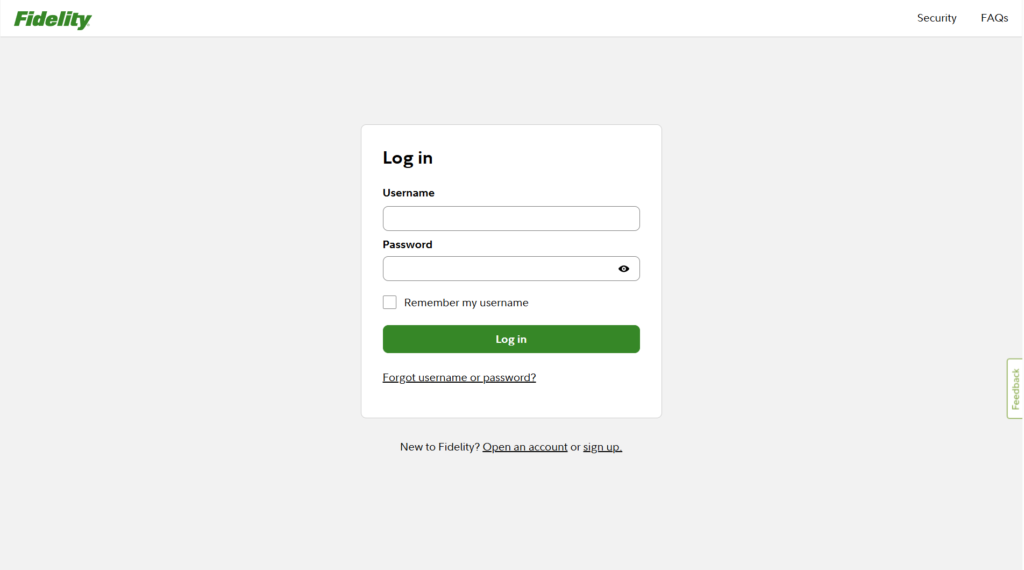

3. Fidelity Login Process

After registering, logging into your Fidelity account is simple:

- Access the Platform: Visit Fidelity.com or open the Fidelity Mobile app.

- Enter Credentials: Input your username and password.

- Two-Factor Authentication (2FA): If enabled, enter a code sent via text, email, or an authenticator app.

- Login Confirmation: Click “Log In” to access your dashboard.

Common Login Issues and Solutions:

- Forgotten Password: Use the “Forgot Password” link to reset via email or security questions.

- Account Lockout: After multiple failed attempts, contact customer support at 800-343-3548 to unlock.

- 2FA Issues: Ensure your phone number or email is up-to-date in your account settings; otherwise, use backup codes or contact support.

4. Available Account Types

Fidelity offers a diverse range of account types tailored to various investor needs:

- Individual Brokerage Account: For self-directed trading; no minimum deposit.

- Joint Brokerage Account: For couples or partners; no minimum.

- Retirement Accounts:

- Traditional IRA, Roth IRA, Rollover IRA: No account fees or minimums to open.

- Fidelity Go (Robo-Advisor): $0 minimum to open, $10 to start investing.

- Custodial Accounts: UGMA/UTMA for minors; no minimum.

- 529 College Savings Plan: Tax-advantaged education savings; no minimum.

- Health Savings Account (HSA): For medical expenses; no minimum or fees.

- Fidelity Cash Management Account: A hybrid checking/investment account; no minimum.

- Managed Accounts:

- Fidelity Personalized Planning & Advice: $25,000 minimum.

- Fidelity Wealth Services: $250,000 minimum.

- Private Wealth Management: $2 million minimum, plus $10 million in investable assets.

Key Differences: Basic accounts have no minimums and are ideal for beginners, while managed accounts cater to high-net-worth individuals with tailored advice and higher minimums.

5. Demo Account Availability

Fidelity does not offer a traditional demo account with virtual funds for practice trading. This is a notable omission compared to some competitors like Interactive Brokers. However, Fidelity provides robust educational tools and a paper trading feature within Active Trader Pro for qualified users (those with 36+ trades in a 12-month period or by request). To access this:

- Contact Fidelity to enable Active Trader Pro.

