1. Introduction to eToro

eToro, established in 2007 in Tel Aviv by Yoni Assia, Ronen Assia, and David Ring, has evolved into a prominent social trading and multi-asset investment platform. Initially launched as RetailFX, the company rebranded to eToro, reflecting its expansion into various financial services. Over the years, eToro has introduced innovative features like the OpenBook social investment platform in 2010, which included the CopyTrader feature, allowing users to replicate the trading strategies of top investors.

Regulation and Licenses

eToro operates under the oversight of several reputable regulatory authorities, ensuring compliance and security for its users:

- Cyprus Securities and Exchange Commission (CySEC): eToro (Europe) Ltd is authorized under license number 109/10.

- Financial Conduct Authority (FCA) in the UK: eToro (UK) Ltd operates under reference number 583263.

- Australian Securities and Investments Commission (ASIC): eToro AUS Capital Pty Ltd holds the Australian Financial Services License 491139.

- Financial Crimes Enforcement Network (FinCEN) in the USA: eToro USA LLC is registered as a Money Services Business (MSB) with FinCEN.

These regulatory affiliations underscore eToro’s commitment to maintaining industry standards and protecting its clients’ interests.

Reputation, Global Presence, and Market Position

As of September 2024, eToro boasts a user base of 38 million registered users across over 75 countries, with more than 3.2 million funded accounts. The platform’s unique blend of social trading features and access to a wide array of financial instruments has solidified its position as a leader in the fintech industry. eToro’s global presence is further enhanced by its offices in key financial hubs, including the UK, USA, Australia, Germany, and the UAE. The company’s valuation reached $3.5 billion in 2023, reflecting its significant impact on the global trading landscape.

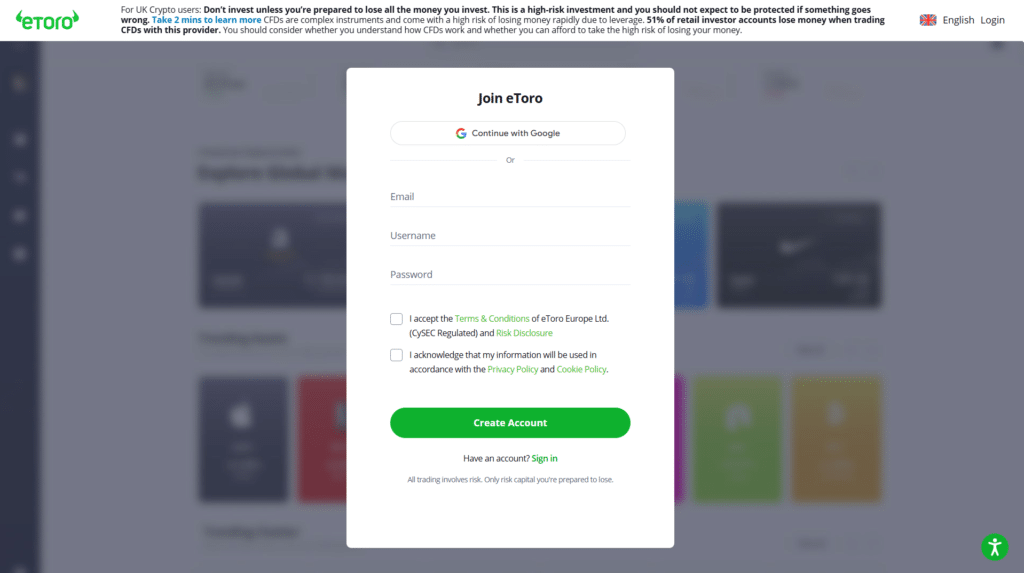

2. How to Register on eToro

Step-by-Step Registration Process

- Visit the eToro Website: Navigate to eToro’s official website and click on the “Sign Up” button.

- Create an Account: You can register using your email address or opt for quicker registration through your Google or Facebook account.

- Complete Personal Details: Provide necessary personal information, including your full name, date of birth, and residential address.

- Set Account Preferences: Choose your username and set a secure password for your account.

- Agree to Terms: Read and accept eToro’s terms and conditions and privacy policy.

Identity Verification (KYC) Requirements

To comply with regulatory standards and ensure the security of its platform, eToro requires users to complete a Know Your Customer (KYC) process:

- Proof of Identity: Submit a clear, color copy of a valid government-issued ID, such as a passport or driver’s license.

- Proof of Address: Provide a recent utility bill, bank statement, or any official document that displays your full name and residential address, dated within the last six months.

Completing the KYC process is crucial for unlocking all platform features, including depositing funds, trading, and withdrawing profits. eToro aims to verify submitted documents promptly, typically within a few business days, ensuring a seamless onboarding experience for new users.

By adhering to these steps and requirements, users can securely and efficiently begin their trading journey on eToro.