- Use the platform’s simulation mode to test strategies with real-time data.

The lack of a widely accessible demo account may disappoint beginners seeking risk-free practice.

6. Trading Platform Overview

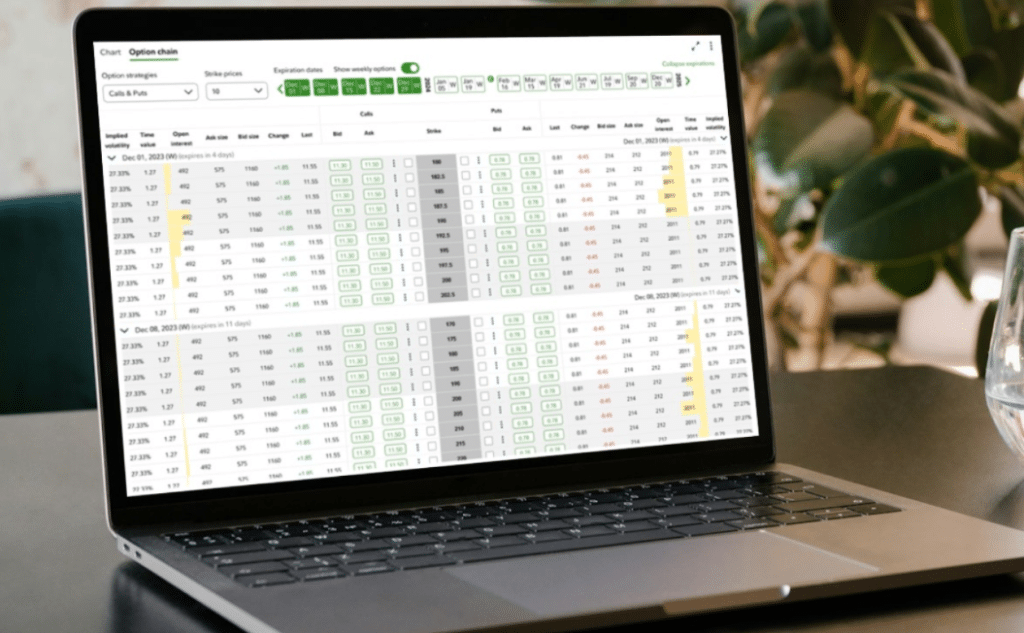

Fidelity offers three main trading platforms, each with distinct strengths:

- Web Platform: Intuitive and browser-based, ideal for casual investors. Features include real-time quotes, basic charting, and portfolio management. Customization is limited but sufficient for most users.

- Active Trader Pro (Desktop): A downloadable platform for active traders, offering advanced charting, Level II quotes, heat mapping, and multi-trade tickets (up to 50 orders). The interface is dated compared to rivals like thinkorswim but highly functional.

- Mobile App: Available on iOS and Android, it supports trading, account management, and basic research. Charting is less robust than the desktop version, making it better for on-the-go monitoring than in-depth analysis.

Evaluation: The platforms are user-friendly and cater to diverse skill levels, though Active Trader Pro’s older design and the mobile app’s limited research tools lag behind competitors.

7. Markets and Assets Available

Fidelity provides access to a wide range of markets and assets:

- Stocks: U.S. and international stocks across 25 global markets (e.g., NYSE, NASDAQ, London Stock Exchange).

- Forex: Not available; Fidelity does not support currency trading.

- Cryptocurrencies: Limited to Fidelity Crypto, offering Bitcoin and Ethereum trading in select states; less extensive than platforms like Robinhood.

- Commodities: No direct commodity trading (e.g., gold futures), but precious metals ETFs are available.

- ETFs: Thousands of ETFs, including 3,300+ with no transaction fees.

- Options: U.S. options trading with advanced strategies on Active Trader Pro.

- Bonds: Over 100,000 individual bonds (corporate, municipal, Treasuries) and bond funds.

- Fractional Shares: Available for stocks and ETFs, starting at $1.