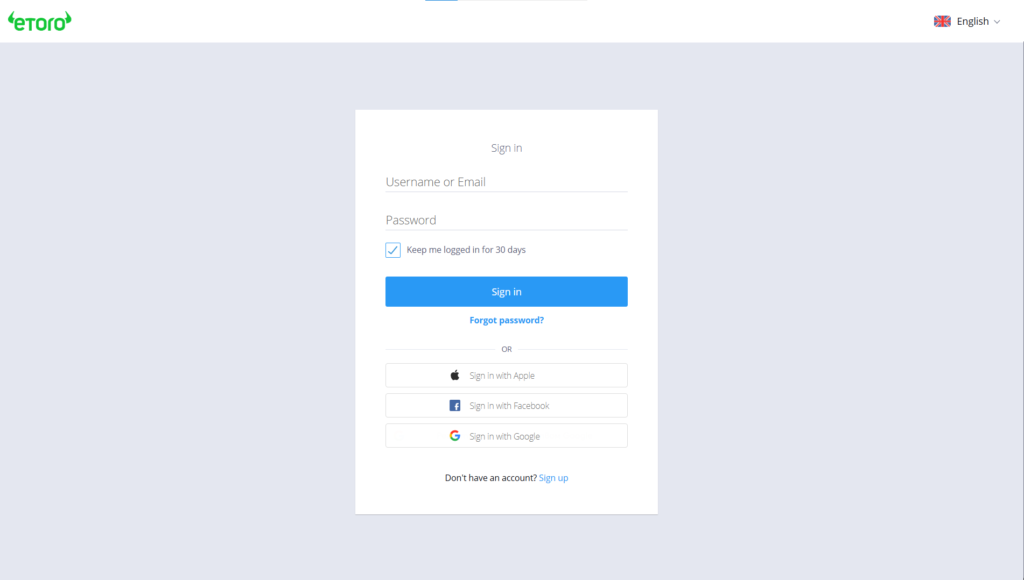

3. eToro Login Process

How Users Log into Their Accounts After Registering

Accessing your eToro account is straightforward and can be done through various methods:

- Standard Login: Navigate to the eToro login page and enter your registered username or email address along with your password.

- Alternative Login Methods: eToro offers the convenience of logging in via linked external accounts:

- Apple ID: Select “Sign in with Apple” and authenticate using your Apple credentials.

- Facebook: Choose “Sign in with Facebook” and provide your Facebook login details.

- Google: Opt for “Sign in with Google” and use your Google account credentials.

These alternative methods streamline the login process, allowing users to access their accounts seamlessly.

Common Login Issues and Solutions

Users may occasionally encounter login challenges. Here are some common issues and recommended solutions:

- Incorrect Username or Password: Ensure that both your username/email and password are entered correctly, paying attention to case sensitivity. If you’ve forgotten your password, use the “Forgot Password” option to reset it.

- Account Temporarily Locked: Multiple unsuccessful login attempts can lead to a temporary account lock for security reasons. If this occurs, wait for a short period before trying again or contact eToro customer support for assistance.

- Browser Compatibility Issues: Using outdated browsers can cause login problems. Ensure your browser is up-to-date or try accessing your account using a different browser.

- Two-Factor Authentication (2FA) Challenges: If you’ve enabled 2FA and are not receiving the verification code, ensure your registered mobile number is correct and has network coverage. Alternatively, use the “Phone Call Instead” option to receive the code via a call.

- Technical Glitches: Occasionally, technical issues may arise. Basic troubleshooting steps include refreshing the page, clearing browser cache and cookies, or restarting your device. If problems persist, consult eToro’s technical support guidelines or contact their customer service.

4. Available Account Types

eToro offers a variety of account types to cater to different trading needs:

- Personal (Retail) Account: This is the default account type suitable for individual traders. It provides access to all available assets, including stocks, cryptocurrencies, commodities, and more. Users can also utilize features like CopyTrader™ and Smart Portfolios.

- Minimum Deposit: Varies by region; typically ranges from $10 to $10,000.

- Leverage: Up to 1:30 for major currency pairs, with variations depending on the asset class and regional regulations.

- Perks: Access to eToro’s social trading features, risk management tools, and a virtual portfolio for practice.

- Professional Account: Designed for experienced traders who meet specific eligibility criteria, such as sufficient trading activity, financial portfolio size, and relevant experience. This account offers higher leverage options and reduced regulatory protections.

- Minimum Deposit: No specific minimum, but eligibility criteria must be met.

- Leverage: Higher leverage ratios compared to retail accounts, depending on the asset class.

- Perks: Access to higher leverage and advanced trading tools.

- Corporate Account: Intended for businesses and legal entities wishing to trade using company funds. This account requires specific documentation and a higher initial deposit.

- Minimum Deposit: Varies by region; typically starts from $10,000.

- Perks: Tailored services for corporate clients, including dedicated account management.

- Islamic Account: Designed for clients who require Sharia-compliant trading conditions. This account type ensures that no interest is charged or received, adhering to Islamic finance principles.

- Minimum Deposit: Aligns with the standard personal account requirements.

- Perks: Interest-free trading without overnight fees, in accordance with Sharia law.

Each account type is designed to meet the diverse needs of eToro’s global clientele, ensuring that traders can select an option that best aligns with their trading strategies and personal or corporate requirements.

5. Demo Account Availability

Does eToro offer a demo account?

Yes, eToro offers a free demo account, also known as a virtual portfolio, allowing users to practice trading without risking real money.

How to open a demo account on eToro

- Register an account:

- Visit eToro’s official website or download the mobile app.

- Click on “Join Now” and complete the registration form with your desired username, email address, and password. Alternatively, you can sign up using your Google, Facebook, or Apple account.

- Access the virtual portfolio:

- After registration, log in to your eToro account.

- Click on “Switch to Virtual” at the bottom of your account dashboard to access the demo account.

Features of eToro’s demo account

- Virtual funds: The demo account is pre-loaded with $100,000 in virtual funds, providing ample resources to practice trading strategies.

- Real-time market data: Experience live market conditions with up-to-date pricing and trends.

- Access to all instruments: Trade a wide range of assets, including stocks, cryptocurrencies, commodities, currencies, indices, and ETFs.

- Unlimited usage: The demo account has no time restrictions, allowing users to practice at their own pace.

- Educational resources: Utilize eToro’s educational materials, such as courses, guides, webinars, articles, podcasts, and video tutorials, to enhance your trading knowledge.

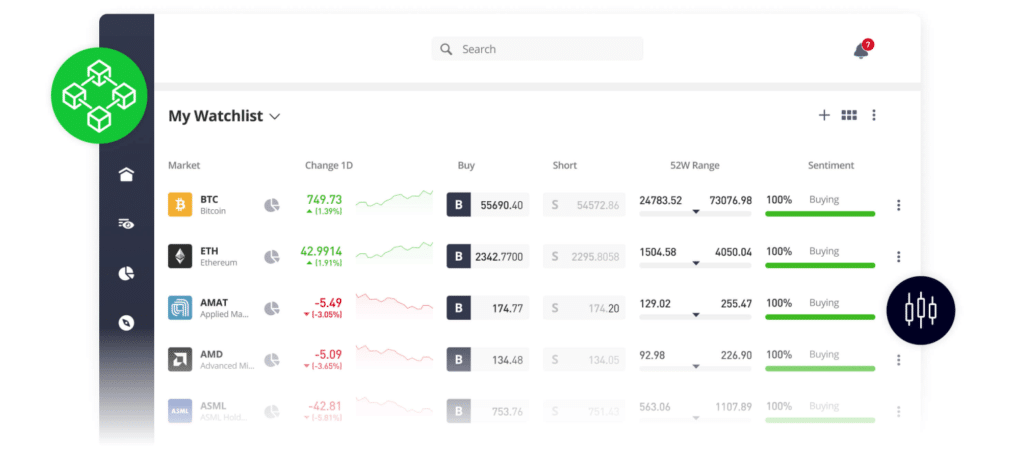

6. Trading Platform Overview

eToro provides a unified trading experience across its web platform, desktop platform, and mobile app. Here’s an overview of each:

Web Platform

- User Interface: The web platform features a clean and intuitive design, making it accessible for both beginners and experienced traders.

- Features and Tools:

- Social Trading: Engage with a community of traders, discuss strategies, and access sentiment indicators.

- CopyTrader: Automatically replicate the trades of successful investors.

- Charting Tools: Access advanced charting tools with various technical indicators to analyze market trends.

- Research and Analysis: Benefit from insightful stock research, including hedge fund activities, insider transactions, analyst opinions, and social scores.

- Customization: Tailor your trading experience with customizable watchlists and personalized notifications.

Desktop Platform

- Availability: As of 2025, eToro primarily focuses on its web-based platform and mobile app. There isn’t a dedicated desktop application; however, the web platform is optimized for desktop use and offers a seamless experience.

Mobile App

- User Interface: The mobile app maintains the platform’s intuitive design, ensuring a smooth trading experience on-the-go.

- Features and Tools:

- Full Trading Functionality: Execute trades, monitor portfolios, and access real-time market data.

- Social Features: Participate in discussions, follow other traders, and receive updates directly within the app.

- Notifications: Set up real-time alerts for price movements, market news, and account activities.

- Customization: Similar to the web platform, the mobile app allows for personalized watchlists and settings to suit individual trading preferences.

7. Markets and Assets Available

eToro offers a diverse range of markets and assets, catering to both novice and experienced investors. The platform’s offerings include:

- Stocks: Access to nearly 3,000 stocks from major exchanges worldwide, including prominent companies like Apple (AAPL), Amazon (AMZN), and Tesla (TSLA).

- Forex: Trade major, minor, and exotic currency pairs, such as EUR/USD, GBP/USD, and USD/JPY.

- Cryptocurrencies: Invest in leading digital assets like Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC).

- Commodities: Engage in trading commodities including gold, silver, oil, and natural gas.

- ETFs: Choose from over 250 Exchange-Traded Funds, such as the iShares Global Clean Energy ETF (ICLN).

- Indices: Trade major global indices like the S&P 500, NASDAQ 100, and FTSE 100.

- Fractional Shares: Invest in fractional shares, allowing for ownership of a portion of high-priced stocks, making it accessible for investors with varying capital sizes.

8. Fees and Commissions

Understanding eToro’s fee structure is crucial for effective financial planning. Below is a breakdown of the trading and non-trading fees:

Trading Fees:

- Spreads: eToro operates primarily on a spread-based model. For example, the spread for EUR/USD starts at 1 pip, while stock CFDs have spreads starting from 0.15%.

- Commissions: As of August 11, 2024, eToro introduced a commission fee of $1 or $2 per stock trade for clients in specific European countries, depending on the country and stock exchange.

- Overnight Fees: Also known as rollover fees, these are charged for positions held open overnight, varying based on the asset and position size.

Non-Trading Fees:

- Withdrawal Fees: A fixed fee of $5 is applied to withdrawals from USD accounts. Withdrawals from GBP and EUR accounts to external accounts incur no fee.

- Inactivity Fees: Accounts inactive for 12 months are charged a $10 monthly inactivity fee.

- Currency Conversion Fees: Deposits and withdrawals in currencies other than USD may incur conversion fees, which vary depending on the payment method and region.

Comparison to Industry Averages:

- Spreads: eToro’s forex spreads are competitive but not the lowest in the industry. For instance, a 1-pip spread on EUR/USD is standard, though some brokers offer tighter spreads.

- Commissions: The introduction of a $1 or $2 commission per stock trade in certain regions aligns eToro more closely with traditional brokers, though it remains competitive compared to others charging higher fees.

- Non-Trading Fees: The $5 withdrawal fee and $10 inactivity fee are standard across many platforms, though some brokers offer free withdrawals and no inactivity charges.

Overall, eToro provides a comprehensive range of assets with a transparent fee structure, making it a competitive choice for diverse investment strategies.

9. Deposit and Withdrawal Methods

Supported Deposit Options

eToro offers a variety of deposit methods to cater to its global clientele. The availability of these methods may vary depending on the user’s country of residence. The primary deposit options include:

- Credit/Debit Cards: Visa, MasterCard, Visa Electron, and Maestro are accepted. Deposits are processed instantly, with a maximum single deposit limit of $40,000.

- Bank Transfers: Wire transfers are available, typically processed within 4-7 business days. The minimum deposit for wire transfers is $500, with a maximum transaction limit of $1,000,000.

- Online Banking: Available in certain countries, allowing for instant deposits with a daily maximum of $10,000.

- e-Wallets: eToro supports deposits via PayPal, Neteller, and Skrill. These methods offer instant processing times, with PayPal allowing up to $10,000 per transaction.