Popular Assets: Apple (AAPL), Tesla (TSLA), SPDR S&P 500 ETF (SPY), Fidelity ZERO Total Market Index Fund (FZROX).

8. Fees and Commissions

Fidelity is known for its competitive fee structure:

- Trading Fees:

- Stocks and ETFs: $0 commission for online U.S. trades.

- Options: $0.65 per contract; buy-to-close orders ≤$0.65 are free.

- Mutual Funds: $0 for Fidelity funds; $49.95 to buy non-Fidelity funds (free to sell).

- Bonds: $1 per bond ($250 max); $0 for U.S. Treasuries.

- Non-Trading Fees:

- Withdrawal Fees: $0 for ACH/USD wire; 3% for non-USD withdrawals.

- Inactivity Fees: None.

- Currency Conversion: Varies by trade size; typically 1-3% for international stocks.

- Comparison: Fidelity’s $0 stock/ETF commissions match industry leaders like Schwab and Robinhood, while its options fees are average. Mutual fund fees are higher than some competitors offering broader no-fee options.

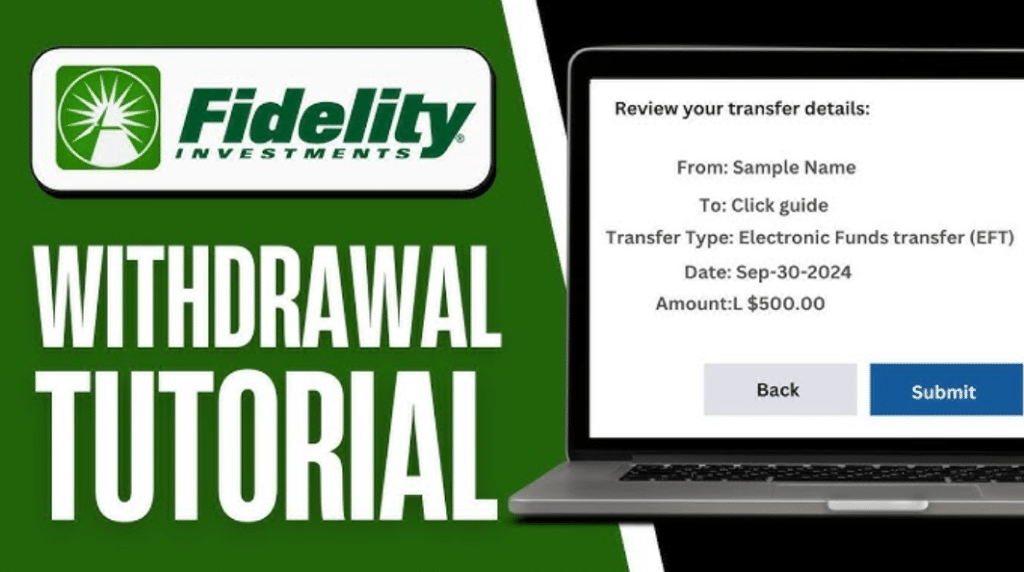

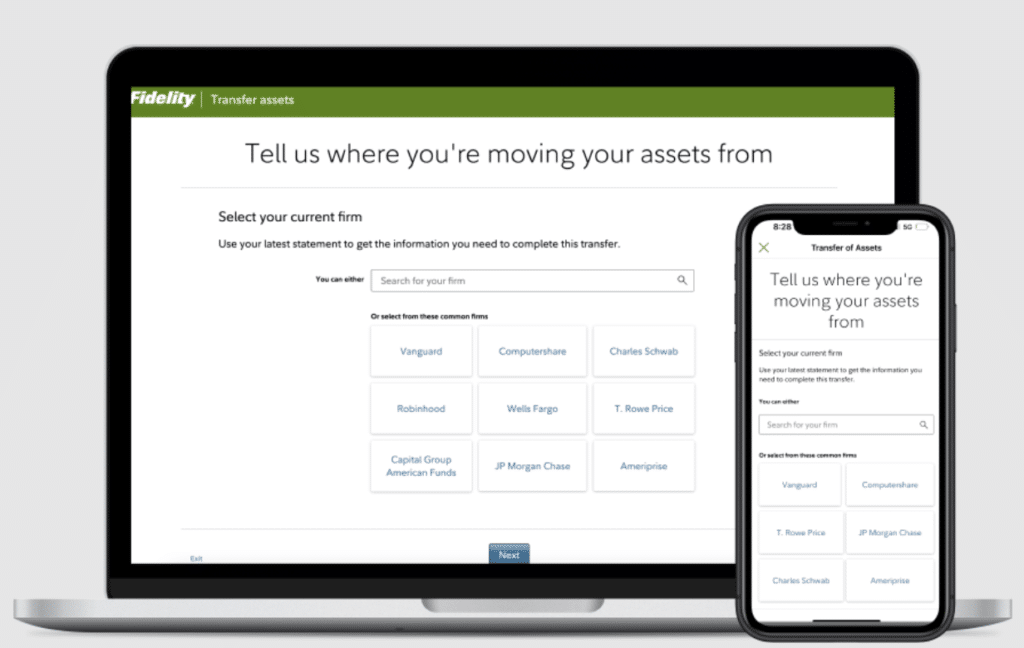

9. Deposit and Withdrawal Methods

- Deposit Options: Bank wire, ACH transfer, check, PayPal, Venmo, Apple Pay, direct payroll deposit.

- Withdrawal Process: Log in, go to “Transfer,” select your Fidelity account and withdrawal method (e.g., ACH), and submit. ACH withdrawals take 1-2 business days; wires are same-day.

- Fees: No deposit/withdrawal fees for USD via ACH or wire; non-USD withdrawals incur a 3% fee.

- Limits: No minimum deposit; withdrawal limits depend on account balance and method (e.g., $100,000 daily ACH limit).

10. Bonuses and Promotions

As of March 2025, Fidelity does not offer cash bonuses or promotional incentives for new clients, unlike some competitors (e.g., Robinhood’s referral bonuses). Historically, Fidelity has offered limited-time perks, such as fee waivers for Fidelity Go (e.g., 0% through July 2024), but no active promotions are currently listed. There are no referral or loyalty programs, focusing instead on low-cost investing as its value proposition.

11. Trading Tools and Features