Withdrawal Process, Timelines, and Fees

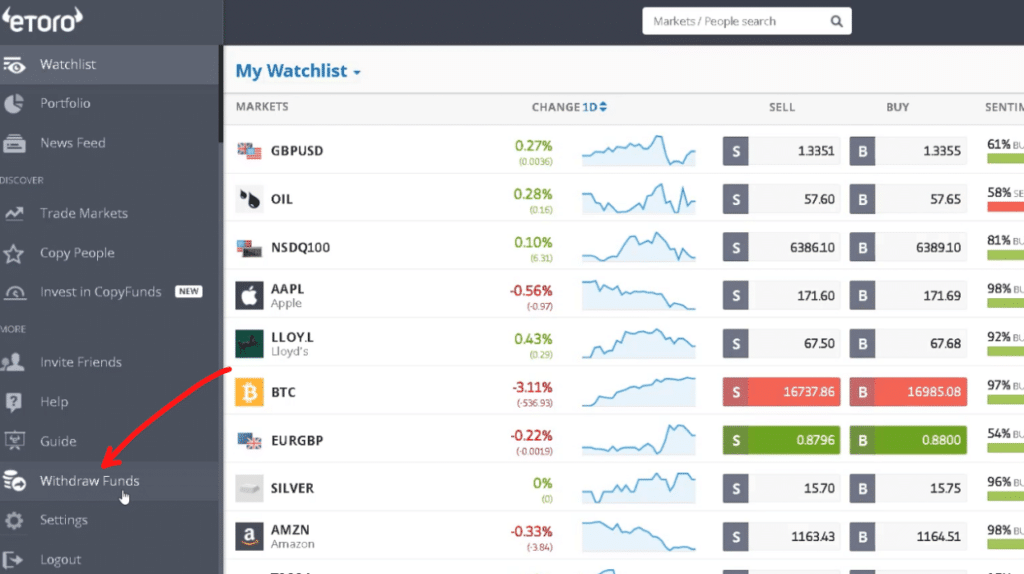

Withdrawing funds from eToro is a straightforward process:

- Initiate Withdrawal: Log in to your eToro account, navigate to the “Withdraw Funds” section, and enter the desired amount.

- Select Withdrawal Method: Choose the method corresponding to your original deposit. eToro prioritizes withdrawals back to the original funding source to comply with financial regulations.

- Processing Time: eToro typically processes withdrawal requests within 1-2 business days. However, the total time for funds to appear in your account depends on the payment provider:

- Credit/Debit Cards: Up to 8 business days.

- Bank Transfers: 4-7 business days.

- e-Wallets: 1-2 business days.

Fees and Limits:

- Withdrawal Fee: eToro charges a $5 fee for withdrawals from USD accounts to external accounts. Withdrawals from GBP and EUR accounts to external accounts are free.

- Minimum Withdrawal Amount: The minimum withdrawal amount is $30 for USD accounts, with no minimum for GBP and EUR accounts.

Currency Conversion Fees: Deposits and withdrawals made in currencies other than USD may incur conversion fees.

Important Considerations:

- Account Verification: Ensure your account is fully verified before initiating withdrawals to avoid delays.

- Consistent Payment Methods: For security and compliance, eToro requires withdrawals to be processed using the same method as the original deposit.

10. Bonuses and Promotions

Current Bonuses and Promotions

As of 2025, eToro offers several promotions to enhance the trading experience for both new and existing clients:

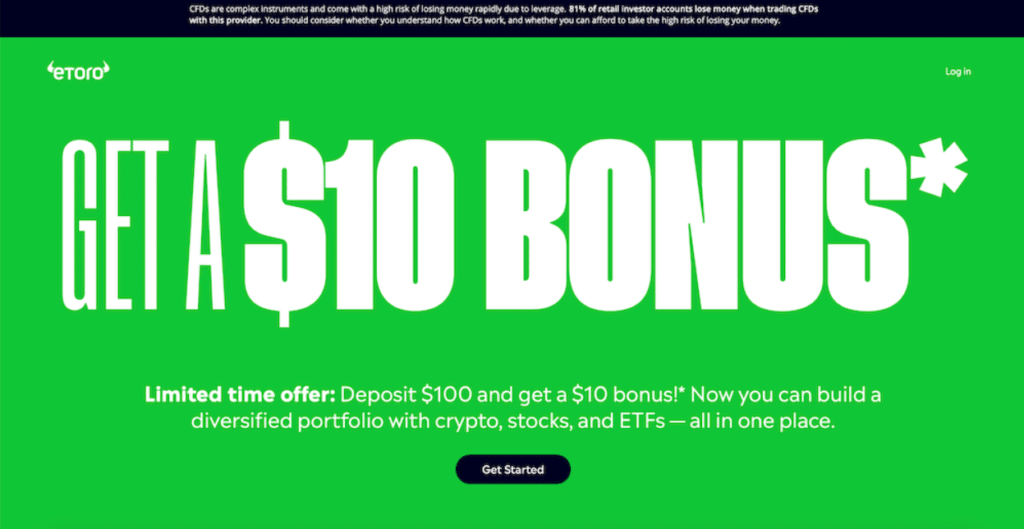

- Sign-Up Bonus:

- $10 Crypto Bonus: New users in the U.S. can receive a $10 bonus upon account verification and an initial deposit of at least $100. This promotion is available for a limited time.

- Referral Program:

- $30 Referral Bonus: Existing eToro clients can earn a $30 bonus for each friend they refer who opens an account and deposits at least $100. The referred friend also receives a $30 bonus. This program is available in the U.S. and the UK, with specific terms applicable to each region.

- eToro Club Bonus:

- $250 Bonus: Clients who deposit $5,000 or more gain access to the eToro Club and receive a $250 bonus. Club members enjoy additional perks, including exclusive webinars, dedicated account managers, and premium subscriptions.

Terms and Conditions

Each promotion has specific terms and conditions:

- Eligibility: Promotions are typically available to new clients who meet the minimum deposit requirements and complete account verification.

- Referral Program Limits: The referral bonus may be limited to a certain number of referrals per client. For example, the U.S. program allows up to 10 referrals, totaling a maximum bonus of $300.

- Withdrawal Restrictions: Bonus funds may have restrictions on immediate withdrawal. Clients are advised to review the specific terms associated with each promotion.

Important Considerations:

- Promotion Validity: Promotions are subject to change and may have specific validity periods. Clients should check eToro’s official promotions page for the most current offers.

- Regional Availability: Some promotions may be region-specific. Ensure the promotion applies to your country of residence.

By understanding eToro’s deposit and withdrawal processes, along with current promotional offers, clients can optimize their trading experience on the platform.

11. Trading Tools and Features

eToro offers a comprehensive suite of trading tools and features designed to cater to both novice and experienced traders.

- Advanced Charting Tools: eToro’s platform is equipped with advanced charting capabilities powered by TradingView. These charts provide real-time data updates multiple times per second, ensuring traders have access to the most current market information. The user-friendly interface offers clear visuals, facilitating quick decision-making. Users can choose from various chart types, such as bars, lines, or candles, and establish timeframes ranging from one minute to a week.

- Technical Indicators and Drawing Tools: Traders have access to over 100 indicators and more than 50 drawing tools, allowing for in-depth technical analysis. These tools assist in identifying trends, patterns, and potential entry and exit points, enhancing the precision of trading strategies.

- Economic Calendar: eToro’s Economic Calendar keeps users informed about upcoming market events, such as earnings reports, dividend payments, and central bank meetings. This feature enables traders to anticipate market movements and adjust their strategies accordingly. The calendar is customizable, allowing users to filter events based on their relevance to specific assets or markets.

- Portfolio Breakdown: This tool provides users with a detailed view of their portfolio’s composition across asset types, sectors, geographies, and exchanges. It aids in assessing diversification and identifying potential areas for rebalancing.

- CopyTrader™: eToro’s signature feature allows users to replicate the trades of experienced investors automatically. This social trading tool is particularly beneficial for beginners seeking to learn from seasoned traders or for those who prefer a more hands-off approach to investing.

- Smart Portfolios: Formerly known as CopyPortfolios, Smart Portfolios are curated investment strategies that bundle together various assets or top traders based on specific themes or strategies. This feature offers a diversified investment approach without the need for individual asset selection.

- Virtual Portfolio: eToro provides a virtual trading environment where users can practice trading strategies without risking real capital. This feature is ideal for beginners aiming to build confidence before engaging in live trading.

Supported Order Types:

eToro supports a variety of order types to accommodate different trading strategies:

- Market Orders: Execute a buy or sell immediately at the current market price.

- Limit Orders: Set a specific price at which to buy or sell an asset. The order is executed only when the market reaches the predetermined price.

- Stop-Loss Orders: Automatically sell an asset when its price reaches a certain level, helping to limit potential losses.

- Trailing Stop Orders: A dynamic stop-loss that adjusts with favorable market movements, locking in profits while protecting against downside risk.

12. Leverage and Margin Requirements

Leverage allows traders to amplify their market exposure by borrowing funds, while margin refers to the collateral required to maintain leveraged positions.

- Maximum Leverage Available:

- Retail Clients: eToro adheres to regulatory guidelines that cap leverage for retail clients to mitigate risk:

- Major currency pairs: up to 30:1

- Non-major currency pairs, gold, and major indices: up to 20:1

- Commodities other than gold and non-major equity indices: up to 10:1

- Individual equities: up to 5:1

- Cryptocurrencies: up to 2:1

- Professional Clients: Traders who meet specific criteria and opt for professional status can access higher leverage levels, up to 400:1, depending on the asset class. However, this classification may result in reduced regulatory protections.

- Retail Clients: eToro adheres to regulatory guidelines that cap leverage for retail clients to mitigate risk:

- Margin Requirements, Margin Calls, and Stop-Out Levels:

- Margin Requirement: The initial deposit needed to open a leveraged position varies based on the asset and the applied leverage. For example, a 10:1 leverage on a $10,000 position requires a $1,000 margin.

- Margin Calls: If the equity in a trader’s account falls below the required margin due to adverse market movements, eToro may issue a margin call, prompting the trader to deposit additional funds to maintain open positions.

- Stop-Out Level: Should the account equity decline further and reach a critical threshold, eToro may automatically close positions to prevent the account balance from turning negative. This mechanism protects traders from incurring debts beyond their initial investment.

Risks Associated with High Leverage:

While leverage can magnify potential profits, it equally amplifies potential losses. High leverage increases exposure to market volatility, which can lead to rapid and substantial losses, potentially exceeding the initial investment. Traders should exercise caution, employ robust risk management strategies, and fully understand the implications of leveraged trading before engaging in such activities.

In conclusion, eToro provides a rich array of tools and features to enhance the trading experience, alongside offering leverage options that cater to different trader profiles. However, it’s imperative for traders to approach leveraged trading with a thorough understanding of the associated risks and to utilize the platform’s risk management tools effectively.

13. Educational Resources

eToro offers a comprehensive suite of educational materials designed to cater to investors at all levels:

- Beginner Guides: The platform provides structured courses that cover fundamental investment concepts, including stock investing strategies and forex trading. These courses are tailored to help new investors build a solid foundation.

- Webinars: eToro hosts live sessions with expert analysts, offering in-depth views and analyses of global markets, recent trends, and potential investment opportunities. These interactive webinars allow participants to engage directly with professionals, enhancing their understanding of complex topics.

- Tutorials and Video Content: The eToro Academy features a rich collection of video tutorials and recorded webinars, covering topics such as technical analysis, commodity investing, and platform navigation. These resources are designed to provide practical insights and step-by-step guidance.

- Daily Analysis and Market Reports: Through its “Market Bites” podcast and webinar series, eToro delivers weekly recaps of the most pertinent financial topics, ensuring investors stay informed about market dynamics and emerging trends.