Fidelity provides robust tools, especially on Active Trader Pro:

- Charting Tools: Interactive charts with 45+ technical indicators (e.g., RSI, MACD).

- Economic Calendar: Tracks market events and earnings.

- Screeners: Thematic stock and fund screening with customizable filters.

- Order Types: Market, limit, stop-loss, trailing stop, conditional orders (web/desktop only).

- Real-Time Analytics: Level II quotes and trade journals for advanced users.

These tools cater to both beginners and pros, though they lack the depth of platforms like Interactive Brokers.

12. Leverage and Margin Requirements

- Maximum Leverage: Fidelity does not offer leverage for retail traders beyond margin accounts. Margin trading requires a $2,000 minimum balance and approval.

- Margin Rates: 12.575% for balances under $25,000; 8.25% for $1 million+ (as of December 2024). These rates are higher than Interactive Brokers (2.6%) or Robinhood (6%).

- Margin Calls/Stop-Out: Occur when equity falls below maintenance requirements (typically 25-30%); no specific stop-out level is publicly detailed.

- Risk Warning: High margin rates increase borrowing costs, amplifying losses in volatile markets. Use cautiously.

13. Educational Resources

Fidelity excels in education:

- Materials: Beginner guides, webinars, video tutorials, and a Learning Center with topics like retirement planning and options trading.

- Quality: Content is clear, comprehensive, and regularly updated, earning praise for accessibility.

- Market Reports: Daily insights, third-party research (e.g., Zacks, Reuters), and economic commentary are available.

These resources are ideal for novices and intermediate investors seeking to build knowledge.

14. Social and Copy Trading

Fidelity does not offer social or copy trading features, focusing instead on self-directed and managed investing. This contrasts with platforms like eToro, which emphasize community-driven trading. Investors seeking social features will need to look elsewhere.