Assessment of Quality and Usefulness

The educational content provided by eToro is both comprehensive and accessible. The materials are curated by financial experts, ensuring accuracy and relevance. The variety of formats—ranging from interactive courses to concise video tutorials—caters to diverse learning preferences. Additionally, the inclusion of up-to-date market analyses and the opportunity to engage with experts through webinars significantly enhance the practical applicability of the content.

14. Social and Copy Trading

eToro is renowned for its pioneering social and copy trading features:

- Social Trading Platform: eToro’s platform integrates social networking elements, allowing users to interact, share insights, and discuss strategies. This community-driven approach enables investors to learn from each other and stay connected with market sentiments.

- CopyTrader™ System: This feature enables users to automatically replicate the trades of experienced investors. By allocating funds to copy a selected trader, users can mirror their trading activities in real-time, proportionate to the invested amount. The minimum amount required to start copying an investor is $200.

- Smart Portfolios: Formerly known as CopyPortfolios, these are thematic investment strategies that bundle together various assets or top traders into a single portfolio, offering diversified exposure based on specific market themes or strategies.

These features collectively democratize investing, allowing users to leverage the expertise of seasoned traders and engage in a collaborative investment environment.

15. Customer Support

Support Channels

eToro offers multiple channels for customer support:

- Live Chat: Available 24 hours a day from Monday to Friday, allowing users to interact in real-time with support agents.

- Automated Chatbot: An AI-driven chatbot is accessible 24/7, providing instant responses to common inquiries.

- Support Tickets: Users can submit queries through a ticketing system via the Customer Service Center.

Working Hours

- Live Chat: Operational 24 hours a day from Monday to Friday.

- Automated Chatbot: Available 24/7.

- Support Tickets: Can be submitted at any time, with responses typically within 24-48 hours.

Quality of Support and Response Times

eToro’s customer support is recognized for its responsiveness and effectiveness:

- Live Chat: Provides prompt assistance during operational hours, with response times often within minutes.

- Automated Chatbot: Offers immediate answers to common questions, serving as a quick resource outside of live support hours.

- Support Tickets: While responses may take up to 48 hours, the system allows for detailed inquiries and tracking.

Overall, eToro’s customer support infrastructure is robust, providing multiple avenues for users to seek assistance, with generally positive feedback regarding response times and support quality.

16. Safety, Security, and Regulation

Regulatory Oversight

eToro operates under the supervision of several reputable regulatory bodies, ensuring compliance with international financial standards:

- Financial Conduct Authority (FCA): Regulates eToro’s operations in the United Kingdom, enforcing strict guidelines for financial conduct, including maintaining adequate capital and safeguarding client funds.

- Cyprus Securities and Exchange Commission (CySEC): Oversees eToro’s activities within the European Union, ensuring adherence to MiFID II regulations.

- Australian Securities and Investments Commission (ASIC): Regulates eToro’s services in Australia, ensuring compliance with local financial laws.

- Financial Industry Regulatory Authority (FINRA): eToro USA LLC is a member of FINRA, overseeing its operations in the United States.

Client Fund Protection

eToro employs several measures to protect client funds:

- Segregated Accounts: Client funds are held in separate accounts with top-tier banks, ensuring they are distinct from the company’s operational funds.

- Investor Compensation Schemes:

- Financial Services Compensation Scheme (FSCS): For clients under FCA regulation, the FSCS provides compensation up to £85,000 in the event of eToro’s insolvency.

- Investor Compensation Fund (ICF): Clients under CySEC regulation are protected up to €20,000.

- Private Insurance: eToro provides additional coverage through private insurance policies, offering protection up to 1 million EUR/AUD/USD per client.

Security Features

To ensure the security of client accounts and data, eToro implements several robust measures:

- Two-Factor Authentication (2FA): Enhances account security by requiring a second form of verification during login.

- Data Encryption: Utilizes advanced encryption protocols to protect sensitive information during transmission and storage.

17. Pros and Cons of eToro

eToro, established in 2007, has positioned itself as a prominent player in the online brokerage industry, offering a range of services that appeal to both novice and experienced investors. However, like any platform, it comes with its own set of advantages and disadvantages.

Pros:

- Commission-Free Stock and ETF Trading: eToro offers commission-free trading for stocks and ETFs, making it cost-effective for investors looking to diversify their portfolios without incurring additional fees.

- User-Friendly Platform: The platform is designed with an intuitive interface, ensuring a seamless experience for users, whether accessed via a browser or mobile app.

- Social and Copy Trading Features: eToro’s unique social trading capabilities allow users to replicate the trades of experienced investors, fostering a community-driven approach to investing.

- Diverse Asset Selection: Investors have access to a wide array of assets, including cryptocurrencies, commodities, stocks, and ETFs, enabling comprehensive portfolio diversification.

- Educational Resources: eToro provides a wealth of educational materials, aiding users in enhancing their trading knowledge and skills.

Cons:

- High Non-Trading Fees: The platform imposes a $5 withdrawal fee and charges for currency conversions, which can accumulate over time.

- Limited Customer Support: Users have reported challenges in accessing timely and effective customer service, indicating room for improvement in this area.

- Inactivity Fee: eToro charges a $10 monthly inactivity fee after 12 months of no trading activity, which could be a drawback for less active investors.

- Limited Account Base Currencies: The platform primarily operates in USD, which may lead to currency conversion fees for users dealing in other currencies.

18. Comparison with Other Brokers

When evaluating eToro against its competitors, it’s essential to consider factors such as fees, platform usability, asset variety, and unique features. Below is a comparison of eToro with three notable brokers: XTB, Trading 212, and Interactive Brokers.

1. XTB

- Fees: XTB offers commission-free trading on stocks and ETFs, similar to eToro. However, it does not charge withdrawal fees, providing an advantage over eToro’s $5 withdrawal fee.