15. Customer Support

- Channels: 24/7 phone (800-343-3548), live chat, secure email (logged-in users), and 200+ in-person Investor Centers.

- Hours: Support is available round-the-clock, a standout feature.

- Quality: Response times are quick (phone: 1-2 minutes; chat: 5-10 minutes), with knowledgeable staff earning high marks in reviews.

16. Safety, Security, and Regulation

- Regulators: SEC, FINRA, SIPC (U.S.); FCA (UK via Fidelity International).

- Fund Protection: Client funds are segregated; SIPC covers up to $500,000 ($250,000 cash) per account, with excess coverage up to $1.9 million. Cash accounts offer FDIC insurance up to $1.25 million via multiple banks.

- Security Features: 2FA, biometric login (mobile), encryption, 24/7 monitoring, and anti-malware systems.

Fidelity’s robust safeguards make it one of the safest brokers available.

17. Pros and Cons of Fidelity

Pros:

- $0 commissions on stocks/ETFs and no account fees.

- Extensive range of account types and investment options.

- Industry-leading research and educational resources.

- Top-tier regulation and fund protection.

- 24/7 customer support.

Cons:

- No traditional demo account.

- Limited cryptocurrency offerings.

- High margin rates compared to competitors.

- Active Trader Pro interface feels outdated.

18. Comparison with Other Brokers

- Fidelity vs. Charles Schwab: Both offer $0 commissions and strong research, but Schwab’s thinkorswim platform outshines Active Trader Pro for active traders.

- Fidelity vs. Interactive Brokers: IBKR offers lower margin rates (2.6%) and forex/commodities trading, but Fidelity is more beginner-friendly with no minimums.

- Fidelity vs. Robinhood: Robinhood provides free crypto trading and a modern app, but lacks Fidelity’s depth in assets and support.

19. User Reviews and Ratings

- Trustpilot (4.2/5): Praised for low fees and customer service; complaints focus on slow withdrawals and platform complexity.

- Google Reviews (4.5/5): Highlights reliability and research tools; some note limited crypto options.

- Forums (e.g., Reddit): Users appreciate no payment for order flow but criticize high margin rates.

20. Platform Availability by Country

- Available: Primarily U.S. residents; Fidelity International serves the UK, Canada, and select Asian/European markets.

- Restricted: Limited or unavailable in countries with strict financial regulations (e.g., India, China) unless through local partnerships.

21. Taxation and Declaring Profits

U.S. traders must report profits/losses to the IRS via Form 1099, which Fidelity provides annually for tax reporting (e.g., 1099-B for sales, 1099-DIV for dividends). Tax rules vary by country for international clients; consult a tax professional. Fidelity does not withhold taxes but offers tools to track taxable events.

22. Common Issues and How to Solve Them

- Login Problems: Reset password or verify 2FA settings.

- Withdrawal Delays: Ensure account details match; contact support if >2 days.

- Verification Troubles: Upload clear, valid documents; call support for assistance.

- Platform Bugs: Clear cache or update app/desktop software.

23. Final Verdict

Fidelity Investments is a powerhouse brokerage with a strong mix of low-cost trading, diverse account options, and exceptional support. Its lack of a demo account, limited crypto offerings, and high margin rates are drawbacks, but its strengths in research, safety, and accessibility make it a top choice for beginners and long-term investors. Active traders may prefer platforms with more advanced tools or lower margin costs.

24. FAQs

- What is the minimum deposit? $0 for most accounts; $10 to start investing with Fidelity Go.

- How long do withdrawals take? 1-2 days via ACH; same-day for wires.

- Is Fidelity safe? Yes, regulated by SEC/FINRA with SIPC/FDIC protection.

- What are the available trading platforms? Web, Active Trader Pro, and mobile app.

- Is Fidelity regulated? Yes, by SEC, FINRA, and SIPC (U.S.), plus FCA (UK).

- Are there any inactivity fees? No, Fidelity charges no inactivity fees.

- Does Fidelity support cryptocurrency trading? Yes, limited to Bitcoin and Ethereum in select regions.

- What are the available contact methods for customer support? Phone, live chat, email, and in-person at Investor Centers.