- Platform: XTB’s platform is known for its advanced charting tools and customization options, catering well to experienced traders. In contrast, eToro’s platform is more geared towards beginners with its user-friendly interface.

- Assets: Both brokers offer a diverse range of assets, including forex, commodities, indices, and cryptocurrencies.

- Features: While eToro excels in social trading, XTB focuses on providing advanced analytical tools and educational resources for traders seeking in-depth market analysis.

2. Trading 212

- Fees: Trading 212 offers commission-free trading for stocks and ETFs without any withdrawal fees, making it more cost-effective compared to eToro.

- Platform: Both platforms are recognized for their intuitive and user-friendly interfaces, suitable for traders at all levels.

- Assets: Trading 212 provides access to a wide range of assets, including stocks, ETFs, forex, and commodities.

- Features: eToro’s social trading feature distinguishes it from Trading 212, which does not offer copy trading capabilities.

3. Interactive Brokers

- Fees: Interactive Brokers charges low trading fees, with commission-free trading available for US clients. However, its fee structure can be complex, potentially posing challenges for new investors.

- Platform: Renowned for its advanced trading tools and comprehensive research capabilities, Interactive Brokers caters to professional and institutional traders. In contrast, eToro’s platform is more accessible to beginners.

- Assets: Interactive Brokers offers an extensive selection of assets, including global stocks, options, futures, forex, and bonds, surpassing eToro’s asset range.

- Features: While eToro emphasizes social trading, Interactive Brokers provides advanced trading tools, research resources, and access to international markets, appealing to seasoned traders.

In summary, eToro stands out for its social trading features and user-friendly platform, making it ideal for beginners and those interested in community-driven investing. However, for traders seeking advanced tools, lower non-trading fees, or access to a broader range of assets, platforms like XTB, Trading 212, or Interactive Brokers may be more suitable. It’s crucial for investors to assess their individual trading needs and preferences when selecting a brokerage platform.

19. User Reviews and Ratings

eToro, as a prominent social trading platform, has garnered a wide array of user reviews across various platforms. Here’s a summary of recent user feedback:

Trustpilot Reviews:

On Trustpilot, eToro has received a mix of positive and negative reviews:

- Positive Feedback: Users frequently commend eToro for its user-friendly interface and the innovative social trading features, which allow them to follow and replicate the trades of experienced investors.

- Negative Feedback: Some users express dissatisfaction with customer support responsiveness and occasional technical issues, such as platform downtime during high market volatility.

Google Reviews:

Google Reviews reflect similar sentiments:

- Praise: Users appreciate the educational resources provided by eToro, which are beneficial for both beginners and seasoned traders.

- Complaints: Concerns are raised about withdrawal processes, with some users experiencing delays or additional verification requirements.

Relevant Forums:

In trading communities and forums:

- Positive Discussions: Members often highlight the platform’s social community aspect, enabling knowledge sharing and strategy discussions.

- Negative Discussions: There are discussions about the platform’s fees, particularly spreads on certain assets, which some traders find higher compared to other brokers.

Common Praise:

- User-Friendly Platform: eToro’s intuitive design makes it accessible for traders of all levels.

- Social Trading Features: The ability to copy trades and engage with a community of investors is highly valued.

Frequent Complaints:

- Customer Support: Some users feel that the support team is not as responsive as expected.

- Fees and Spreads: Certain assets have higher spreads, leading to concerns about trading costs.

20. Platform Availability by Country

Countries Where eToro is Available:

eToro operates in over 140 countries, including: Europe: United Kingdom, Germany, France, Spain, Italy, Netherlands, Sweden, Norway, Denmark, Finland, Austria, Ireland, Portugal, Poland, Czech Republic, Romania, Bulgaria, Greece, Hungary, Slovakia, Croatia, Slovenia, Estonia, Latvia, Lithuania, Cyprus, Malta.

- Americas: United States (with certain state restrictions), Mexico, Brazil, Argentina, Chile, Colombia, Peru, Uruguay.

- Asia-Pacific: Australia, New Zealand, Singapore, Thailand, Vietnam.

- Middle East and Africa: United Arab Emirates, Saudi Arabia, Qatar, South Africa.

Restricted Regions or Countries with Limited Access:

Due to regulatory requirements and business decisions, eToro does not offer its services in certain countries and territories, including:

- North America: Canada, Cuba.

- Asia: Japan, North Korea, Iran, India, Pakistan, Bangladesh, Indonesia, Malaysia.

- Africa: Nigeria, Zimbabwe, Sudan.

- Europe: Belgium, Albania, Serbia.

- Oceania: Papua New Guinea, Vanuatu.

It’s important to note that even within supported countries, certain services like CFD trading might be restricted due to local regulations. For instance, CFD trading is not permitted for clients residing in Belgium, Hong Kong, Israel, New Zealand, Spain, and the USA.

21. Taxation and Declaring Profits

Taxation Rules for eToro Traders

Tax obligations for eToro users vary based on their country of residence and the nature of their trading activities. Generally, profits from trading activities, including capital gains, dividends, and interest, are subject to taxation. It’s essential for traders to understand their local tax laws to ensure compliance.

eToro’s Tax Reporting Services

To assist users in fulfilling their tax obligations, eToro offers a comprehensive tax report service:

- eToro Tax Report: This detailed annual report includes all relevant financial information on a user’s eToro transactions, such as income, profits, and losses throughout the tax year. The report is tailored to the tax laws and regulations of the user’s country of residence. This service is available to eToro Club members (Silver tier or higher) residing in supported countries.

Accessing the Tax Report

Eligible users can request and download their tax reports through the eToro platform. The reports are made available in advance of each country’s tax filing deadlines.

Third-Party Tax Reporting Tools

For users seeking additional assistance, third-party services like Tax-Wizard and Coinpanda offer automated tax reporting solutions compatible with eToro. These tools can simplify the process of calculating taxes on investments.

Important Considerations

While eToro provides tools to assist with tax reporting, it’s crucial for users to consult with tax professionals to ensure accuracy and compliance with local tax regulations. eToro does not provide tax advice, and the information in the tax reports is for informational purposes only.

22. Common Issues and How to Solve Them

Users may encounter various issues while using the eToro platform. Below are some common problems and suggested solutions:

1. Login Problems

Symptoms:

- Inability to access the account.

- Error messages during login attempts.

Potential Solutions:

- Reset Password: Use the “Forgot Password” feature to reset your password.

- Clear Browser Cache: Clearing cache and cookies can resolve browser-related issues.

- Disable VPN/Proxy: Ensure you’re not using a VPN or proxy that might interfere with the connection.

- Contact Support: If issues persist, reach out to eToro’s customer support for assistance.

2. Withdrawal Delays

Symptoms:

- Withdrawals not processed within the expected timeframe.

Potential Solutions:

- Verify Account: Ensure your account is fully verified, as unverified accounts may experience delays.

- Check Payment Method: Confirm that the withdrawal method matches the deposit method, as discrepancies can cause delays.

- Allow Processing Time: Standard processing times can vary; wait for the specified period before raising concerns.

- Contact Support: If delays exceed the standard processing time, contact eToro’s customer support.

3. Verification Troubles

Symptoms:

- Difficulty completing the account verification process.

Potential Solutions:

- Provide Clear Documents: Ensure that all submitted documents are clear and meet eToro’s requirements.

- Check Document Validity: Verify that identification documents are valid and not expired.

- Follow Instructions: Carefully follow the verification guidelines provided by eToro.

- Contact Support: For persistent issues, seek assistance from eToro’s support team.

4. Platform Bugs or Performance Issues

Symptoms:

- App crashes or unresponsiveness.

- Features not functioning as intended.

Potential Solutions:

- Update Application: Ensure you’re using the latest version of the eToro app or platform.

- Clear Cache/Data: On mobile devices, clearing the app’s cache or data can resolve performance issues.

- Reinstall Application: Uninstall and reinstall the eToro app to address potential software glitches.

- Check Internet Connection: Ensure you have a stable internet connection.

- Contact Support: Report persistent bugs to eToro’s customer support for further assistance.

5. Connectivity Issues

Symptoms:

- Unable to connect to eToro’s servers.

- Frequent disconnections during use.

Potential Solutions:

- Check Network Settings: Ensure your network allows connections to eToro’s servers.

- Disable Firewalls: Temporarily disable firewalls or security software that might block the connection.

- Use Alternative Networks: Try connecting from a different network or device.

- Contact Internet Service Provider: If issues persist, consult your ISP to rule out network problems.

23. Final Verdict

eToro has established itself as a prominent player in the online brokerage industry, offering a unique blend of social trading features and a user-friendly platform. However, like any financial service, it presents both strengths and weaknesses.

Strengths:

- Social Trading Platform: eToro’s innovative social trading features, including CopyTrader™, allow users to replicate the trades of experienced investors, fostering a community-oriented trading environment.

- Diverse Asset Selection: The platform provides access to a wide range of assets, including stocks, ETFs, cryptocurrencies, commodities, and more, enabling users to diversify their investment portfolios.

- User-Friendly Interface: eToro’s intuitive and visually appealing platform caters to both beginners and seasoned traders, making navigation and trading straightforward.

- Educational Resources: The platform offers a wealth of educational materials, including tutorials and market analyses, supporting users in making informed investment decisions.

Weaknesses:

- Non-Trading Fees: eToro imposes certain non-trading fees, such as a $5 withdrawal fee and inactivity fees after 12 months of no trading activity.

- Limited Customer Support: Users have reported challenges in accessing timely and effective customer service, indicating room for improvement in this area.

- Limited Account Base Currencies: The platform primarily operates in USD, which may lead to currency conversion fees for users dealing in other currencies.

Suitable For:

- Beginners: The user-friendly interface, educational resources, and social trading features make eToro an excellent choice for novice investors seeking guidance and community support.

- Cryptocurrency Enthusiasts: With a broad selection of cryptocurrencies available for trading, eToro appeals to those interested in digital assets.

- Social Traders: Investors who value community insights and wish to emulate successful trading strategies will find eToro’s social trading features particularly beneficial.

Conversely, active traders seeking advanced analytical tools and lower non-trading fees might find other platforms more aligned with their needs.

24. FAQs

1. What is the minimum deposit?

The minimum deposit on eToro varies by region and account type. For most countries, the minimum deposit is $50.

2. How long do withdrawals take?

Withdrawal processing times on eToro typically range from 1 to 3 business days, depending on the payment method and verification status.

3. Is eToro safe?

Yes, eToro is considered safe. It is regulated by reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC), ensuring adherence to stringent regulatory standards.

4. What are the available trading platforms?

eToro offers a web-based platform accessible via browsers and a mobile app compatible with iOS and Android devices, providing flexibility for traders on the go.

5. Is eToro regulated?

Yes, eToro is regulated by multiple financial authorities, including the FCA in the UK, ASIC in Australia, and CySEC in Cyprus, ensuring compliance with international financial standards.

6. Are there any inactivity fees?

Yes, eToro charges an inactivity fee of $10 per month after 12 months of no login activity. This fee is deducted from the available balance and does not close open positions.

7. Does eToro support cryptocurrency trading?

Yes, eToro supports cryptocurrency trading, offering a wide selection of digital assets for users to trade.

8. What are the available contact methods for customer support?

eToro provides customer support primarily through a ticketing system accessible via the platform’s Help Center. Users can submit inquiries and receive responses from the support team.

In conclusion, eToro presents a robust platform with unique social trading features and a diverse asset selection, catering well to beginners and those interested in community-driven investing. However, potential users should be mindful of the platform’s non-trading fees and consider their individual trading needs when choosing eToro as their brokerage platform.